Only America has the economic, military and, yes, moral power.

I am writing about this topic, both as a patriot who cares about America’s and the free world’s future and as the CEO of our company, because it may be the most critical factor affecting the future of JPMorganChase itself. The success of JPMorganChase has always been predicated on the success of the United States of America and the health of the world, particularly the strength of free and democratic countries.

Whether you call them adversaries or major competitors, they have made their goal clear. We must act now.

The brutal invasion of Ukraine and the indescribable terrorist acts on Israel should have dispelled any illusion that the world is a safe place. We do not need another Pearl Harbor or 9/11 to shatter any false sense of security based on the hopeful notion that dictators, terrorists and oppressive nations won’t use their economic and military powers to advance their aims – particularly against what they perceive as weak, incompetent and disorganized Western democracies. Global peace and world order are vital American interests. We also need to answer the question: What kind of world do we want to live in? And do we believe that we can, or should, try to make the world a better place? Practically, what is the other choice?

Our international adversaries and major competitors have made it clear that their goal is to dismantle American hegemony, which means dismantling the rules-based system led by America in concert with our allies (essentially the Bretton Woods system and the North Atlantic Treaty Organization, as well as the International Monetary Fund and the United Nations). Since the end of World War II, this system has brought forth the longest period of peace and prosperity among the great powers. Today, it is clear this system needs serious reform and strengthening, not total destruction. Yet, if given the opportunity, that is exactly what our adversaries want to happen: Tear asunder the extensive military and economic alliances that America and its allies have forged. In the multipolar world that follows, it will be every nation for itself – giving our adversaries the opportunity to set the rules and use military and economic coercion to get what they want. That is what is at stake here. We need to bring the whole of government and the private sector together to build the world we want while dealing with the cold realities of the world we have.

We face the most perilous and complicated geopolitical and economic environment since World War II. Today’s world is more complex and more interconnected than ever before. Comprehensive strategies, diligently deployed, are required to address challenges on many fronts: the war in Ukraine; terrorism in the Middle East and the real possibility that Iran may develop a nuclear weapon; Europe’s potential fragmentation; and ongoing trade disputes and the rise of China. If Iran acquires a nuclear weapon, many other nations around the world will seek to acquire nuclear weapons, presenting us with a catastrophic situation. A global nuclear arms race is the worst outcome that could happen to our world – and this may be the greatest threat to mankind’s survival. Lastly, it is extremely important to recognize that security and economics are interconnected – “economic” warfare has caused military warfare in the past.

Not only is America’s global leadership role being challenged outside our borders by other nations but also inside our borders by our polarized electorate.

The actions taken in the next decade may prove, depending on how our country and our allies perform, the most consequential of our lives and may very well determine the fate of the free and democratic world over the next century. America has always had an amazing ability to confront enormous challenges – and we did so by facing them head-on with superb leadership from Abraham Lincoln to FDR to Dwight Eisenhower. We should remember that America, “conceived in liberty and dedicated to the proposition that all men are created equal,” still remains a shining beacon of hope to citizens around the world.

Here are five things our nation needs to do well in order to secure the future we should want for our country and our companies. I fear that if we fail at one of them, we may fail overall:

- Celebrate America’s values and virtues, with humility, in order to restore civic pride, citizenship and purpose.

- Acknowledge and fix our problems at home by regaining common sense and being resolute.

- Recognize that the best strategy for America’s success is to implement effective domestic policies that drive robust economic growth for the benefit of all citizens.

- Initiate comprehensive economic foreign policy to win the new global “economic” war. America will be first—but not if it is alone.

- Affirm that our national security and the world’s best military, at whatever cost, are paramount and necessary for peace.

These are my prescriptions, and I understand that some people may disagree with them – and, on some issues, I may ultimately be wrong. What I am not wrong about, however, is the urgent need to face these issues head-on—we should not assume that America will overcome them. We have always been a resilient nation and have overcome significant adversity in the past because we faced our challenges and dealt with them properly. Problems don’t age well. And the consequences of not dealing with this properly range from bad to catastrophic.

Celebrate America's values and virtues, with humility, in order to restore civic pride, citizenship and purpose.

To be able to attack our problems at home and abroad, we must be strong. And our core strength is based upon our commitment to our values, as well as our ability to work hard and think intelligently about our problems. If the soul of America is not strong, then the rest will be weak. While we should acknowledge America’s flaws, they should not be used to pull apart our country.

Our values transcend any political stance – libertarian, conservative, progressive, Democrat or Republican. We need to believe in ourselves and get back to work (in the office!), not tear each other down.

America’s strength is not a divine right – it is earned by citizens committed to a common purpose.

Many of the blind ideologies being bandied about run counter to our fundamental principles. Our principles of freedom of speech, religion and enterprise allow individuals to pursue life as they lawfully see fit. Ideologues often adhere to rigid beliefs and seek to impose those beliefs on others; in extreme forms of fanaticism, there is no room for individual differences.

I applaud many traditional Democratic values, such as a commitment to try to lift up all of our citizens and to provide more justice and equal opportunity. I also deeply respect many traditional Republican values, such as a dedication to provide a strong national defense, to promote free enterprise and encourage a pro-business environment, and to emphasize the importance of the Constitution. And we should all support other core values, such as family, country, self-reliance, respect for workers and common sense. These values are not mutually exclusive and should be embraced and upheld by both parties. We, the people, need to be able to embody all these values.

