Our findings are six-fold:

Finding 1: In the typical community, 29 percent of small businesses were unprofitable, and 47 percent had two weeks or less of cash liquidity.

Finding 2: Nearly 70 percent of communities where small businesses had limited cash liquidity in 2013 also had small businesses with limited cash liquidity in 2017.

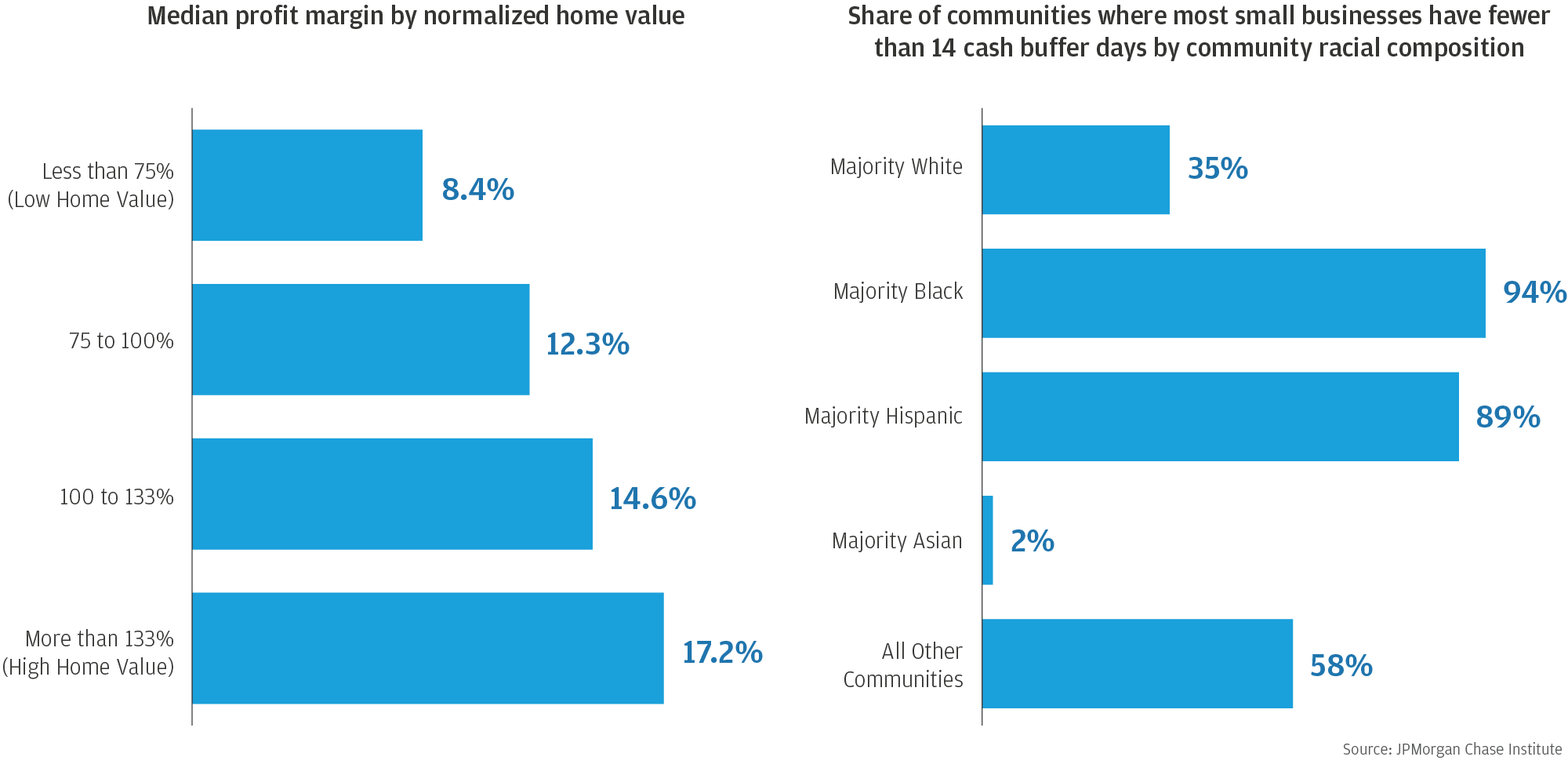

Finding 3: Small businesses in low home value communities had seven fewer cash buffer days than those in high home value communities. However, they had similar exit rates.

Finding 4: Profit margins for small businesses in communities with few college graduates were over 10 percentage points lower than those in communities with many college graduates.

Finding 5: In all majority Black or Hispanic communities, most small businesses had fewer than twenty-one cash buffer days.

Finding 6: Communities where small businesses had limited profits and cash liquidity rarely had large high-tech or other professional firms, but often had large retail or health care services firms.

These findings suggest that the socioeconomic and industry composition of a community have a meaningful impact on the financial health of small businesses and their ability to contribute to broad-based economic growth.