Figure 1: In the pre-pandemic period, nearly a third of small businesses discontinued health insurance from one year to the next.

(2018–2019)

Research

April 10, 2025

Entrepreneurship is a significant driver of economic growth and dynamism, yet recent trends suggest stagnation in some industries. A critical factor contributing to this stagnation may be the burden of health insurance payments, which disproportionately affects small businesses.

This study addresses a critical gap in understanding how health insurance burdens affect small businesses and their survival, particularly within different industries. To do so, we leverage unique deidentified firm-level deposit account data that allows us to analyze health insurance payments within the context of other firm finances, providing insights by industry.

Our findings highlight the substantial financial pressures faced by small businesses in managing health insurance costs, underscoring the need for a deeper understanding of these challenges and for targeted policy measures or strategic initiatives aimed at supporting their resilience and growth.

Key findings

This study emphasizes the need for policies and healthcare products that keep premiums affordable, helping small businesses maintain consistent coverage. Inconsistent health insurance coverage can hinder entrepreneurship and economic growth, as nonemployer firms may face financial instability if health issues arise, while employer firms may struggle to attract and retain skilled employees. Addressing these challenges is crucial for fostering a stable and innovative small business sector.

Health insurance remains a vital component of the American workforce's well-being, with a substantial portion of U.S. workers relying on employer-sponsored health plans for their coverage. Approximately 55 percent of workers are covered through these plans, highlighting the critical role that employers play in providing access to healthcare services (Keisler-Starkey, Bunch, and Lindstrom 2023). The current policy landscape encourages employers with 50 or more employees to offer health insurance by imposing penalties on those that fail to provide it. This approach aims to ensure that a significant segment of the workforce has access to necessary and affordable healthcare services.

However, a notable gap exists in the coverage system for employees working at firms with fewer than 50 employees. These employees account for 27 percent of the private sector workforce, yet there is no established framework to ensure their access to employer-sponsored health insurance.1 This lack of coverage can lead to disparities in healthcare access and financial security for a significant portion of the workforce.2

Nonemployer small business owners—defined as small business owners who do not have any paid employees—face even greater challenges, as they must navigate the individual market to secure health insurance, adding to their financial burdens.3 The complexity and cost of obtaining health insurance independently can discourage individuals from pursuing entrepreneurship (Bailey 2017, Fossen et al. 2024),4 further impacting economic growth.5

As healthcare expenditures were an estimated 18.3 percent of the U.S. gross domestic product (GDP) in 2021 and are projected to rise to 19.6 percent of GDP by 2031 (Keehan et al. 2023), small businesses are confronted with the difficult task of managing these costs among others, especially if they try to avoid passing them onto their employees, which could impact employee satisfaction and retention (Carrns 2024).

The current system offers some tools and incentives to help small business owners contain the burden generated from health insurance expenses,6 such as the Small Business Health Care Tax Credit for firms with fewer than 25 employees.7 Additionally, advance premium tax credits (APTC) are available for individuals who purchase insurance through ACA marketplaces, potentially lowering monthly premiums. These credits are generally available to households with incomes between 100 and 400 percent of the Federal Poverty Level (FPL), with expanded eligibility under the American Rescue Plan Act (ARPA) of 2021, set to expire at the end of 2025 (Fernandez 2024). Small firms may also leverage Professional Employer Organizations (PEOs) to access healthcare coverage for their employees.

Despite these measures, financial strains persist for many small businesses. Our previous report highlighted that health insurance premiums are an increasing share of operating expenses for nonemployer businesses, though tax credits appeared to moderate premium growth for some. Notably, while the median premium increased in a longitudinal panel, it remained flat in cross-sectional data, suggesting that individual firm experiences over time were not fully captured in cross-sectional statistics (Wheat and Mac 2024). This discrepancy raised important questions about the consistency of health insurance premiums and the factors driving firms to discontinue coverage, especially in light of a recent study showing that the percentage of employers providing health benefits has reached a near-record low in 2023 (EBRI 2024).

Additionally, our previous report showed that health insurance premiums comprised a larger share of compensation costs for employer businesses with lower revenues (Wheat and Mac 2024). Since revenue varies across industries (Farrell, Wheat and Mac 2020), this finding prompted further investigation into how health insurance burdens and changes in these burdens varied by industry, and how the growth in health insurance premiums compared to the growth in payroll expenses.

Given these puzzling results, this study aims to delve deeper into the dynamics of health insurance costs for small businesses from 2018 to 2023 and studies the choices small businesses make regarding health insurance. Specifically, we address the following questions:

To address these questions, we analyzed our unique dataset that allowed us to follow cohorts of firms with Chase Business Banking deposit accounts over time, providing insights into small business decisions regarding health insurance payments relative to other costs. Consistent with the prior report (Wheat and Mac 2024), we designed our research samples to analyze small business owners who buy health insurance for themselves, as well as small businesses that offer health insurance benefits to their employees. We first computed the health insurance burden for these firms. We then followed these firms over the years and identified those that discontinued health insurance premiums but continued to operate.

By examining these dynamics, we aimed to provide a clearer understanding of the economic pressures and strategic considerations that drive small businesses' decisions to maintain or discontinue health insurance coverage. This study not only sheds light on the challenges faced by small businesses but also informs potential policy interventions to support their resilience and growth.

Nearly one-third of small businesses dropped health insurance coverage from one year to the next, with rising health insurance burdens as a contributing factor.

Health insurance can be a critical support for small business employees and nonemployer small business owners. Nevertheless, many small businesses stop making health insurance payments. Here we investigate whether small business owners are stopping these payments because of soaring prices for health insurance. In our previous report, we focused on firms paying health insurance premiums over time using a longitudinal panel sample, following the same firms over five years. We found that health insurance premiums became a growing portion of operating expenses for nonemployer businesses. However, tax credits appeared to help moderate this growth for some firms (Wheat and Mac 2024). Most importantly, the number of firms in our sample that continued to pay health insurance premiums over a five-year period was relatively small.8

Interestingly, while the median premium rose in our longitudinal study, it remained stable in cross-sectional data. Notably, differences between the premium growth in a panel as compared to cross-sectional growth suggest that the population of health insurance premium paying small business is changing meaningfully over time. To shed more light on whether the sample composition played an important role, we analyzed how consistently firms paid health insurance premiums from one year to the next and the potential reasons for discontinuation.

To answer this question, we constructed a sample of firms that made health insurance payments in 2018. We then identified the status of these firms in 2019 to determine the share that remained active and paying health insurance premiums, the share that discontinued health insurance premiums, the share that closed their deposit accounts or were inactive, and the share that had some other outcome.9 We followed the same procedure for the changes between 2022 and 2023. We found that across both categories of nonemployer and employer firms, it was very common for firms to discontinue health insurance premium payments. This fact was consistent across industries and over time.

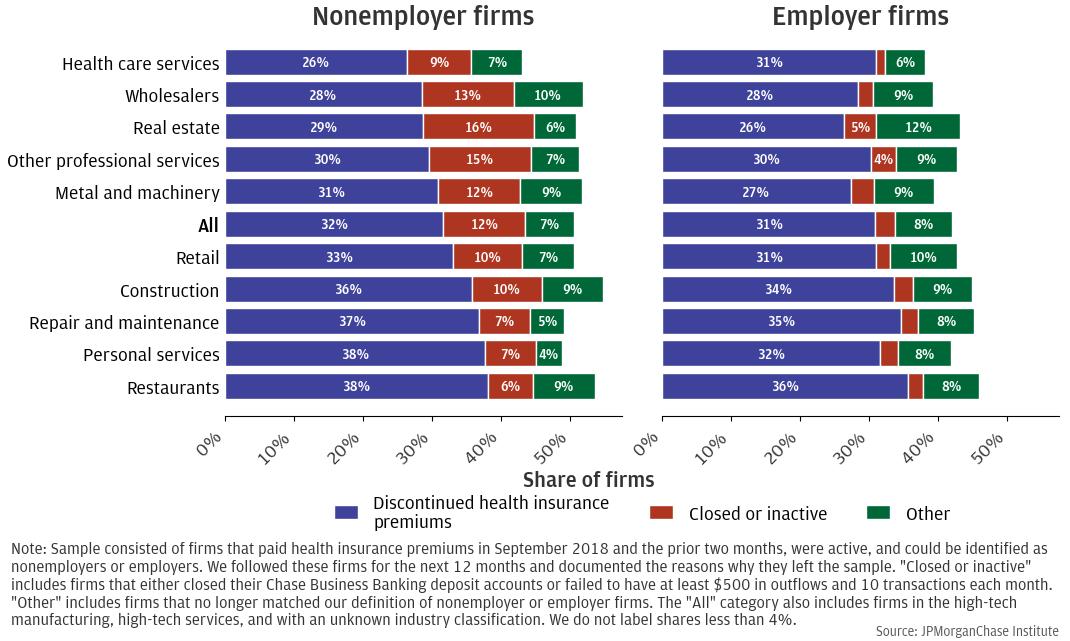

Figure 1: In the pre-pandemic period, nearly a third of small businesses discontinued health insurance from one year to the next.