Even with all of our current problems, billions of people, if they could, would leave their country and move to ours. Similarly, if most people could only invest in one country, they would choose the United States. Our exceptionalism is based on our freedoms, our liberties, our opportunities and our rule of law, all under the protection of the Constitution (and the military) of the United States of America. You need only to witness the deep appreciation of new citizens, who often made enormous sacrifices to be here, to feel what it must be like when they take the Oath of Allegiance to the United States of America – it would bring you to tears.

It is incumbent on us to educate ourselves, our fellow citizens and future generations about American values and our ongoing pursuit of a more perfect democracy. This education should start in grammar school – our civic roles and responsibilities need to be taught. Our common values are transcendent.

Acknowledge and fix our problems at home by regaining common sense and being resolute.

Facts are often used by people to justify what they already think, and then populists on both sides distort the facts and use them to jazz up citizens around their grievances. But, as former U.K. Prime Minister Tony Blair asserts, we need to separate the populists from the grievances because many of these grievances are partially rooted in truth and must be addressed. The following are issues that I believe are causing legitimate frustration and anger in the country today. This list is not complete, but let’s acknowledge some of these profound challenges. In this section and the next, I discuss some possible solutions:

- Lack of control of our borders. Uncontrolled immigration is highly disturbing to affected populations around the world and reduces the ability to manage legal and needed immigration. In the United States, the number of immigrants has increased by approximately 50% over the last 20 years. Once we gain control of our borders, I believe most Americans would support increasing merit-based immigration, including allowing anyone who earns a degree here to stay, ensuring there are proper visas for seasonal workers, enabling children born in this country to remain and providing a rigorous path to citizenship for law-abiding, undocumented immigrants. Healthy and proper immigration would bring great talent to our country and has been shown to actually help grow the economy.

- Too many left behind. Our fellow citizens at the lowest income tier have, in fact, been left behind, a trend we’re seeing globally. From 1979 to 2019, wage growth of the top 10% income tier was nearly 10 times that of the bottom 10% – which, basically, did not increase at all. Our very low-income citizens experience higher school dropout rates, greater joblessness, increased drug use and crime in their neighborhoods, and significantly worse health outcomes. They often reside in rural areas and in inner cities. So while enormous wealth has been created in the country, the promise of equal opportunity seems unfulfilled for too many for too long.

- Education, some of the best and some of the worst. We have many of the best universities (including research universities) in the world. However, over the last 20 years, the cost of college has more than doubled for both public and private colleges, while household median incomes have gone up only 18%. Many inner-city schools graduate under 50% of their students. And in both high schools and colleges, we don’t teach enough skills that lead to well-paying jobs. Again, this affects the bottom income tier far more. Equal opportunity is clearly not fairly shared.

- Ineffective and incompetent government. Most people do not believe that the government, regardless of party control, is doing a good job. For some, it’s the constant bureaucracy, lack of permitting and failing schools; for others, it’s the constant anti-business sentiment. We struggle to build pipelines, upgrade our electrical grid, develop high-speed rails and accomplish other necessary goals. Our government seems unable to reform and reorganize itself, which is a problem. This is amplified by the fact that many of our career politicians have little real-world experience, and it shows. We have failed at basic common sense. And let’s stipulate here that this is not about blaming individual workers. We all know that many government employees are hard-working, ethical and caring citizens doing very important jobs that support and protect their fellow Americans.

- Profligate fiscal management. Most people do not believe that giving the government more money leads to better outcomes. In fact, most people perceive government actions, such as special tax breaks, as patronage for favored interest groups. Many people think the tax system itself is littered with unfair loopholes. Government has been fiscally irresponsible and profligate – and even with all the money spent, grievances increased. Our government estimates that it makes over $200 billion in “improper” payments per year. Somehow, we have huge deficits and bad outcomes.

- A leviathan both too weak and too strong. Our state is paradoxically both too weak – ineffective at accomplishing essential tasks – and overly strong – overreaching in ways that undermine fundamental democratic principles like individual freedom and autonomy. Over the last few decades, many have felt violated by the government’s increasing interventions. This heavy-handedness often prescribes not only how we should act but also how we should think and feel.

Culture wars and virtue signaling. In the past, the elite often insulted traditional values of family, God and individual success, lecturing about their superior values from their comfortable perches and imposing all of this on people who believed differently. We have implemented many climate policies that do not effectively address climate change and raise the cost of living. We have stopped teaching some important parts of American history. Instead of acknowledging America’s significant virtues, we denigrate them and tear them down. We engage too frequently in class warfare and excessively in identity politics; i.e., using race, sex or creed inappropriately. And state laws were passed that actually increase crime instead of preventing it. Many of these policies hurt the very people they were meant to protect most. Many cities that paid a high price for their misguided policies are now returning to obvious policy goals – safe streets, better schools, more housing.

Unfortunately, more and more people are being disrespectful, condescending and unwilling to listen to one another. While adjustments are needed, it is quite predictable that the pendulum will swing too far in the other direction. When all is said and done, let’s hope we can all treat each other with a little more respect.

- An imperfect healthcare system. While in some ways our healthcare is the best in the world, it is also expensive, essentially costing almost twice as much as the average healthcare in OECD (Organisation for Economic Co-operation and Development) countries. Our healthcare system is also lacking in preventive care, transparency and proper incentives, and leaves too many uninsured.

- Crippling litigation, bureaucracy and regulation. An effective legal environment, upheld by a dependable judiciary, is essential for economic health, protecting rights, ensuring justice, resolving disputes, maintaining checks and balances, and supporting innovation. However, the current environment is demoralizing and slowing growth. While we all want justice through the legal system, our litigation system is expensive (far more than most other countries), capricious, arbitrary and slow. All of this leads to extreme risk aversion – mostly on the part of government but often on the part of business as well. It is concerning that some politicians have grown increasingly beholden to the interests of tort lawyers, posing real risk to balanced policymaking. In some ways, this could be America’s Achilles heel.

