We are also investing in key growth sectors. Since the start of 2024, we’ve hired more than 300 bankers across Global Banking. Our goal is to continue to grow market share across 28 subsectors in investment banking with a particular emphasis on healthcare, technology, infrastructure and the middle market. Despite being the leading franchise in the world for more than a decade, there are still plenty of ways we can grow and expand our relationships over time.

Serving client ecosystems

We are partnering across the firm to deliver more value to important client ecosystems, such as financial sponsors, the Innovation Economy, sovereign wealth funds and family offices.

Financial sponsors represent a major market opportunity, with an estimated $3 trillion of investable assets. Over the last five years, about half of the Investment Banking wallet from sponsors has come from middle-market-sized transactions. As the bank to over 32,000 middle market companies, we have a significant competitive advantage. To support our growth, we’ve expanded our teams globally. Strong collaboration among our Markets, Banking and Private Bank teams has resulted in differentiated dialogue with financial sponsor clients, who are expected to drive a significant amount of activity around the world.

By strengthening the partnership between Banking and Markets, we have been able to bolster our capabilities in private credit. Over the past four years, we have successfully deployed more than $10 billion in 100 direct lending financings. Recently, we announced that we are dedicating up to $50 billion from our own balance sheet, along with nearly $15 billion from our co-lending partners, highlighting our determination to be a leader in both the broadly syndicated and private credit markets.

Our investment also continues in banking the full Innovation Economy ecosystem – the network of venture-backed companies, founders and investors – where we had nearly 30% client growth in 2024. Our ability to support clients throughout every stage of their life cycle is a true differentiator. As they scale and grow, we are uniquely positioned to meet their increasingly complex and global needs.

Delivering leading capabilities

In Global Banking, we’re equipping our commercial, corporate and investment banking teams with data-enabled analytics and intuitive applications to best serve our clients. Leveraging the latest technology and J.P. Morgan’s unparalleled access to data across global markets, we are empowering our teams with rich market insights that lead to better client outcomes.