(2018–2019)

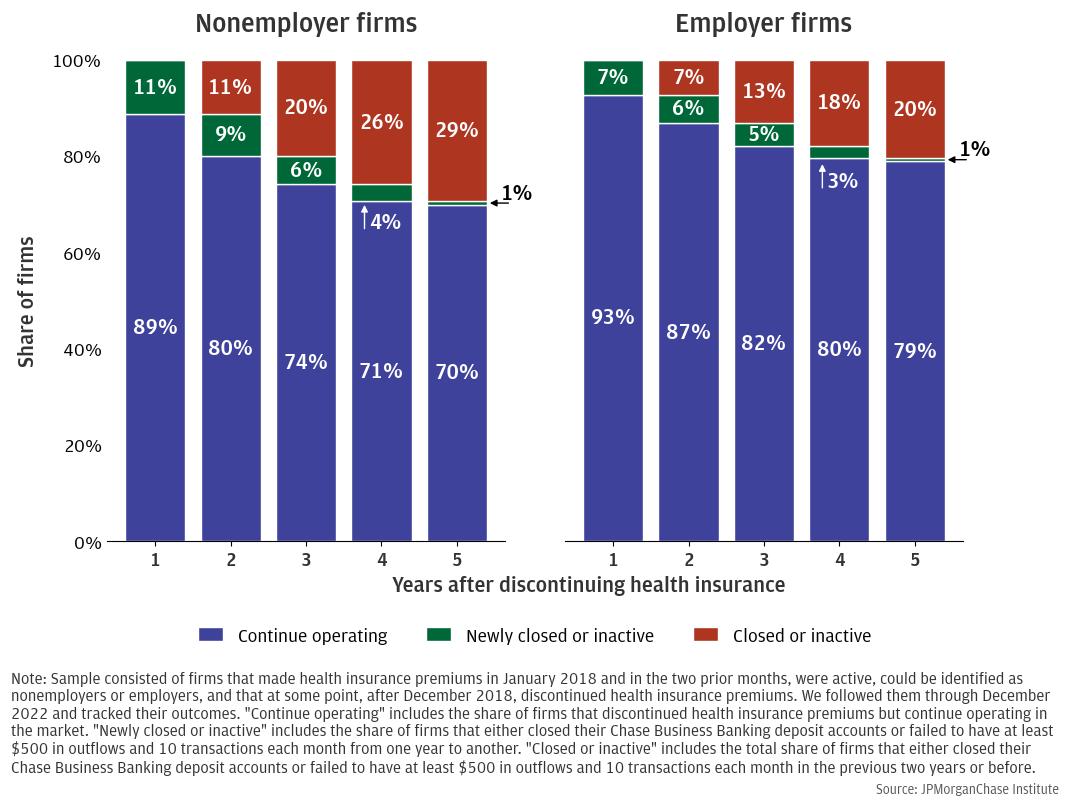

Figure 1 provides some insights on the dynamics of firms that did not continue to operate and pay health insurance premiums, focusing on the pre-pandemic period. For instance, looking at the nonemployer firms (left panel), about 32 percent of firms that paid health insurance premiums in 2018 stopped doing so in 2019, with the highest shares found in restaurants (38 percent), personal services (38 percent) and repair and maintenance (37 percent).10 These findings are consistent with the idea that industries with lower profit margins, such as restaurants, are more likely to discontinue health insurance premiums, while industries with higher profit margins, such as health care services, are less likely to do so (Farrell, Wheat, and Grandet 2019). It is worth noting that for nonemployer firms, discontinuing health insurance payment does not necessarily translate in losing health coverage altogether. For example, business owners could switch from purchasing their own insurance to accessing health insurance through family members’ employer-sponsored plans.11

We found a similar result for employer firms (right panel). About 31 percent of firms that paid health insurance premiums in 2018 stopped doing so in 2019, with the highest concentration found in restaurants (36 percent), repair and maintenance (35 percent), and construction (34 percent). Compared to nonemployer firms, employer firms showed less variation across industries, possibly because health insurance coverage involves not just the owner but also multiple employees. Completely discontinuing coverage requires ceasing it for all employees, which could be more challenging and complex. Moreover, discontinuing health insurance payments does not necessarily imply that the employer no longer plays a role in securing health insurance. For example, employers could alternatively provide funds for their employees to purchase insurance on the individual market, where they might also qualify for tax credits.12 Another possibility is that businesses obtain coverage for their employees through PEOs instead of paying for insurance coverage directly.

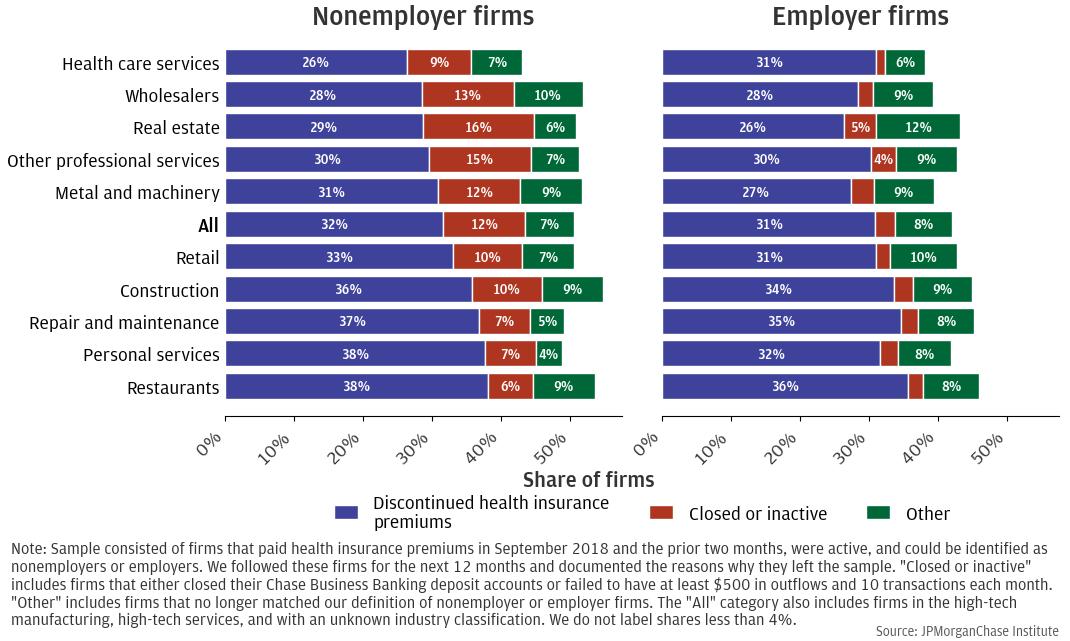

Figure 2: In the post-pandemic period, a material share of firms discontinued health insurance payments from one year to the next.

(2022–2023)

Figure 2 illustrates similar trends for the post-pandemic period, examining changes from 2022 to 2023. During this time, the overall rate of discontinuation decreased slightly to 26 percent for nonemployer firms and 27 percent for employer firms, compared to 32 and 31 percent, respectively, in the pre-pandemic period. This reduction may be attributed to the exit of weaker firms during the pandemic (Crane et al. 2022) and the substantial market liquidity resulting from government aid. Nonetheless, a material share of firms discontinued health insurance premiums in the following year. For nonemployer firms, about 26 percent that paid health insurance premiums in 2022 discontinued the payments in 2023, with the highest share found in the personal services (30 percent), construction (29 percent), repair and maintenance (29 percent) and restaurant (28 percent). For employer firms, about 27 percent discontinued health insurance premiums in 2023, with the highest concentration found in the personal services (33 percent), construction (31 percent), metal and machinery (31 percent) and repair and maintenance (31 percent).

Overall, we found that a large percentage of firms, both nonemployers and employers, discontinued health insurance premiums from one year to the next. This result was robust across time, pre- and post-pandemic, and across industries.

This observed trend raises an important question about the potential factors influencing firms' decisions to discontinue paying health insurance premiums across industries. A recent survey revealed that health costs could be one of the leading drivers of it: nearly one-quarter (24 percent) of small businesses surveyed dropped health coverage altogether due to increasing health costs (Small Business Majority 2024). This is consistent with our previous research, which showed that firms with higher health insurance burdens — defined as the share of health insurance premiums relative to overall costs —exhibited higher rates of discontinuing health insurance premiums (Farrell, Wheat, and Mac 2017).