- Red tape 2.0. Red tape has always meant excessive paperwork, bureaucracy and regulations. But it’s been taken to a whole new level by people who really like it and want even more of it. They have doubled down on regulations and bureaucracy, which also dramatically increased red tape. In so doing, they made sure that new rules were written by academics with no pragmatic experience, guaranteeing that they would be excessive, confusing, contradictory and infused with ideology. So we need to give credit where credit is due. Therefore, I have renamed it “BLUE” tape. Even when “blue” tape has been shown to slow down economic growth and make it hard for businesses and individuals to thrive, those who created it excuse the outcome and refuse to change (see Europe).

- Damaging trade practices, particularly with China. While trade has greatly benefited the world and many – if not most – American citizens, the damage that was done to some, while acknowledged, was never rectified. Those who suffered felt the sting – both in lost jobs and lower wages. We also allowed too much unfair trade. Finally, and most important, we failed to protect our national security, becoming too reliant on potential adversaries for critical products that the military needs (more on this later).

- Selfishness on the part of our citizens and elected officials. Whether it is unions fighting new technologies or businesses getting tax breaks, the focus on “what am I going to get” needs to stop. There are 13,000 groups lobbying in Washington, D.C., defending their “special interest.” Rarely do they fight for what is good for America. When America’s future hangs in the balance or when special interest groups wield undue influence, it is time to prioritize principle over profit – and put country before company or union. Many in our country do this – our uniformed officers in the military are an ideal example as they put their lives on the line out of a deep belief in our values and our country.

America is still the exceptional nation, but its problems demand that we adjust our strategies. America has carried the burden of keeping the world safe and has made extraordinary efforts, including through trade, to improve the lives of the citizens of other nations. It is time to rebalance and rebuild but not retreat from the post-world order. A U.S. retreat from international leadership will leave a vacuum that may be filled by China or other actors that seek to promote an alternate set of international rules and norms.

Both parties contributed to our failures (and the media amplifies it).

Many of the grievances I’ve noted existed and grew under both parties’ leadership. These grievances are frequently amplified by media, both traditional and new, that often adheres to only one party’s views, which leaves audiences blind to all of the issues and consequences of flawed policies. For example, when conducting interviews, reporters many times reveal their biases whether through subtle support or open skepticism. Interview subjects may be discredited because of who they are, not because of the content of their argument. Much of this is making us meaner to each other – a little more kindness and understanding would go a long way. I am a firm believer that we should constantly talk with each other, air our views, hold each other accountable and try to respect all sides of an argument.

Social media has made this worse, in fact, deliberately worse by using algorithms to manipulate as opposed to educate. Networks and platforms could meaningfully improve the quality of discourse on the town square both by offering a menu of algorithms, as opposed to ones that are addictive, and by requiring all users to authenticate their identities, whether they choose to speak anonymously or not. In banking, we have “know your customer” requirements – social media should have them as well. Verifying identities would go a long way toward eliminating foreign influence and bots, and would make individuals, not the platform, subject to the law.

We also exist in a nation awash with inaccurate and unfair labeling and scapegoating; i.e., Wall Street versus Main Street. Who exactly is Wall Street in this comparison with Main Street? Large business and small business are symbiotic. Shouldn’t we respect jobs and workers and the companies that create those jobs? And some give voice to the view that public sector jobs are more virtuous than private sector jobs. Less than 25 million people work in the public sector and we should hold them in high regard – teachers, police, firefighters, military, sanitation workers and others. All jobs have dignity and purpose, and add to the general well-being of the country. It is good to remember that the 135 million people who work in the private sector generate the income that funds the public sector.

All of these are among the reasons why I believe the body politic may be tired and ready to see bold disruption. While we need to take proper actions, we also need reform and reconstruction.

In addition, our adversaries mistake our apparent disarray as a sign that we are lazy, weak and decadent. Anyone who knows America – its work ethic, innovation and morality of most citizens – knows this is not true.

Recognize that the best strategy for America’s success is to implement effective domestic policies that drive robust economic growth for the benefit of all citizens.

We need to address the underlying issues causing the grievances that are tearing us apart and holding the nation back. By enacting meaningful policy reforms to resolve these issues, I believe our gross domestic product (GDP) would grow by over 3% a year – benefiting all Americans and especially those in our lower-income communities. From 2000 to 2024, GDP grew by just over 2% a year. Had it grown by 3%, which should be easily achievable with the right policy decisions, our GDP per person would be approximately $16,000 higher this year.

In this section and in the following, I describe many of the policies that we need to fix – and, in some cases, how to do it. Some of the fixes are easy, while others are more challenging. They run the gamut from improving the supply side, such as education, infrastructure, permitting, production capability and technology, to addressing the demand side, including fiscal and tax policy. All of these are domestic policies, which we can fix on our own. Later in this section, I talk about foreign economic policies, including trade, foreign investment and the U.S. dollar as the world’s reserve currency, all of which are essential to our country and the world.

Policy needs to be detailed, comprehensive and coordinated to be successful – how you describe it politically is a separate matter.