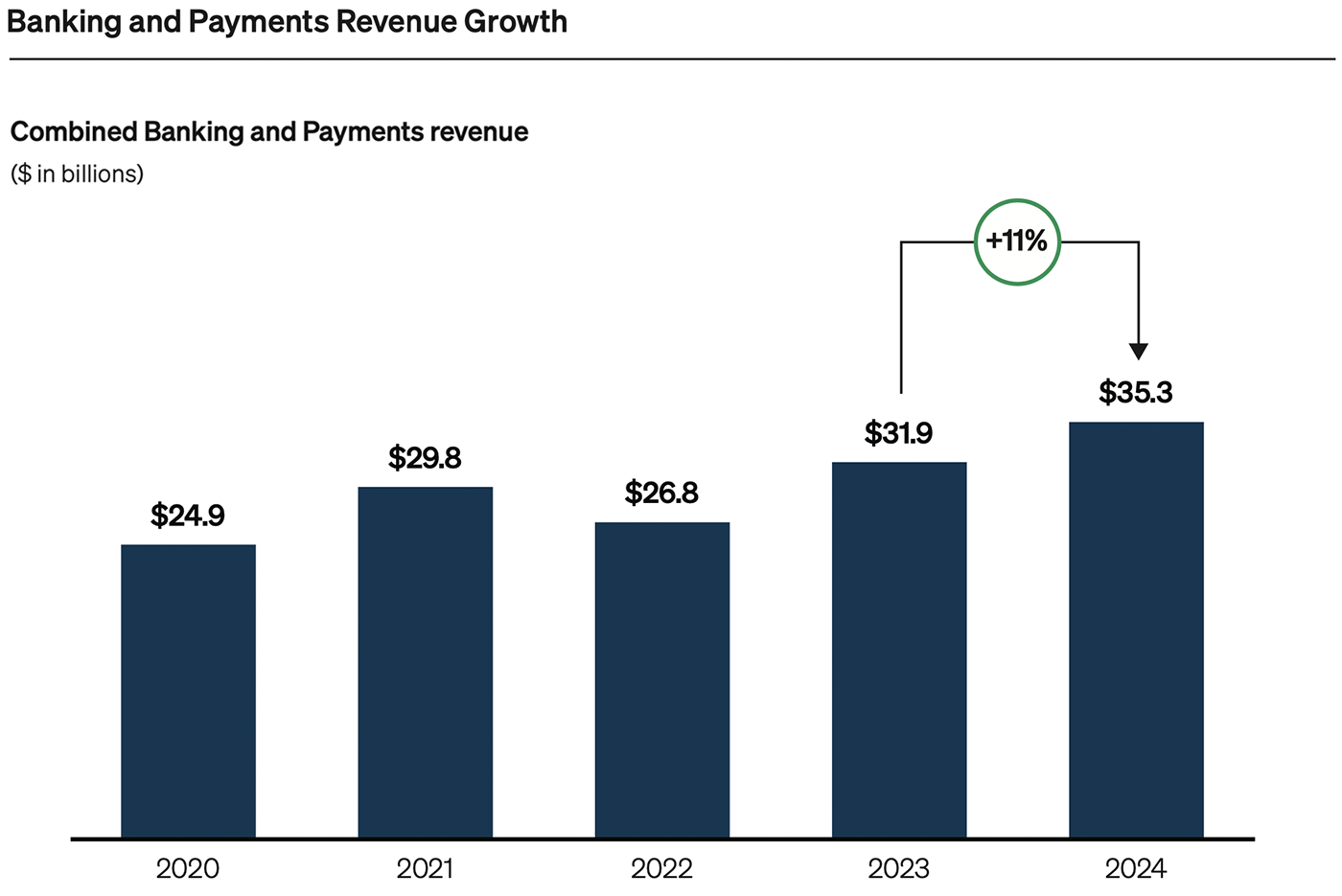

In Payments, we operate at scale, processing over $10 trillion in payments daily, with a 5% increase in volumes year-over-year. J.P. Morgan is also the largest U.S. dollar clearer globally, with over 28% of SWIFT market share and the largest merchant acquirer in North America, with settled sales of about $2.6 trillion globally. There is still significant room for growth, particularly with corporates and in international markets. With that goal, we are investing in innovation, enhancing product capabilities and modernizing to improve the resiliency of our platforms. We have expanded our biometric payments offerings, rebranded our blockchain business to Kinexys by J.P. Morgan – processing over $2 billion in transactions daily – and launched our acquiring services in France through our partnership with the Cartes Bancaires network.