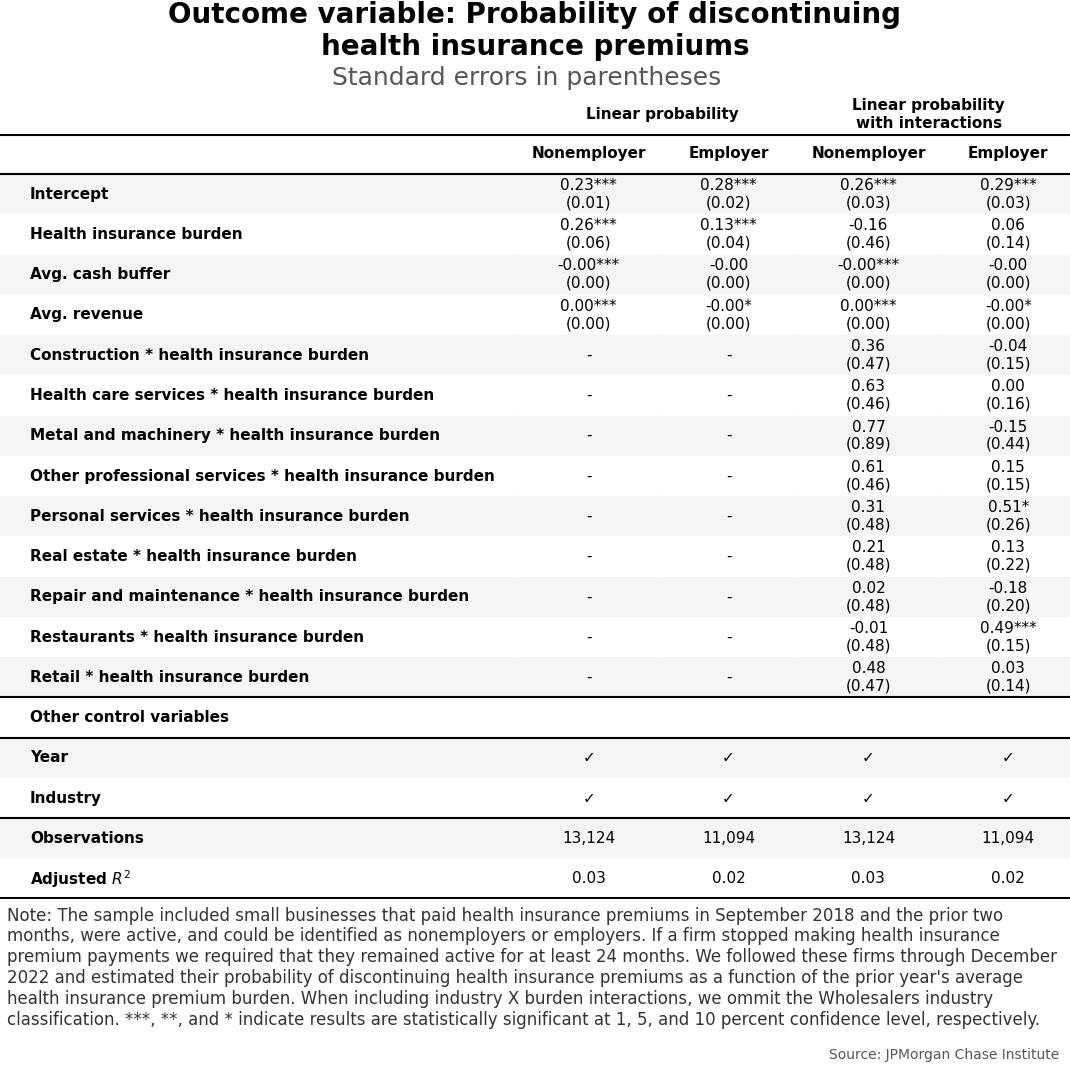

We further investigated this relationship between the health insurance burden13 and the decision to discontinue health insurance using regression models, which allowed us to isolate the effects of one variable while controlling for others. We analyzed how the previous year's health insurance burden affected the likelihood of a firm deciding to discontinue health insurance premiums in the following year, while controlling for observable firm characteristics such as industry and revenues, among others.14 Specifically, we studied how a hypothetical 10 percent increase in the health insurance burden affects the likelihood of a firm discontinuing premium payments. To ensure that our findings were not influenced by firms winding down operations, we excluded those that closed their accounts or became inactive within two years of discontinuing health insurance payments.15

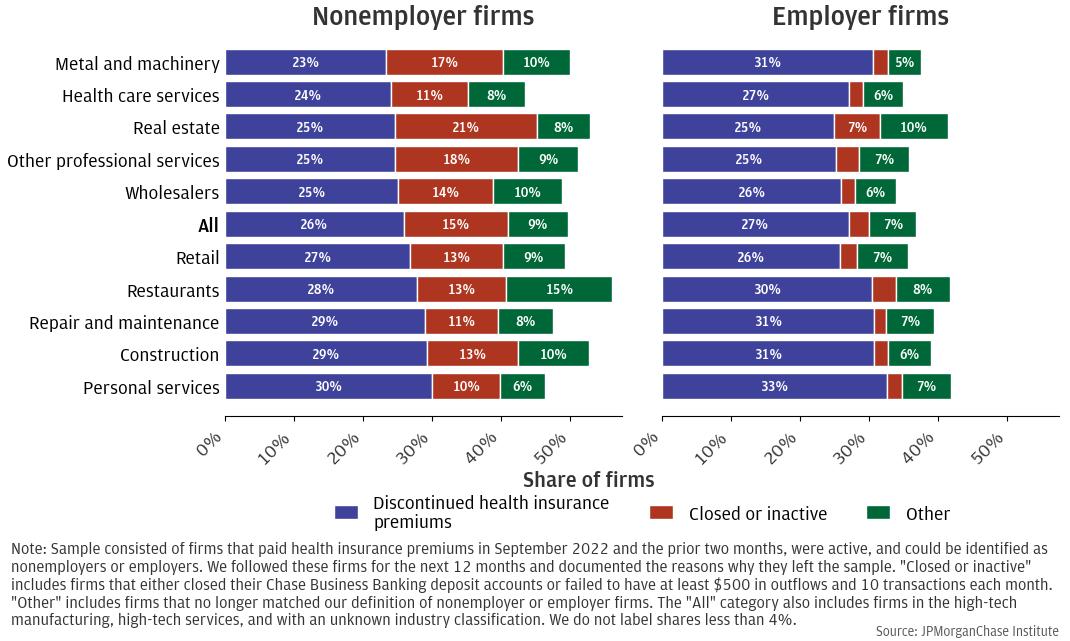

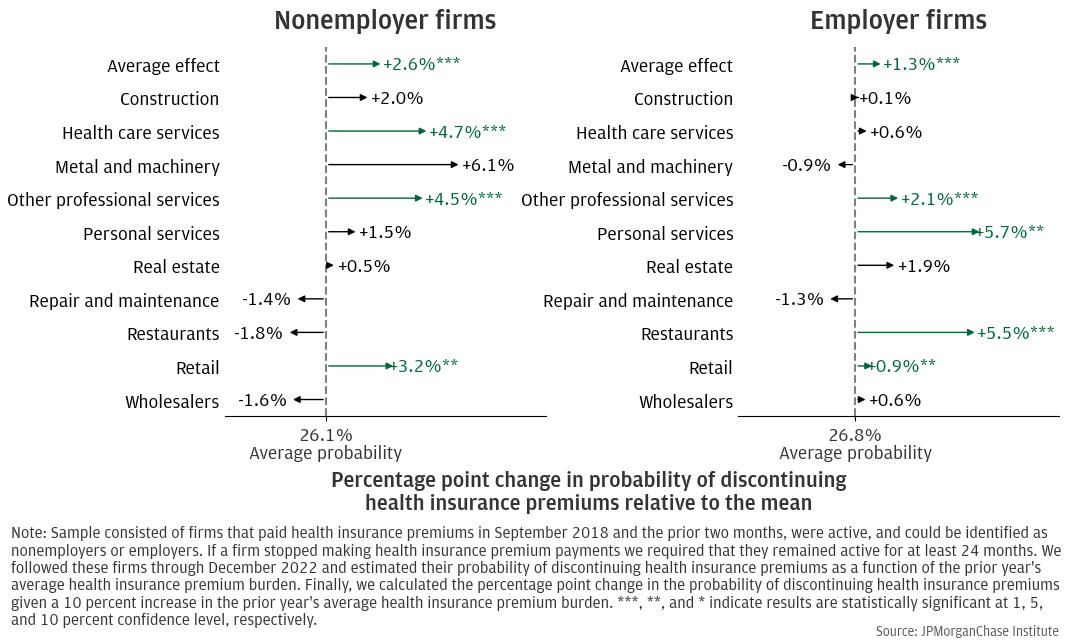

Figure 3: A 10 percent increase in the health insurance burden increases the likelihood of discontinuing payment of premiums.

The average firm in both samples of nonemployers and employers was sensitive to changes in the health insurance burden. Figure 3 shows the impact of a 10 percent increase in the health insurance burden on the probability that a firm discontinues health insurance payments, relative to its mean. The left panel of Figure 3 shows estimates for nonemployer firms, while the right panel of Figure 3 shows estimates for employer firms. While the baseline average probability of nonemployer firms to discontinue health insurance premiums was 26.1 percent, we found that a 10 percent increase in the health insurance burden for the average nonemployer firm increases this probability by 2.6 percentage points and this result was statistically significant.16

We illustrate this result with an example. Assume that for the hypothetical average nonemployer firm, the annual health insurance premium is $500, and the average probability of discontinuing the health insurance premiums, under typical circumstances, is 26.1 percent. An increase in the health insurance premium by 10 percent would raise the payment to $550. For simplicity, assume that the operational expenses remain the same across years. If the operational expenses stay constant, the health insurance burden will reflect the increase in health insurance premium by the same magnitude. This means that the results from the regression analysis suggest that this additional $50 would increase the probability of the firm discontinuing health insurance coverage next year by 2.6 percentage points, raising the probability to 28.7 percent. While this example is purposefully simple, it underscores how even modest increases in premium costs can significantly influence a firm's decision-making process regarding health insurance coverage, highlighting the financial pressures faced by small businesses.