As someone once said, “If you are going to do what you already did, you are going to get what you already got.” We have the best economy in the world, but we must confront our extensive flaws and fault lines. We need to build our own capabilities and stop the constant under- and over-reaction. Our policies must foster healthy, sustainable growth, and it’s essential that we unite the entire nation – government and business alike – to achieve it. Around the world, we observe both effective and counterproductive policies. For example, well-intentioned labor laws can backfire, as seen in parts of Europe where rigid labor regulations have contributed to persistently high unemployment. Similarly, certain safety net programs may inadvertently discourage paid work. On the other hand, streamlined permitting policies show how smart governance can accelerate development and get projects built – in short order and safely. Nations that implement sound policies are capable of achieving remarkable outcomes; consider Ireland, Singapore, South Korea and Sweden. Even Greece, which used to be Europe’s perennial basket case, has managed to turn itself around, driven by an exceptional political leader.

Good political leaders get both the politics and the policies, in detail, right. They are constantly educating the public instead of just responding to it. Our country needs leaders who can guide their parties away from catering to the extremes and who can collaborate effectively with our allies to craft integrated policies that address both economic and security challenges – in the short and long term. Most important, on the home front, we need lawmakers on both sides of the aisle to commit to the serious work of governing – setting aside partisan divides to develop policies that foster economic growth and expand opportunities for all Americans to succeed. Running for any executive office (mayor, governor or president) and running the government are completely different things. Some quickly figure that out, and some don’t. While a good politician must communicate policies in a clear, compelling way that resonates with the American public, the policies themselves must be well designed to be truly effective. And this is more important today than ever before because the future, for both foreign policy and economic policy, is fraught with extreme risk.

We need to promote, not denigrate, businesses, large and small.

On economic policy, the Republicans are right to champion business and free enterprise, limit excessive government intervention, establish an international tax system that has made America competitive for the first time in over 15 years, and cut back on needless, mind-numbing, job-killing regulations. And all of this could be done while still maintaining the proper regulation necessary to prevent market abuses and safeguard the economic environment.

Recent Democratic policies, driven by often-misguided narratives and an often-dismissive tone, have left much of the business community frustrated and disillusioned. Many government agencies and regulators frequently criticize business by relying on oversimplified and dishonest concepts like “price gouging” to justify their stance. They tend to take the isolated missteps of a few companies and use them to paint the broader business community as unethical. This fuels rhetoric that undermines free enterprise and leads to regulatory overreach that frequently exceeds the intent of the law. Few in the previous administration actually understood business or had any experience running a business – and it showed. Other important policies (for example, infrastructure, the CHIPS and Science Act, the Inflation Reduction Act), while well-intentioned, were laden with virtue-signaling and uninformed rules, which limit their effectiveness. And instead of fixing endless regulations, like permitting, government effectively made them worse.

It would be wiser to properly educate the public about the role of business, large and small. The private sector is the engine for investing our country’s capital into high-returning areas — it is our most effective tool for promoting innovation, sustainable growth, productivity and jobs. There are more than 30 million businesses in America, but within the private sector, it is large companies that are responsible for 85% of the research and development (R&D) and nearly half of all nonresidential capital investment. Big companies generally have excellent healthcare, wellness, retirement and training programs.

Every time a new plant is built somewhere, it creates four or five times more jobs in that area, usually in small businesses. Small business and large business are truly symbiotic.

Initiate comprehensive economic foreign policy to win the new global “economic” war. America will be first – but not if it is alone.