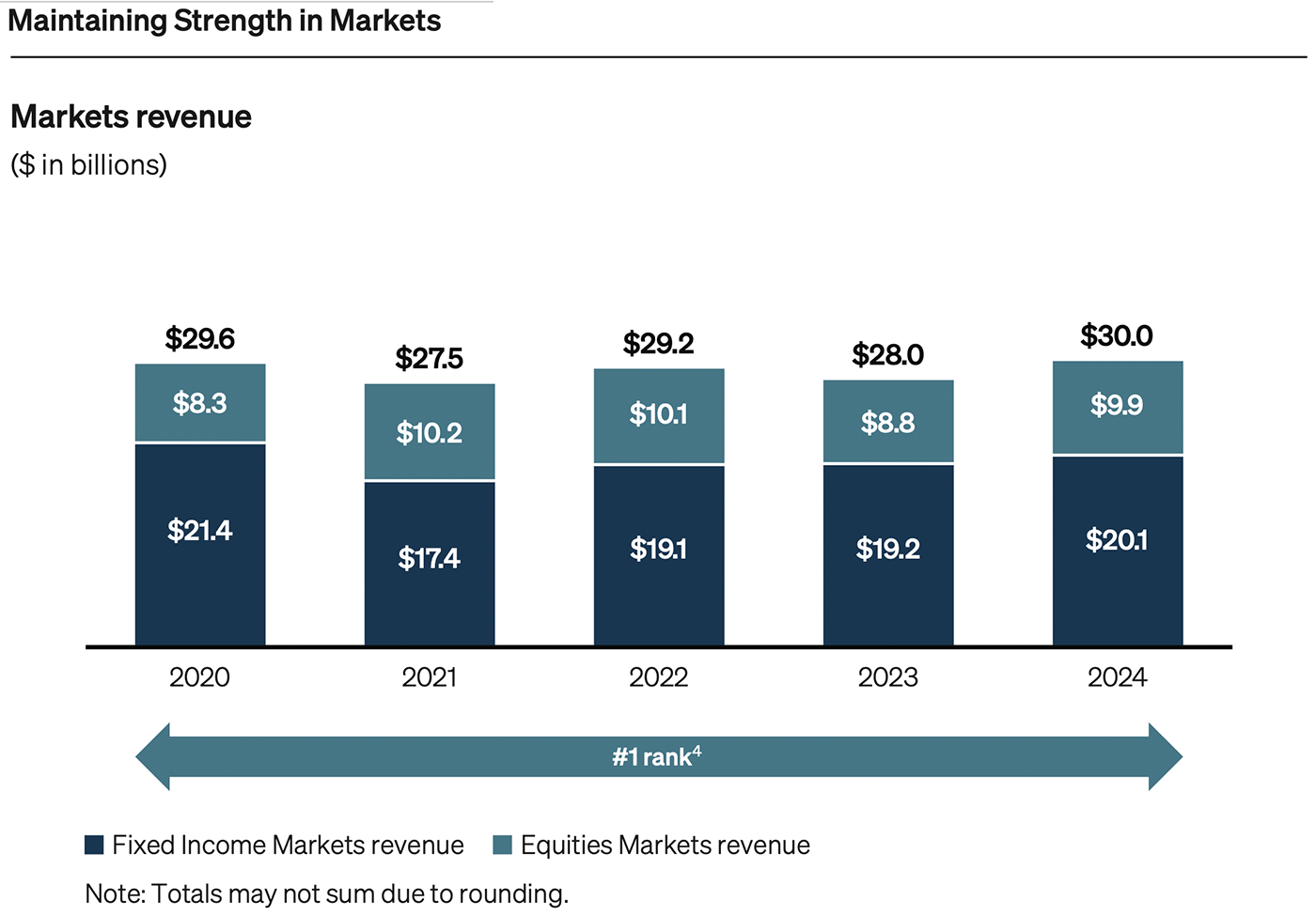

In Markets, we continue to add value for clients across the trading life cycle, from research and market insights to execution and post-trade services. The Global Research team, which plays a crucial role in acquiring and retaining clients in this business, achieved a clean sweep of #1 rankings in Extel’s Global Leaders Tables for research providers. J.P. Morgan was named the world’s top research house for the fifth consecutive year. J.P. Morgan Markets, our client research platform, underwent a redesign to improve the user experience, personalize content and make it easier to access our trading services.

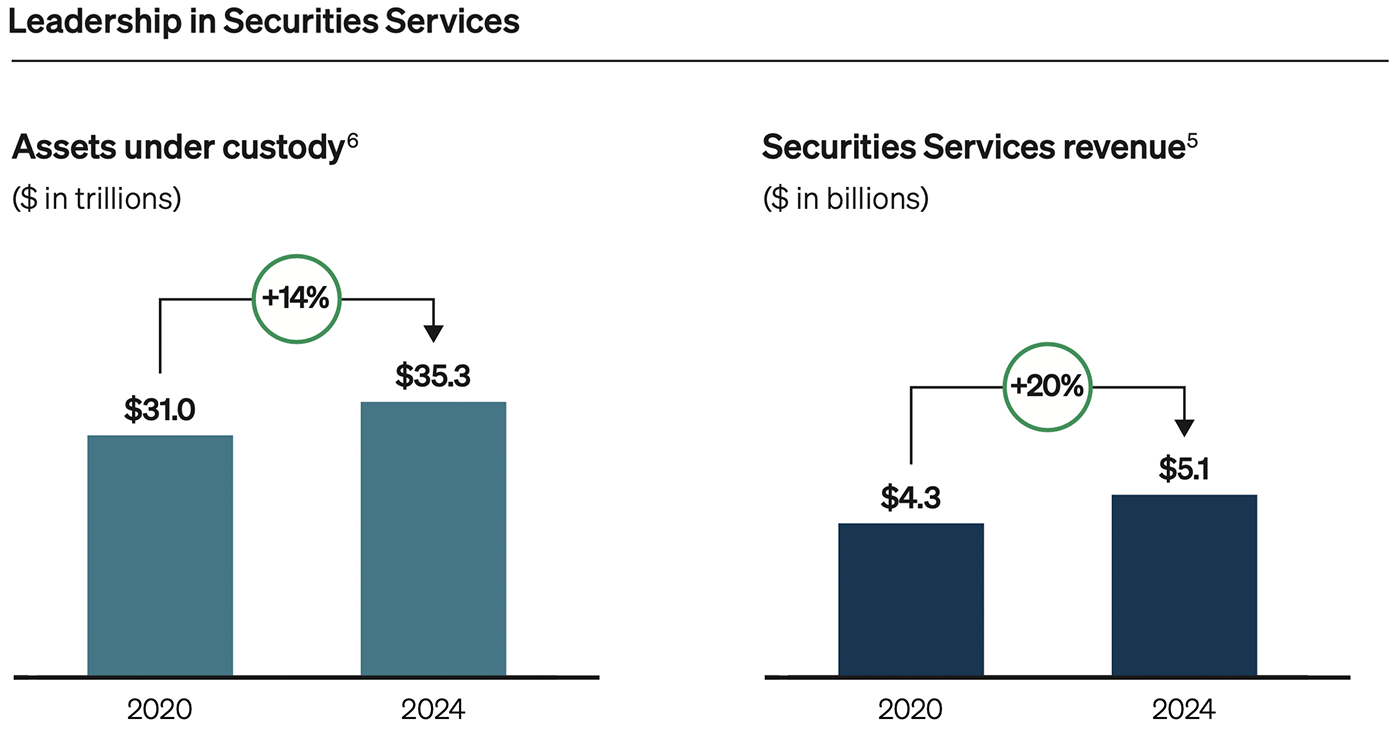

Investments in technology have also enhanced the scale and resiliency of our Securities Services platforms, enabling revenue growth and securing major new wins. Among recent innovations, our Fusion platform provides clients with tools for data discovery, simplified access to consistent data, and proprietary analytics within a robust governance framework.