We found similar results for the average employer firm. The average probability of employer firms discontinuing health insurance premiums was 26.8 percent. An increase in health insurance burden by 10 percent would increase this probability by 1.3 percentage points, raising it to 28.1 percent. Similar to the average nonemployer firm, this increased probability is statistically significant.

Overall, these results were consistent with and formalize previous findings on the association between higher health insurance burden and increased rates of firms discontinuing health insurance premiums (Farrell, Wheat, and Mac 2017) and were in line with qualitative evidence from surveys revealing that rising costs were one of the reasons to discontinue health coverage (Small Business Majority 2024). These findings highlighted the risk that rising health insurance burdens pose, potentially leading small businesses to discontinue coverage.

There are significant differences across industries in how sensitive firms are to changes in health insurance costs. Beyond the impact on the average firm discussed earlier, we found that there are industry-specific factors that influenced a company’s decision to stop paying health insurance premiums. Some industries are particularly sensitive to changes in the health insurance burden.

For nonemployer firms, we found that an increase in health insurance burden significantly increased the probability of discontinuing premiums in three industries: health care services, other professional services, and retail. For instance, in the case of health care services, a 10 percent increase in the burden was associated with an increase in the probability of discontinuing health insurance premiums by 4.7 percentage points, raising the probability from 26.1 percent to 30.8 percent. For other professional services, a 10 percent increase in the burden was associated with an increase in the probability of discontinuing health insurance premiums by 4.5 percentage points, raising the probability to 30.6 percent. For retail, a 10 percent increase in the burden resulted in an increased probability to 29.3 percent. Note that for these industries the results are statistically significant. Firms in these industries may be especially vulnerable to rising health insurance costs because they tend to face narrower profit margins, more unpredictable revenue streams, and higher overhead or administrative burdens. For instance, small retail firms often operate on slim margins, while other professional service providers (e.g., independent lawyers, accountants, or consultants) often rely heavily on billable hours that can fluctuate. Similarly, small healthcare practices can face high equipment and licensing costs. Because these small business owners usually have limited bargaining power in the insurance market, premiums can be disproportionately high. They may opt to discontinue coverage if they can secure more affordable options elsewhere (e.g., spouse’s employer-sponsored plan) or if their personal risk tolerance reduces the perceived necessity of continuous coverage.

Industries such as metal and machinery, personal services, and real estate also showed an increased probability of discontinuing health insurance premiums with rising burdens. However, these results were not statistically significant. In contrast, in industries such as restaurants, wholesalers, and repair and maintenance, an increased burden was associated with a decreased probability of discontinuing payments, though these findings were also not statistically significant.

Similarly, for employer firms, we found that the impact of an increase in health insurance burden significantly raised the probability of discontinuing premiums in some industries, with the largest effect experienced by the personal service industry, followed by restaurants, other professional services, and retail. For instance, for personal services, a 10 percent increase in the burden was associated with an increase in the probability of discontinuing health insurance premiums by 5.7 percentage points, raising the probability from 26.8 percent to 32.5 percent. For restaurants, a 10 percent increase in the burden was associated with an increase in the probability of discontinuing health insurance premiums by 5.5 percentage points, raising the probability from 26.8 percent to 32.3 percent. For other professional services, a 10 percent increase in the burden raised the probability to 28.9 percent and for retail to 27.7 percent.

This significant sensitivity in these particular industries could be attributed to several factors. Firms in the industries may be more likely to discontinue health insurance coverage in response to rising health insurance costs because they frequently face low profit, high labor turnover, and a workforce that often includes part-time or seasonal staff. For instance, employer firms in the restaurant industry often operate with thin profit margins and face high labor costs, especially post-pandemic, making any increase in health insurance premiums a significant financial strain (My NewMarkets 2024). Additionally, the industry experiences high employee turnover, which complicates the management of consistent health insurance offerings due to the administrative burden and costs associated with frequent changes in coverage. Many restaurant employees work part-time, and while some employers offer health insurance to part-time staff, rising premiums can disproportionately affect their financial stability. Furthermore, intense competitive pressures limit the ability of restaurants to pass on increased costs to customers through higher prices. According to Porter’s five forces framework, when customers can easily find substitutes, restaurants are pressured to keep prices competitive to retain customer loyalty (Porter 1979). As a result, restaurants may have to absorb increased costs rather than raising prices. The industry's revenue is also highly variable, influenced by factors such as seasonality and general economic conditions, making it challenging to commit to fixed costs such as health insurance premiums. Last, changes in regulations or local laws regarding employee benefits can further impact how restaurants manage health insurance offerings, contributing to their increased sensitivity to cost changes.17 Employer firms in the retail industry may also face intense competition, narrow margins, and fluctuating consumer demand, further constraining their ability to absorb premium hikes. Employer firms in other professional service industry, although they sometimes operate with higher-margins, may nevertheless face overhead pressures, such as billable-hour structure or project-based revenue, which may increase their sensitivity to rising health insurance costs. Firms in the personal services industry tend to have a higher proportion of part-time and lower-wage employees, factors strongly correlated with lower rates of employer-sponsored coverage. These factors combined may have made employer firms in these industries particularly vulnerable to fluctuations in health insurance costs, leading to a higher and significant likelihood of discontinuing coverage when premiums rise.

Other industries, such as real estate, health care services and wholesalers, also showed an increased probability of discontinuing health insurance premiums as burdens rose, but the results were not statistically significant. In contrast, metal and machinery and repair and maintenance were the two industries where an increase in the health insurance burden was associated with a decreased probability of firms discontinuing health insurance payments, though these results were also not statistically significant.

Overall, our analysis indicated that small businesses, both nonemployer and employer firms, were highly sensitive to increases in health insurance burdens. A 10 percent rise in the burden significantly increased the likelihood of these firms discontinuing health insurance coverage. This trend underscored the financial challenges small businesses face in maintaining health benefits. Moreover, industry-specific factors played a crucial role, with some sectors showing higher sensitivity. Among nonemployer firms, these sectors included health care services, other professional services, and retail. For employer firms, personal services, restaurants, other professional services, and retail demonstrated higher sensitivity. For these industries, this heightened sensitivity might have been due to factors such as thin profit margins, high labor costs, high employee turnover, unpredictable revenue streams, and higher overhead or administrative burdens, all of which made it challenging for firms in these industries to absorb rising premiums. These combined factors could have led to a higher likelihood of discontinuing coverage when premiums rose, highlighting the unique challenges faced by firms in these industry in managing health insurance costs.

Moreover, this analysis suggested that relying on statistics from a repeated cross-sectional sample, such as the median premium burden over time, might be misleading, as the composition of firms in the sample may have changed as some dropped coverage, obscuring the changes experienced by those that continued paying health insurance premiums. This may explain the puzzling differences in median burden trends observed when comparing the longitudinal panel to the cross-sectional sample, as highlighted in the previous report (Wheat and Mac 2024).

Most small businesses that stopped paying health insurance premiums continued to operate in the following years.

Firms may stop paying health insurance premiums because they are winding down operations or they may strategically decide to give up on the health coverage to reduce the financial burden. We tried to disentangle the main driver of this decision by following firms that stopped paying health insurance premiums at some point between 2019 and 2023. In particular, we constructed a sample of firms that consistently paid health insurance premiums in 2018 and discontinued them between 2019 and 2023. We tracked them and identified whether they continued to operate after discontinuing health insurance premiums or if they became inactive or closed their deposit accounts.

Figure 4: Most firms continued to operate after discontinuing health insurance premiums.

Figure 4 shows the dynamics of this pattern. The left panel considers the case of nonemployer firms. Within the first year of discontinuing health insurance premiums, only 11 percent of firms became inactive or closed their accounts, while the rest continued operating. Within the second year, only an additional 9 percent of firms transitioned from active to either becoming inactive or closing their accounts, newly closed or inactive, totaling 20 percent. By the end of their fifth year after discontinuing health insurance premiums, about 70 percent of the nonemployer firms continued operating in the market. This significant share suggests that discontinuing health insurance premiums was not necessarily a sign of impending closure or winding down operations. Instead, it could have been a strategic decision to reduce operational costs and stay competitive.

The right panel of Figure 4 shows a similar pattern for employer firms. Like the sample of nonemployer firms, these are firms that discontinued health insurance premiums at some point between 2019 and 2023. Within the first year of discontinuing health insurance premiums, only 7 percent of firms became inactive or closed their accounts, while the rest continued to operate. Within the second year after discontinuing health insurance premiums, only an additional 6 percent of firms transitioned from active to either becoming inactive or closing their accounts. By the end of their fifth year after discontinuing health insurance premiums, 79 percent of employer firms continued operating in the market while only 21 percent became inactive or closed their account. Overall, similar to nonemployer firms, the large share of employer firms that continued to operate after discontinuing health insurance premiums suggests that this was a strategic decision. In particular, this decision may have reflected a calculated risk where the immediate financial relief outweighed the potential downsides of not providing health insurance, such as reduced employee satisfaction or increased turnover. These companies could have been making the choice to contain costs and remain competitive in a challenging economic environment, potentially prioritizing their financial stability and long-term viability over the short-term benefits of offering health insurance. This approach may have allowed them to focus on sustaining their business, exploring new opportunities for growth, and navigating economic uncertainties more effectively.18 This logic follows in line with qualitative results from surveys. For instance, in a survey designed by the Commonwealth Fund, one-third of the firms surveyed had considered discontinuing health care coverage for their employees as an active step to lower their own health care costs (Buttle, Wonnerberg and Simaan 2019). This further supports the idea that the decision to discontinue health insurance premiums can be a strategic move to manage expenses rather than an indication of financial distress or impending closure.