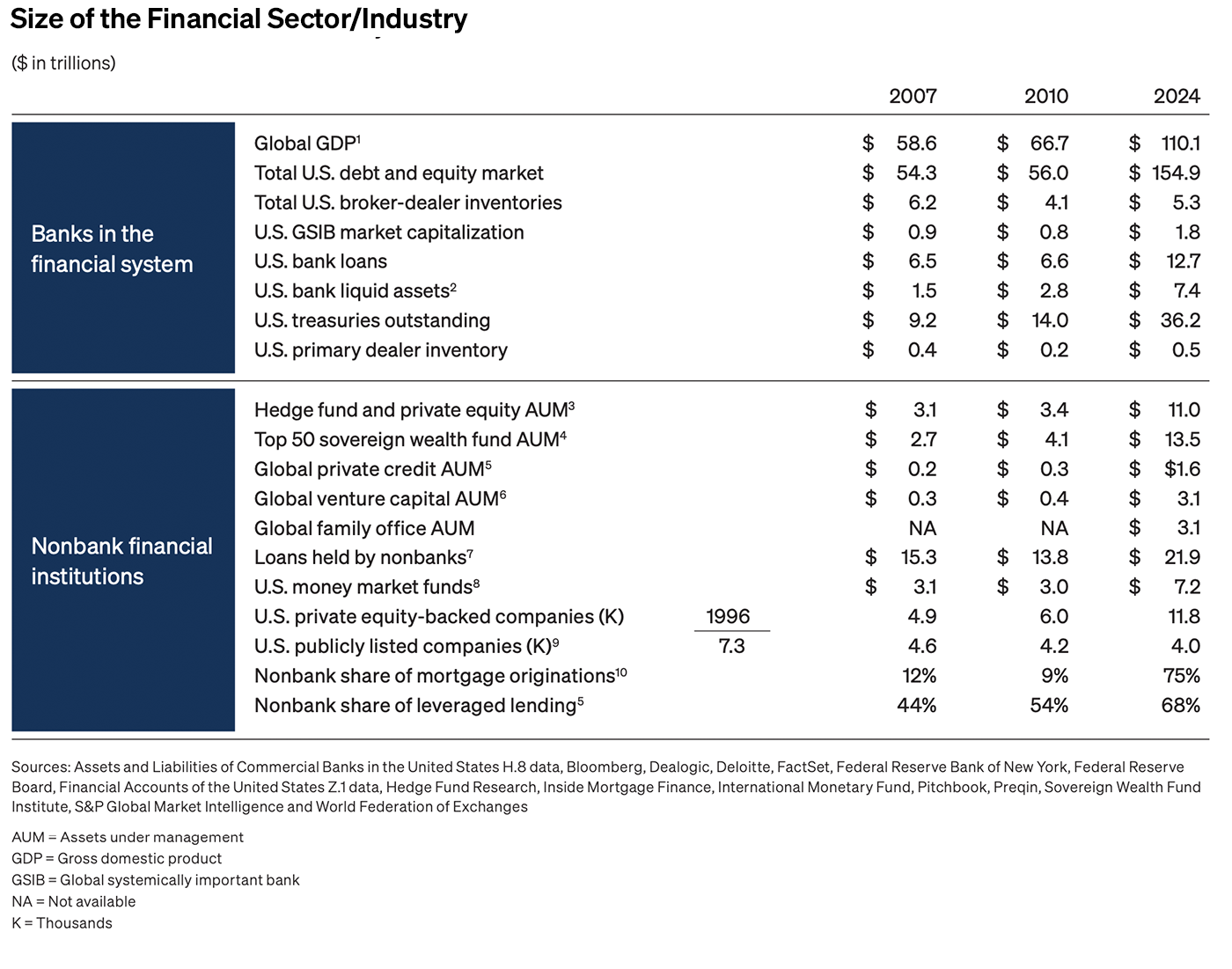

America’s extraordinary standing in world affairs is predicated on our economic, military and moral strengths. Our exceptional relationships with our allies largely exist both because of the security they receive from America’s military umbrella and our strong economic ties. But we are in a new world defined by shifting power dynamics, rapid technological disruption and rising geopolitical tensions, including China’s growing assertiveness. This economic competition and conflict will likely go on far longer than the wars on the battlefield.

The autocratic nations of the world, and some of the nonaligned nations, would like to see a fragmentation of America’s economic alliances and a weakening of our global economic position, including our status as the world’s most powerful economy, a leader in innovation and holder of the world’s reserve currency. This competition has many players, using many tactics, over many years. But our long-term strategic goals should be crystal clear: to maintain the cohesion and strength of the Western world, including their economies. If the Western world’s military and economic alliances were to fragment, America itself would inevitably weaken over time.

Economic fragmentation from our allies may be disastrous in the long run.

Keeping our alliances together, both militarily and economically, is essential. The opposite is precisely what our adversaries want. Europe has some serious issues to fix. Since 2008, the eurozone’s GDP per person has gone from over 75% of U.S. GDP per person to approximately 50%. While Europe has received some tough messages from U.S. leaders recently, what European leaders should do is seize the moment. European nations know what they need to do: significantly reform their economies so they can grow; e.g., finish the economic union to make commerce across their countries easier and more efficient, and initiate labor reform and tax reform to incent more business growth and more labor participation (see the Draghi report). They also recognize that they need to materially increase their military spend and capabilities. This is going to be hard, but our country’s goal should be to help make European nations stronger and keep them close.

If Europe’s economic weakness leads to fragmentation, the landscape will look a lot like the world before World War II. Each nation will need to seek out its own relationships to secure its future, and that may very well mean closer relationships with Russia and Iran for energy and China for trade and economics. Such moves would ultimately make these countries far more reliant on China and Russia – over time effectively making them vassal states. Economics is the longtime glue, and America First is fine, as long as it doesn’t end up being America alone.

We do not need to fear China – we just need to get our act together.

Comprehensive economic policy is critical to compete with China. There is no more consequential relationship for the world, and this relationship will affect the whole Indo-Pacific region, especially our allies: Australia, Japan, the Philippines, South Korea and others.

Over the last 20 years, China has been executing a more comprehensive economic strategy than we have. The country’s leaders have successfully grown their nation and, depending on how you measure it, have made China the largest or second-largest economy in the world. That said, many people question China’s current economic focus – it continues to be beset by many economic and domestic issues, particularly capital misallocation, which have resulted in large real estate problems, a weakened financial system, policies that inhibit entrepreneurs in their own country and an urgent need to accommodate a rapidly aging population.

China has its own national security concerns, as it is located in a very politically complex part of the world. Many of China’s actions have caused its neighbors (e.g., Japan, Korea, the Philippines, among others) to start to re-arm and draw closer to the United States. It also surprises many Americans to hear that while our country is 100% energy sufficient, China needs to import 10 million barrels of oil a day. It is clear that China’s new leadership has set a different course, with a much more intense focus on national security, military capability and internal development. That is its right, and we simply need to adjust to it.

America still has an enormously strong hand – plenty of food, water and energy; peaceful neighbors; and what remains the most prosperous and dynamic economy the world has ever seen, with a per person GDP of over $86,000 a year (this compares with China’s GDP per person of $13,000 in 2024). Most important, our nation is blessed with the benefit of true freedom and liberty.

Starting well over a decade ago, both business and government should have focused on certain problems with China: unfair trade across multiple dimensions and our reliance on China for critical national security-related components. While we may always have a complex relationship with China (made all the more complicated and serious by its actions in supporting Russia in the ongoing war with Ukraine), the country’s vast size and importance to so many other nations (China is the largest trading partner to almost every other nation) require us to stay engaged – thoughtfully and without fear. At the same time, we need to build and execute our own long-term, comprehensive economic security strategy to keep our position safe and secure. For example, we need to remain competitive with China in the artificial intelligence (AI) race by bolstering our technological advancements and reducing our reliance on Taiwan for semiconductor chips. Most of the actions we can take to protect our country are unilateral and do not need China’s agreement. Overall, I believe that respectful, strong and consistent engagement would be best for both the United States and China, as well as the rest of the world.