Figure 5: Across industries, most firms continued to operate after discontinuing health insurance.

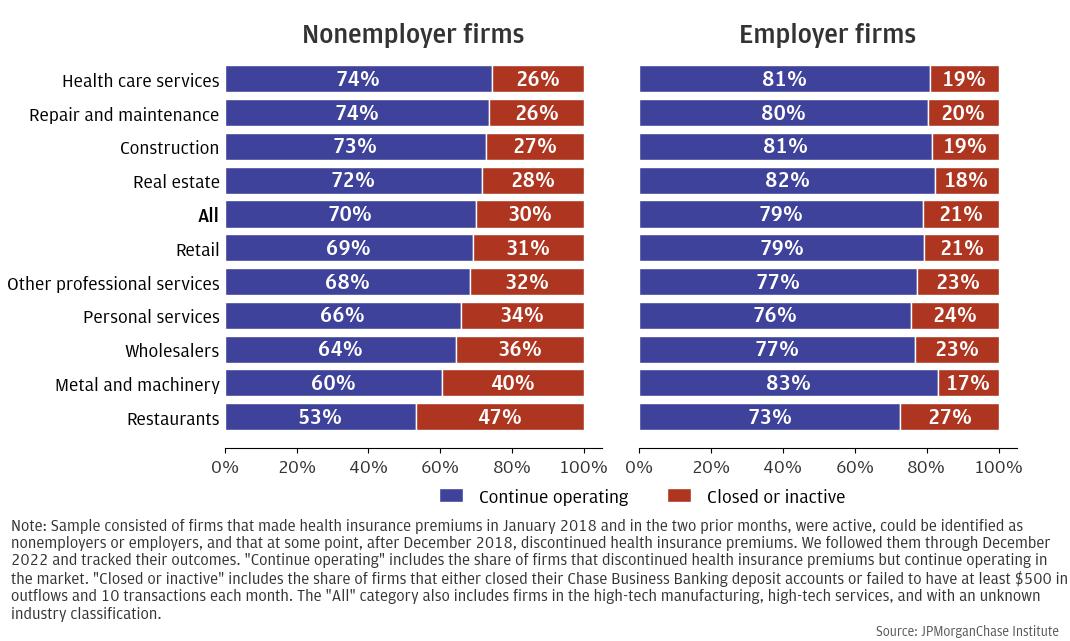

Figure 5 shows the breakdown in terms of industries. The left panel shows the result for nonemployer firms, while the right panel shows the result for employer firms. For nonemployer firms, in most industries, more than 50 percent of them continued to operate in the following years despite discontinuing health insurance premiums. Health care services and repair and maintenance experienced the highest share of firms that continued to operate (74 percent), while restaurants showed the lowest share (53 percent).

For employer firms, the proportion of businesses that remained operational during subsequent years is even greater. In every industry, over 70 percent of firms continued to operate despite ceasing to pay health insurance premiums. Metal and machinery had the highest continuation rate at 83 percent, while restaurants had the lowest share at 73 percent. The different shares across industries may be attributed to the specific characteristics of each. For instance, restaurants typically operate with thin profit margins, making them more vulnerable to financial pressures. The added burden of health insurance premiums can exacerbate these challenges, leading some businesses to close or become inactive.

Overall, this result is consistent over time and across industry. In particular, the high percentage of firms that remained active after stopping health insurance premiums suggests that this decision was often a strategic choice to reduce costs, rather than a sign that the company was about to go out of business. Companies could be balancing the risk of not offering health coverage against the effort to ease their financial burden.

However, this strategic decision comes with significant trade-offs and risks. One of the primary risks, especially for employer firms, is the potential impact on employee morale and retention. A recent survey showed that health benefits help employers attract and retain employees (McKinsey & Company 2022). Another survey highlighted that employees ranked health care benefits as very important or extremely important (Miller 2018). Without health insurance, employees may feel less valued and more financially insecure, which can lead to decreased job satisfaction and higher turnover rates. This, in turn, could result in additional costs for the company, such as expenses related to recruiting and training new employees, among other costs. In line with this idea, Mendoza (2022) shows that factors such as attracting and retaining talent, employee demand, and moral considerations play significant roles in the motivations behind small firms offering health insurance despite being exempt from the ACA’s employer mandate.

Moreover, the lack of health insurance can affect the overall health and productivity of the workforce. Employees without health coverage may be less likely to seek preventive care or timely medical treatment, leading to increased absenteeism and reduced productivity. This can have long-term negative impacts on the company’s performance and profitability.

Finally, another trade-off is the potential damage to the company's reputation. In a competitive job market, offering health insurance is often seen as a standard benefit that attracts and retains top talent. A recent survey showed that employees are more likely to stay if they like their health plan (Miller 2018). Companies that do not provide this benefit may struggle to compete for skilled workers, which can hinder their ability to innovate and grow.

In summary, while the decision to stop paying health insurance premiums may provide immediate financial relief and help companies manage their resources more effectively, it also involves significant trade-offs and risks. Companies must carefully weigh these factors and consider the long-term implications for their workforce, reputation, and overall business success. The goal is to strike a balance between cost management and maintaining a motivated, healthy, and productive workforce.

Nonemployer firms with the highest health insurance burdens experienced the largest premium increases, even though the typical firm across industries saw mixed growth rates.

Our prior research highlighted that health insurance premiums are increasingly becoming a significant portion of operating expenses for nonemployer businesses. Moreover, the report revealed a notable inverse correlation between the size of employer firms and their health insurance burdens, indicating that smaller firms typically face higher premium costs relative to their revenues (Wheat and Mac 2024).

Typical firm size varies by industry, which suggests that health insurance burdens may also vary by industry. To investigate this, we constructed a cross-sectional sample of nonemployer firms from 2018 to 2023 that consistently paid health insurance premiums. Contrary to our longitudinal sample, in the cross-sectional sample we do not require firms to pay health insurance premiums for the entire period. As a result, firms may enter or exit the sample. This approach allowed us to capture a comprehensive view of the financial pressures faced by small business owners in the individual health insurance market, reflecting their dynamic choices and adaptations in response to changing economic conditions.

Figure 6: Mixed growth in median nonemployer health insurance burdens across industries.

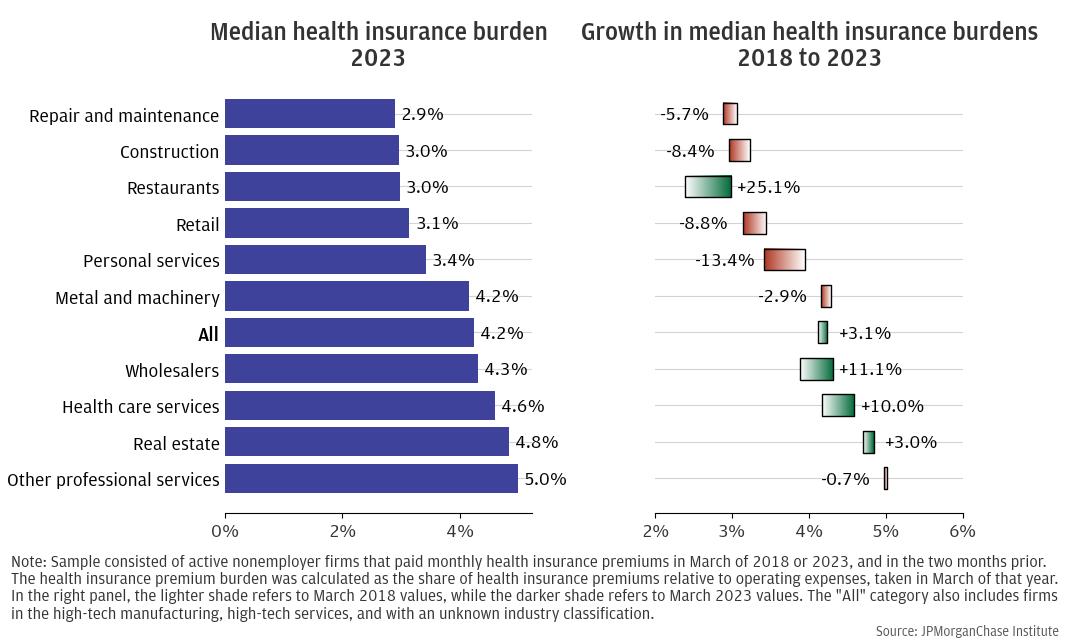

Figure 6 provides a detailed view of the health insurance burden levels across various industries in 2023 (left panel), along with their growth trajectory from 2018 to 2023 (right panel) for nonemployer firms. The median burden across industries was 4.2 percent, but this figure masks significant variations. Industries such as other professional services and real estate faced higher median burdens of 5.0 percent and 4.8 percent, respectively. In contrast, repair and maintenance, construction, and restaurants experienced lower burdens, at 2.9 percent for the former, and 3.0 percent for both construction and restaurants, respectively.