Whether you view China as a competitor or a potential adversary, we should work with our allies to firmly negotiate an ongoing relationship. Tough but thoughtful negotiations over strategic, military and economic concerns – including unfair competition – should lead to a better situation for all. If America provides strong leadership, and keeps the Western world together, China will be better off forming partnerships with a strong Western world than with nations like Russia, Iran and others. We should also recognize what critical common interests with China we share in combating nuclear proliferation, climate change and terrorism.

What China does so well is manage its country as a whole – coordinating government and business so that they are able to further some of their strategic goals. We must improve our ability to act in a more organized and strategic way to succeed in this new global landscape. Simply put, if we keep our economy the strongest and maintain the strength of our alliances, we will thrive.

We should promote healthy economic alliances, which includes fair trade.

Global trade is enormous, amounting to approximately $20 trillion a year, of which only $2.5 trillion is with the United States. And global trade will take place with or without us. We should remember that other nations have choices, both in the short term and in the long term, and they will make these choices in their own self-interest based on economics, security and reliability.

Many countries need trade to help grow their economies. The European Union, for example, has the largest trade network with 40 individual agreements. China has applied for and signed several new trade agreements (e.g., the Regional Comprehensive Economic Partnership, Digital economy Partnership Agreement, and Comprehensive and Progressive Agreement for Trans-Pacific Partnership). The United States lacks trade agreements with some of its closest allies, many of whom have signed trade deals with China. We should more actively be seeking free (and, of course, fair) trade agreements, particularly with strong allies like Australia, Japan, the United Kingdom and – we hope one day – the European Union. These can be done in a way that is clearly beneficial to both sides.

We already trade with most nations on the planet – and, of course, we should always be trying to make it better and fairer for America. Deepening high-standard trade with key trading partners is good economics and great geopolitics. And we don’t need to ask many nonaligned nations, like India and Brazil, to align with us – but we can bring them closer to us by simply extending a friendly hand with trade and investment.

There are many ways to combat unfair trade – industrial policy is one of them, but it should be done right or not at all.

For hundreds of years, countries have used trade practices to get a leg up on other countries. This economic competition is often exercised through industrial and trade policy, and it comes in many forms: banning or limiting trade (quotas), tariffs, subsidies, grants, tax credits or accelerated depreciation, loan guarantees, long-term purchase agreements and capital controls. These tools are generally intended to give a company or an industry an unfair competitive advantage, and when used together, they can create unbeatable economies of scale. In their harshest form, they can be used by countries as a tactic to try to unfairly dominate whole industries. This should not be allowed.

There are other unfair trade practices that need to be mentioned; e.g., nontrade barriers, such as regulations that effectively stop specific types of trade and various unfair tax policies that range from value-added taxes to a particular country’s tax schemes. Many countries use some of these tools in various forms (including the United States).

So trade agreements have many flaws and need to be carefully negotiated. Practices such as permitting countries to circumvent trade restrictions imposed on them – for example, allowing China to use agreements that it has with other nations to bypass tariffs on Chinese goods – can and should be stopped. Obviously, where the United States is treated unfairly, we should demand that those agreements be fixed. It would also be good to acknowledge that we have sometimes treated others unfairly (for example, parts of the Inflation Reduction Act unfairly favor American business).

Industrial policy mechanisms, when used, should be as targeted and as simple as possible. The cleanest of these is tax credits in various forms. Whatever the policy, two rules should not be violated: (1) there should be no social engineering and (2) markets should allocate capital, not the government – lest the result is a buffet where corporate America gorges. The government is simply not good at allocating capital in a free market. One example should suffice: In our attempt to create a more competitive chip manufacturing industry in the United States (it costs two times more to manufacture these chips in America, and, therefore, our manufacturers would fail if they tried to compete), the government could have given land grants for the land, accelerated depreciation and lowered taxes or offered tax credits for an extended period. Then the companies and the capital markets would have competed to decide how best to do this.

Nonetheless, we need to acknowledge that there have been real negative job impacts as a result of trade (in 1990, manufacturing created 18 million jobs in this country versus 13 million today), which are usually concentrated around certain geographic areas and businesses. So any new trade policy should be combined with a greatly enhanced and effective Trade Adjustment Assistance program, which provides retraining, income assistance and relocation for those workers directly impacted by trade.

America already trades with more than 200 countries, territories and regional associations. We should strike the best and, of course, the most fair trade agreements that we can. And we should do this while maintaining our close economic relations with our allies.

What’s the truth about trade deficits?

Trade deficits, by their nature, are not necessarily good or bad. Even if our country had no net trade deficit, it would likely be running deficits with some countries and surpluses with others. Sometimes a high trade deficit results from a country’s extraordinary attractiveness as an open investment destination, and these investments help that country grow and prosper. This may be true for part of America’s trade deficit. However, trade deficits for pure consumption may mean a country is slowly selling parts of itself to someone else, and I’m not sure that’s a good idea.

Our trade deficit over the last 20 years has totaled over $12 trillion, and this is probably too large. The other side to the trade deficit is an investment surplus, which has resulted over the years in foreign investors owning $30 trillion of U.S. securities, while U.S. investors own only $16 trillion of foreign securities. In 2005, these numbers were $6.3 trillion and $4.3 trillion, respectively. You can see that, over time, foreign investors have come to own an increasing share of the United States. (For your information, China’s holdings of U.S. assets are approximately $1.5 trillion, of which half is U.S. Treasury securities.)