This variation highlights a significant trend potentially related to the income generation across industries: those with lower profit margins, such as repair and maintenance and restaurants (Farrell, Wheat, and Grandet 2019), generally experienced health insurance burdens below the median. Since these are nonemployer firms, likely purchasing insurance on the individual market, this trend could be related to their greater eligibility for income-based tax credits, which may have helped alleviate the financial pressure of health insurance premiums. Conversely, industries with higher profit margins like other professional services and real estate faced greater burdens, potentially because fewer businesses in these sectors qualified for tax credits.

Overall, the role of tax credits is crucial in understanding these dynamics. By offsetting some of the costs, tax credits can significantly reduce the financial strain on smaller businesses, enabling them to maintain health insurance coverage without disproportionately impacting their operating expenses.

When we looked at the change over time in the health insurance burden we found mixed results across industries. Overall, we found that the median burden growth across industries was positive, increasing from 4.1 percent of expenses in 2018 to 4.2 percent in 2023. This represented a burden growth of 3.1 percent from 2018 to 2023. However, some industries experienced a larger positive growth rate. For instance, in the restaurant industry, the growth rate was 25.1 percent, with the median burden increasing from 2.4 percent in 2018 to 3 percent in 2023. In the health care services industry, the growth rate was 10 percent, with the burden increasing from 4.2 percent in 2018 to 4.6 percent in 2023.

Conversely, other industries experienced a decrease in the health insurance burden over time. For instance, in the personal services industry, the burden decreased by 13.4 percent, from 4 percent in 2018 to 3.4 percent in 2023. Changes in health insurance burdens over time could result from changes in health insurance plans (e.g., from higher-cost to lower-cost), changes to coverage (e.g., from a family plan to an individual plan), or eligibility for a tax credit. Some decreases were observed in industries with lower profit margins, such as repair and maintenance and personal services (Farrell, Wheat and Grandet 2019), suggesting that income-based tax credits may have played a role in containing the growth of the health insurance burden in these sectors.

To shed more light on these results, we studied the growth of premiums across the entire distribution within each industry. That is, we considered not just the median firm, but also firms at the 25th percentile and the 75th percentile of the distribution. To do so, we constructed a cross-sectional sample of nonemployer firms that paid health insurance premiums between 2018 and 2023. Firms need not make premium payments throughout this period and may exit the sample. The resulting sample included approximately 13,000–27,000 firms each month.

Figure 7: Significant increase in health insurance premium for firms in the upper tail of the payment distribution across industries.

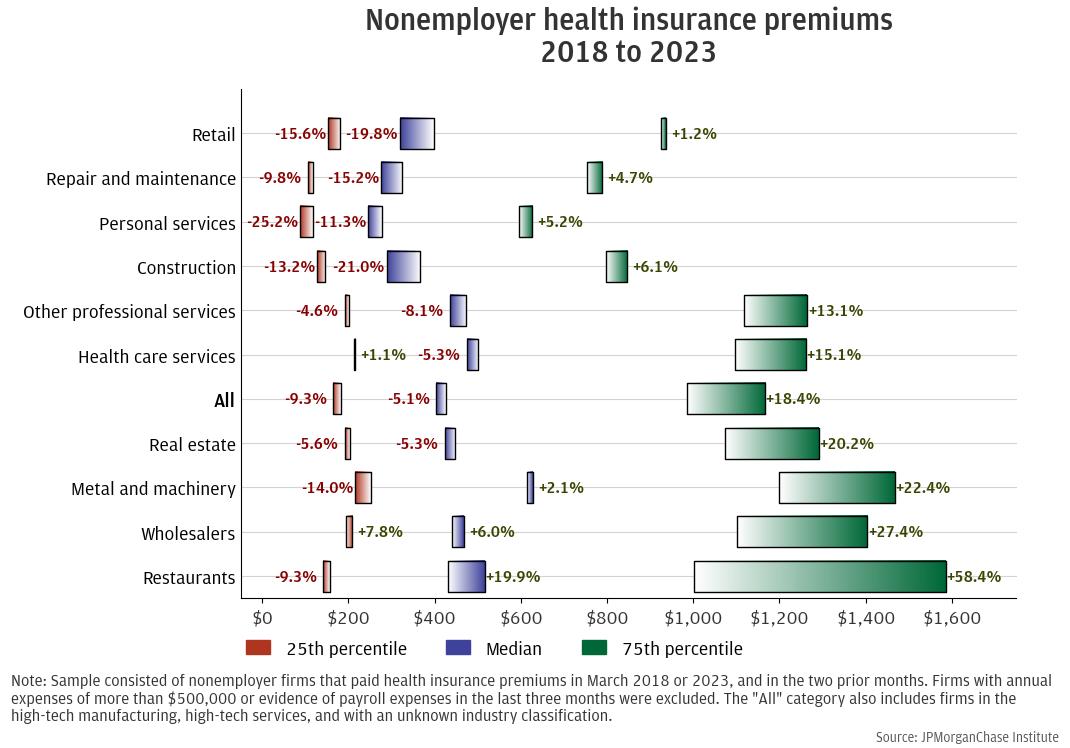

Figure 7 shows that when taking all the industries together, the growth of the health insurance premium was negative for both firms in the lower percentile of the premium distribution (–9.3 percent) and in the median (–5.1 percent). In contrast, firms in the upper tail of the payment distribution experienced a significant positive growth of the premiums (18.4 percent). This finding is consistent with tax credits containing premium growth on the lower end of the distribution while premiums on the upper end increased over the five-year period.

Looking at the specific industries, we found two distinct results. First, we confirmed the positive growth in the upper tail of the distribution for all the industries, and more mixed results for the lower tail and median. For instance, the monthly payment for restaurants at the 75th percentile increased by 58.4 percent, from $1,001 to $1,585. The payment for the median restaurant increased by 19.9 percent, while the payment for the nonemployer restaurant in the lower tail of the distribution, the 25th percentile, decreased by 9.3 percent. The smallest increase at the 75th percentile was experienced by the retail industry, with the health insurance premium increasing by 1.2 percent, from $925 in 2018 to $937 in 2023, while for both the 25th percentile and the median retail firm the health insurance premium decreased by 15.6 percent and 19.8 percent, respectively.

Second, the highest growth was experienced by the upper end of the distribution of industries with higher profit margins, consistent with previous results. For example, the retail industry typically has lower profit margins, and premiums at the 75th percentile increased by only 1.2 percent over five years. In contrast, the 75th percentile premium among real estate firms—which typically has higher profit margins—increased by 20.2 percent over the same period, consistent with lower utilization of tax credits by business owners in real estate compared to those in retail. Among restaurants, which often have lower profit margins, the increase in premiums at the 50th and 75th percentile and decrease at the 25th percentile may reflect a wide range of restaurant owners.

The wide distribution of changes in health insurance premiums over the 2018–2023 period suggests that small businesses and their owners may face very different burdens depending on their needs as well as their eligibility for policies that could mitigate premium costs, such as tax credits.

For employer firms across all industries, payroll expense increases explained the decrease in health insurance payroll burden over time.

The majority of U.S. workers receive health insurance coverage through employer-sponsored plans, but not all employer firms are required to provide health benefits. Businesses with fewer than 50 employees are not subject to penalties related to the employer shared responsibility provisions of the ACA (Whittaker 2016), but they may still decide to offer health insurance as a part of competitive pay and benefits packages for their employees.

The relationship between health insurance costs and number of employees is not necessarily linear, as employers may offer health insurance benefits only to a particular type of employee (e.g., full time).19 Moreover, some employees may choose family plans while others choose individual plans, and the mix of plans may materially affect the cost to employers. To adjust for firm size, we calculated the health insurance payroll burden, interpreted as health insurance premiums as a share of total compensation. We examined the health insurance payroll burdens across industries in 2023 and compared them to the burdens in 2018.20