It is good to remember that our trade deficit is also driven by our large government deficit. Therefore, it is perfectly reasonable for us to focus on our “twin” deficits: our $2 trillion fiscal deficit and our $1 trillion trade deficit. While the numbers in the above paragraph highlight the attractiveness of the American economy, they also reveal certain underlying risks: If America, for whatever reason, becomes a less-attractive investment destination, the U.S. dollar and the economy could suffer if foreigners sold their U.S. assets.

Our extraordinary energy position is a massive competitive advantage, ensuring affordable, reliable, safe and ever cleaner energy, both for us and critically for our allies.

The United States has a huge competitive advantage in that it is essentially self-sufficient on energy – and will be for decades. This reduces the cost of so many things in our country (e.g., up to 40% of the cost of food is related to energy) and makes it much easier for American companies to compete. It’s also an enormous geopolitical benefit for us to be able to export safe, affordable, secure liquefied natural gas overseas to our allies. This binds them to us, gives them greater security and is economically beneficial for the United States. It also has the virtue of being good for the climate – as cleaner liquefied natural gas replaces dirtier coal.

America should lead the way in generating more energy to meet greater demand, including from AI, which will require huge amounts of energy. And we need an “all of the above” strategy for developing renewable energy, as well as tapping conventional energy sources. We should not forget that to make energy ever more efficient and cleaner, we also need more rapid permitting, investment in the grid and access to critical minerals. I am convinced that, over time, our innovative capabilities will make energy cleaner and solve the carbon emissions problem.

In this country, we have made many mistakes around climate policy – and I believe a lot of money will ultimately be wasted. We also made many bad decisions. For example, we failed to build the pipeline that would bring gas from Pennsylvania to New York – this would have replaced coal (in a cleaner way) and dramatically decreased the cost of energy for New Yorkers. It’s also important to remember that pollution in the United States was significantly reduced because we effectively outsourced the production of “dirty” manufacturing, like steel, to other nations that have lower emissions standards than we do.

One last point: Billions of people around the world still lack access to affordable and reliable energy, a fundamental driver of higher and healthier living standards. Meeting this demand improves lives on a global scale.

There are many other critical foreign economic policies that could be used to promote the American economy and protect our allies.

Essentially, they are:

- We must keep America’s tax system internationally competitive so as not to drive capital, companies, intellectual property or people overseas. There is a complexity to this because so many countries play games with their tax systems – but staying competitive can be done. It would be a huge mistake for America to put itself at a disadvantage – there are better ways to collect taxes (more on taxes in the next section).

U.S. development finance institutions, including the two main ones (the U.S. International Development Corporation and the Export-Import Bank of the United States), are generally used to develop projects in and support exports from developing nations. Our development finance is very small relative to the size of our country – in total, America’s development finance investment is approximately $60 billion. We are virtually absent compared with China. By contrast, China’s government-led Belt and Road initiative has lent or invested $1.4 trillion in 155 different countries. China does this to promote its business expansion overseas and to enhance its own energy, minerals or supply chains.

In addition to the Belt and Road initiative, China has foreign direct investment of approximately $3 trillion in the rest of the world. This investment was virtually zero in 2000. By comparison, America’s foreign direct investment totals $6.7 trillion. In my travels in Africa and Latin America, the absence of American business or government investment is palpable. African and Latin American nations want more of America, but they are getting what they need from China. Done right, America could dramatically increase its development finance – it is not a giveaway, it can be quite profitable, and it has the virtue of promoting America and its businesses overseas.

- We need to do a better job, in general, of promoting American business overseas. America’s development institutions can work with American businesses far more effectively, for instance, by providing political insurance on large capital investments. This insurance would protect businesses and enable them to make investments in unstable regions by covering risks like government takeovers or political unrest.

At the same time, while laws like the Foreign Corrupt Practices Act have helped reduce corruption and level the playing field abroad, such laws often put firms at a disadvantage, including American firms and international firms with a U.S. nexus. The rules can be vague, the guidelines are ambiguous and the penalties are steep – making impacted companies hesitant to compete. This needs to be fixed.

- We need to constantly educate and inform the world about America’s values and virtues. We don’t need to be condescending or lecturing, just consistently educating and sharing – the lore of freedom and democracy combined with a gentle assist will eventually win the day.

America’s strong economy plays a critical role in preserving the U.S. dollar as the world’s reserve currency.

The U.S. dollar is a “fiat” currency. Some say this makes the dollar purely a matter of trust. This is simply not true. The Federal Reserve, which issues dollars, owns assets (mostly U.S. Treasuries) supporting each dollar it issues. Those assets carry the full faith of the U.S. government, backed by its taxing power on the most prosperous nation the world has ever seen. If you have U.S. dollars, you are essentially free to do with them as you see fit – that is not true in many autocratic nations. The U.S. dollar is the world’s reserve currency because of America’s open markets, the strength of our economy and our rule of law upholding property rights – all protected by the U.S. military. These are also the reasons why the United States is such an attractive investment destination for anyone wanting to invest their money.

A well-functioning international monetary system is good for the United States and for our allies, particularly since the rules are set by us and our allies (although some reform is needed). The U.S. dollar is foundational to a healthy global economic system, and it’s the cornerstone of America’s commanding global influence. The strength of our financial system gives America considerable clout, not only in allocating capital efficiently but also in creating a huge informational advantage for our country. The U.S. financial system writ large is the best in the world – with extraordinary knowledge and capabilities, it is a critical flywheel of the American economy.

To protect the status of our global economic influence and of our reserve currency, America also needs to be broadly trusted and reliable. Good trade should be enabled to flourish. Sanctions are a powerful tool (against not just financial corruption but global bad actors) – but they should only be used judiciously and for the right purpose and, generally, done in concert with our allies. In addition to the benefits mentioned above, being the reserve currency saves the United States $100 billion a year at current interest rates. People around the world actually carry approximately $2.5 trillion of paper U.S. dollars, which, in effect, is borrowing without paying interest.