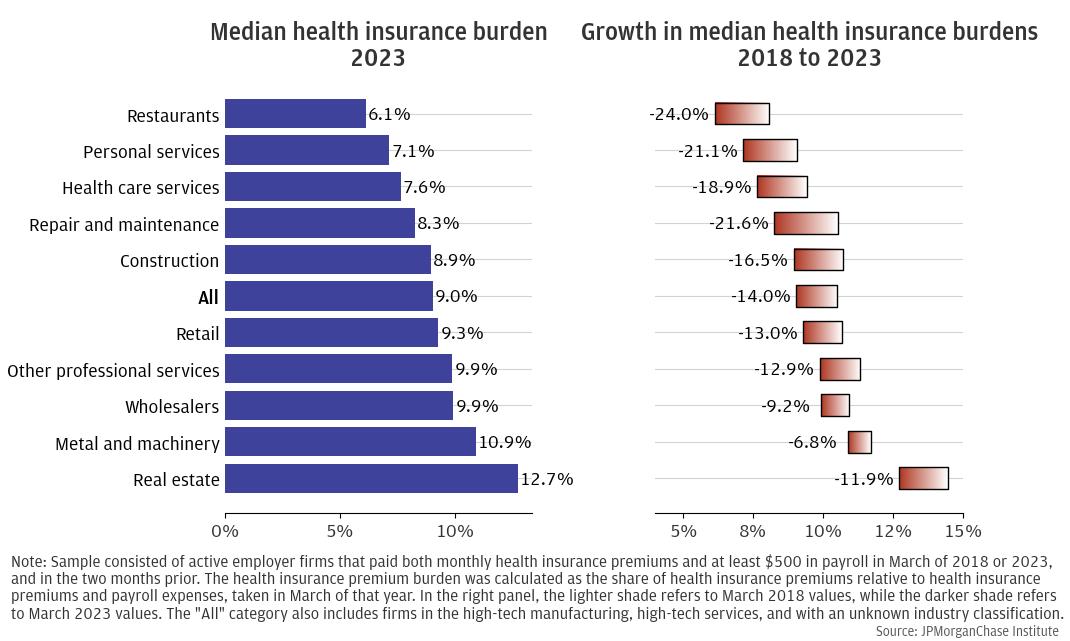

The left panel of Figure 8 shows the burden level of the median employer firm across industries as of 2023. There was significant variation across industries. For instance, real estate had a burden of 12.7 percent in 2023, the highest across all industries. Metal and machinery followed with a burden of 10.9 percent. On the other end of the spectrum, restaurants had a median burden of 6.1 percent, which was the lowest.

Figure 8: Median employer health insurance payroll burdens decreased over time across industries.

The right panel of Figure 8 shows the change in the burden from 2018 to 2023. In each industry, the median burden was lower in 2023 than in 2018. The largest decrease, 24 percent, was experienced by the restaurant industry, with the burden decreasing from 8 percent in 2018 to 6.1 percent in 2023. Other industries experienced similar changes: repair and maintenance (21.6 percent decrease), personal services (21.1 percent decrease), and health care services (18.9 percent decrease). This trend may seem counterintuitive, given the perceived increase in health insurance costs.

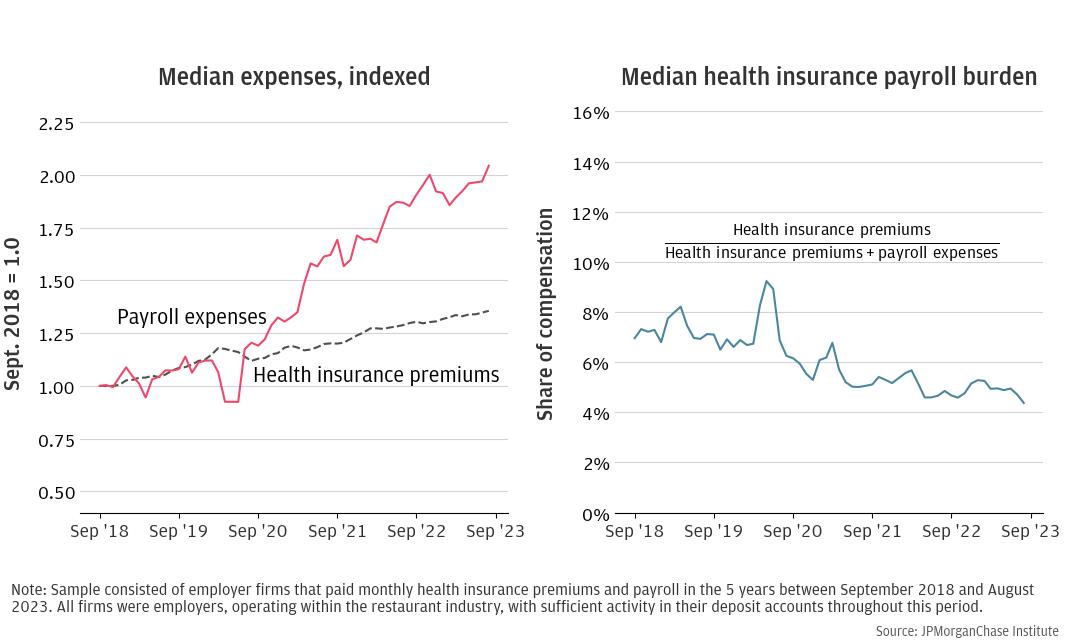

Figure 9 provides a concrete example by looking at the case of restaurants. The sample consisted of firms operating in the restaurant industry that consistently paid health insurance premiums and payroll expenses over the five years between September 2018 and August 2023. That is, unlike cross-sectional samples in Figure 8 that may reflect different sets of firms in 2018 and 2023, this longitudinal sample consisted of the same set of restaurants that paid health insurance premiums over the five-year period.

Figure 9: Median health insurance payroll burden for restaurants decreased due to a significant increase in median payroll expenses over time.

The left panel of Figure 9 plots both the median health insurance premiums and the median payroll expenses, indexed to the values as of September 2018. Indexing allows for easy comparison of data over time. From the graph, it is evident that while both health insurance premiums and payroll expenses increased over time, the latter increased at a significantly higher rate, more than doubling compared to its initial value. As a result, the health insurance payroll burden decreased over time, as depicted in the right panel of Figure 9. This rise in payroll expense among restaurants is also, to some extent, shown in the growth in average hourly earnings of production and nonsupervisory wages at food service locations documented by the Bureau of Labor Statistics, increasing 37 percent from a seasonally adjusted $13.16 per hour in September 2018 to $18.03 per hour in September 2023.21 This was a direct consequence of the labor shortage caused by the pandemic, which forced restaurants to offer higher wages to attract employees (Mendoza 2022). Overall, our analysis indicated that the observed decrease in the health insurance payroll burden for employer firms across various industries could be largely attributed to significant increases in payroll expenses. This trend underscores the importance of considering broader economic factors, such as wage growth and employment rates, when evaluating and interpreting changes in specific cost burdens. As industries continue to recover and adapt post-COVID-19, it will be crucial to monitor these dynamics to better understand their long-term implications on both employer costs and employee benefits.

Our analysis highlighted the complex interplay between health insurance costs and small business financial outcomes. The findings underscored the financial pressures faced by small businesses, particularly in managing health insurance premiums amidst varying industry dynamics. As these businesses navigate the challenges of maintaining coverage, several key implications emerge from our study:

In line with the prior report (Wheat and Mac 2024), we designed our research samples to analyze small business owners who buy health insurance for themselves, as well as small businesses that offer health insurance benefits to their employees. Our research sample comprised de-identified firms with Chase Business Banking deposit accounts that satisfied three conditions. First, they made regular health insurance premium payments. To ensure that we captured regular health insurance payments, we examined firm activity using rolling three-month windows. We included a firm in the sample in a focal month if it made at least three health insurance premium payments during the last two months and the focal month, and the amount of the payment was the average across the payments. This process allowed for variation in timing that was still relatively consistent. For example, payments made towards the end of a short month such as February sometimes posted at the beginning of the next month, which made it appear as though the health insurance payment was twice as large in March and zero in February. If a firm had fewer than three health insurance payments over this window, we defined them as having discontinued health insurance premiums.

Second, they satisfied our activity filters. In particular, we defined a firm as active if it had at least $500 in outflows and 10 financial transactions in each month. These conditions ensured that our analyses of health insurance payments relative to business expenses and payroll excluded dormant firms while allowing for variations in business activity.

Last, these firms held at most two business deposit accounts with combined balances not exceeding $20 million and operated in one of the following twelve industries: construction, health care services, metals and machinery manufacturing, real estate, repair and maintenance, restaurants, retail, personal services, other professional services (e.g., lawyers, accountants, consultants, marketing, media, and design), wholesalers, high-tech manufacturing, and high-tech services. They also showed no evidence of operating in more than a single location or industry.

If a firm ceased to have regular health insurance payments, we removed it from the sample and identified it as “discontinued health insurance premiums.” If a firm ceased to meet the activity condition, it was removed from the sample and identified as “inactive.” If a firm became inactive and eventually closed, we referred to it as “closed.”

We then divided our sample into nonemployers and employers based on evidence of electronic payroll and estimated annual expenses. Our nonemployer sample included small business owners who paid health insurance premiums for themselves and their families. Our employer sample included small businesses who made both health insurance and payroll payments. Note, while businesses with 50 or more employees face penalties if they do not offer health insurance benefits, smaller businesses do not.22 Thus, the typical firm in our employer sample may be larger than those in samples unrelated to health insurance.

We employed rolling three-month windows to determine whether a firm had regular payroll. Firms in our employer sample showed evidence of payroll averaging at least $500 per month in at least three transactions during the three-month window. This relatively low threshold allowed for fluctuations in payroll among employers. Nonemployer firms did not have payroll in any of the three months and their annual expenses were under $500,000. This threshold was set with the understanding that firms with relatively large expenses are likely employers, even if we do not observe their payroll payments.