There is a correlation between the strength of our economic and military alliances and our status as reserve currency: The stronger our alliances, the stronger our reserve currency status. However, the opposite is also true. History has shown that as countries become weaker, their currency loses reserve currency status.

Affirm that our national security and the world's best military, at whatever cost, are paramount and necessary for peace.

In today’s troubled world, we’ve seen several stark reminders that national security is and always will be paramount even if that idea seems to recede in tranquil times. America remains the arsenal of democracy and the bastion of freedom for the whole world. We must explain to the American public, over and over, how Ukraine and the terrorist activity in Israel, fueled mainly by the Iranian regime, are the actual battlefields of freedom. It is our hope that these terrible events have awakened all of us to the fact that the world is never safe. As President Ronald Reagan once wisely said, “The only way to stay safe is peace through strength.” Having the best military is expensive, but it is not nearly as expensive as dealing with what would happen without it. We must maintain the world’s strongest military, without question.

Of course, it is reasonable to expect allies to pay their fair share of global military expenses – but we should also recognize that it is in our own strategic self-interest to keep our allies together. The U.S. military presence around the world should not be viewed as mere protection for hire – it’s a critical pillar of global stability and a reflection of our leadership.

We hope one day there will be a lasting and permanent peace for Israel and the Middle East. Ukraine needs a proper resolution – one that provides it with sovereignty, stability and security – putting their country on a path to healthy growth. Sovereignty means that they are a free nation left to make their own decisions. If Ukraine is left in a weakened position (meaning, essentially, that Russia succeeded), we will see a fracturing of America’s military alliances as countries, Europe in particular, search for better security arrangements.

One more point about military security: There was always a thought that America was far from European wars, even though we have been dragged into them many times. With the advent of cyber war, satellites and hypersonic missiles, the world has changed; other countries’ military capabilities are already on our doorstep.

We need to employ all instruments of national power.

The exercise of power isn’t measured by military force alone but also includes other instruments of national power: diplomacy, economic development, foreign assistance (all done in a strategic, efficient and accountable way) and constant education about the benefits of freedom. Again, as President Reagan said, “Freedom is special and rare. It’s fragile; it needs protection.” Fundamentally, we need to realize that power is also based on trust: trust that we will do the right thing, that we can do the right thing and that we are not just strong but reliable.

We need to immediately change certain policies to secure and enhance our military capabilities.

Sustaining America’s position of power requires major changes in the funding and planning of our military. This includes major changes in trade, production capacity and supply chains to make our military as resilient and capable as possible. Some specifics will suffice:

- We don’t have multi-year plans for critical military expenditures and often rely on short-term continuing resolutions to fund our military. This costs the military billions of dollars a year and creates instability and uncertainty for the defense industry. Switching to multi-year plans could potentially provide $40 billion in savings a year (out of a 2024 Defense Department budget of almost $850 billion) and greater stability for the military.

- We need to allow greater flexibility on the reallocation of money; i.e., to continuously innovate (buy the newest drones and other items).

- Our stockpiles of vital munitions are seriously inadequate – if there was a war in the South China Sea, we would run out of missiles in seven days. If it were up to me, I would be stockpiling ammunition, air and missile defense, rare earths and other critical components, importantly to preserve peace.

- We don’t maintain sufficient excess production capacity in our defense industrial base to ramp up the production of weapons, if necessary. We don’t even have the proper capacity to build battleships anymore. It would be rather easy for the government to work with the private sector to help maintain factories capable of producing military materials that would be required at a wartime pace.

- We also lack sufficient labor necessary to do everything outlined above. It can take up to six years to train workers on the complex skills that are needed to manufacture this equipment – and we don’t have six years.

- We need to immediately restructure some of our trade and supply chains. Surprisingly, many of the essential items we would need in case of war would come from potential adversaries. These products range from rare earths to penicillin and other pharmaceutical ingredients to certain types of steel, semiconductors and even some manufactured components. We need to use all of the tools at our disposal to do this as expeditiously as possible.

- Taking the proper unilateral actions on very targeted investment and export restrictions (chip making equipment, advanced chips and other hard-to-duplicate technology used for military purposes) is essential. However, we should only expect these kinds of actions to slow down our competition, not necessarily stop it.

- Finally, the extraordinary science that comes out of our national labs and our exceptional universities has been critical to creating and maintaining our scientific discoveries and advances, which have not only fueled America’s economy but have also maintained our military superiority. There are lots of complaints – some legitimate – about America’s elite universities, but this cannot and should not be one of them.

Protecting our country goes way beyond just the military and includes, among other items, grid security, data centers, communications and cybersecurity in general.

Foreign policy is realpolitik.

America’s alliance system is the foundation of our geopolitical advantage and is the special sauce of American leadership. Foreign policy must be grounded in realpolitik – a pragmatic approach that prioritizes national interest over ideological considerations. Realpolitik means that many decisions are properly subordinated to national security. For example, while addressing global challenges, like climate change, is important, such efforts should not overshadow the strategic imperatives of our foreign relations.

We need to bring our allies along and help them build their own capabilities. A weak Europe is ultimately very bad for America. Among other things, our allies need reliable, safe, secure and affordable energy – or they will be in a terrible position. Diplomacy and our economic relationships, including trade, are a critical part of maintaining these alliances. While we should educate other nations about the virtues of our values, we should stop lecturing – we don’t need them to have all our values, but we do need them to be strong allies.