If a firm was considered an employer during the first month of the panel and then had less than $500 in payroll expenses over a three-month window, we removed it from the sample of employer firms and categorized it as “other.” Similarly, if a firm was defined as a nonemployer in the first month of our panel and then showed evidence of payroll expenses or grew to have annual expenses over $500,000, it was removed from our sample of nonemployer firms and categorized as “other.”

(Stop Health Insurance Premiums)i,m,t = α+β *(Health Insurance Burdeni,m,t-1 ) + θm + ηt

+ δ * Xi,m,t + ϵi,m,t

where i stands for firm, m stands for industry, and t stands for year. (Stop Health Insurance Premiums)i,m,t is the outcome variable, namely a binary variable taking value 1 if firm i in industry m discontinued health insurance premium payments at time t, α is the intercept, (Health Insurance Burden) i,m,t-1 is the health insurance premium payment burden for firm i in industry m at time t-1, θm are the industry fixed effects, ηt are year fixed effects, Xi,t are firm-level controls that vary over time such as the annual average of the monthly cash buffer and the annual average of monthly revenue, and ϵi,t is the error term. We clustered standard errors at the industry-year level.

The second model was a linear probability model that included year and industry fixed effects as well as an interaction term between industry dummies and the lagged health insurance premium payment burden. The reference industry was wholesale. This meant that the coefficient of the interaction term was interpreted as the change in probability with respect to the wholesale industry. The mathematical equation describing the model is the following:

(Stop Health Insurance Premiums)i,m,t = α + β1 * (Health Insurance Burdeni,m,t-1 ) + θm

+ β2 * (Health Insurance Burdeni,m,t-1 ) * θm

+ ηt + γ * Xi,m,t + ϵi,m,t

where i stands for firm, m stands for industry, and t stands for year. (Stop Health Insurance Premiums)i,m,t is the outcome variable, namely a binary variable taking value 1 if firm i in industry m discontinued health insurance premium payments at time t. α is the intercept, (Health Insurance Burden)i,m,t-1 is the health insurance burden for firm i in industry m at time t-1, θm are the industry fixed effects, (Health Insurance Burdeni,m,t-1 ) * θm is the interaction term, ηt are year fixed effects, Xi,m,t are firm-level controls that vary over time such as the annual average of the monthly cash buffer and the annual average of monthly revenue, and ϵi,m,t is the error term.

Table A1: Regression analysis of the probability of discontinuing health insurance premiums.

Table A1 shows the estimated coefficients for the main explanatory variables. The variable of interest in the first model, the lagged health insurance burden, was statistically significant. From the second model, we were not able to identify statistically significant differences across industries in the probability of firms discontinuing health insurance premium payments as a result of a change in the lagged health insurance premium payment. The only exception was employer restaurants and employer personal services, where we found that a change in the lagged health insurance premium payment burden was statistically significantly associated with an increased probability of the firm discontinuing health insurance premiums.

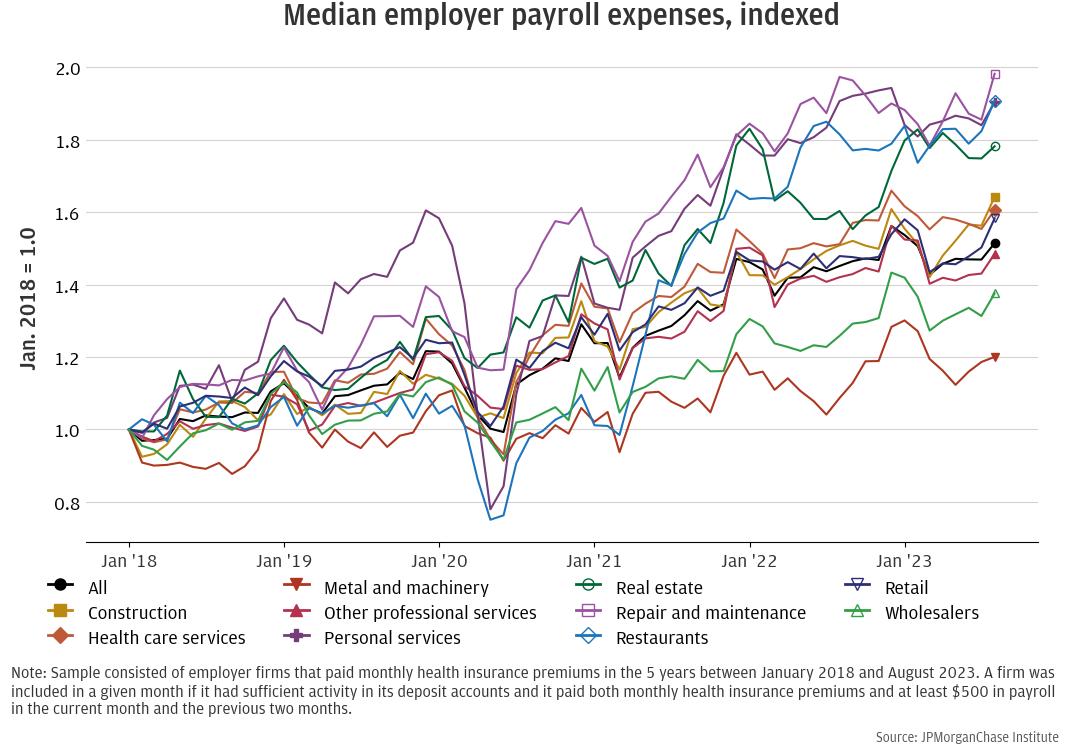

Figure A1: Median employer payroll expenses have increased over time, particularly after COVID-19 outbreak.

Figure A1 corroborates the results discussed in Finding 4. In particular, it provides additional evidence across industries that the decrease in the health insurance payroll burden may be explained by substantial increases in payroll expenses over time, especially after May 2020. Many industries experienced wage growth and increased hiring as they recovered from the economic impacts of the COVID-19 pandemic. These increases in payroll expenses effectively diluted the relative burden of health insurance premiums.

We thank Lucas Nathe for his hard work and critical contributions to this research. Additionally, we thank Oscar Cruz, Katie Faryniarz, and Alfonso Zenteno for their support. We are especially indebted to the Morgan Health team for their partnership, and to all other internal partners and colleagues, who support delivery of our agenda in a myriad of ways and acknowledge their contributions to each and all releases.

We would like to acknowledge Jamie Dimon, CEO of JPMorgan Chase & Co., for his vision and leadership in establishing the Institute and enabling the ongoing research agenda. We remain deeply grateful to Peter Scher, Vice Chairman; Tim Berry, Head of Corporate Responsibility; Heather Higginbottom, Head of Research, Policy, and Insights and others across the firm for the resources and support to pioneer a new approach to contribute to global economic analysis and insight.

Bailey, James. 2017. “Health Insurance and the Supply of Entrepreneurs: New Evidence from the Affordable Care Act.” Small Business Economics, Vol. 49, No. 3: 627–646. https://link.springer.com/article/10.1007/s11187-017-9856-8.

Buttle, Reth, Katie V. Wonnenberg, and Angela Simaan. 2019. “Small-Business Owners’ Views on Health Coverage and Costs”. The Commonwealth Fund. September 2019. https://www.commonwealthfund.org/sites/default/files/2019-09/Buttle_small_business_owners_survey_ib.pdf.

Carrns, Ann. “Expect Higher Costs for Your Health Care Benefits Next Year”. The New York Times, November 1, 2024. https://www.nytimes.com/2024/11/01/your-money/benefits-health-care-enrollment.html.

Crane, D. Leland, Ryan A. Decker, Aaron Flaaen, Adrian Hamins-Puertolas, and Christopher Kurz. 2022. “Business exit during the COVID-19 pandemic: Non-traditional measures in historical context.” Journal of Macroeconomics, Vol. 72, No. 103419. https://www.sciencedirect.com/science/article/pii/S0164070422000210?via%3Dihub.

DePillis, Lydia. “A Capitalist for the Little Guy? How Harris Is Pitching Small Business.” The New York Times, October 29, 2024. https://www.nytimes.com/2024/10/28/business/economy/harris-economic-plans-small-business.html.

Farrell, Diana, Christopher Wheat, and Carlos Grandet. 2019. “Place Matters Small Business Financial Health in Urban Communities.” JPMorganChase Institute. https://www.jpmorganchase.com/institute/all-topics/business-growth-and-entrepreneurship/place-matters-small-business-financial-health-in-urban-communities.

Farrell, Diana, Christopher Wheat, and Chi Mac. 2017. “Paying a Premium: Dynamics of the Small Business Owner Health Insurance Market.” JPMorgan Chase Institute. https://www.jpmorganchase.com/content/dam/jpmc/jpmorgan-chase-and-co/institute/pdf/institute-smb-health-insurance.pdf.

Farrell, Diana, Christopher Wheat, and Chi Mac. 2020. “Small Business Owner Race, Liquidity, and Survival.” JPMorganChase Institute. https://www.jpmorganchase.com/content/dam/jpmc/jpmorgan-chase-and-co/institute/pdf/institute-small-business-owner-race-report.pdf.

Fernandez, Bernadette. 2024. “Health Insurance Premium Tax Credit and Cost-Sharing Reductions.” Congressional Research Service report R44425. https://crsreports.congress.gov/product/pdf/R/R44425?.

Fossen, Frank M., Mobarak Hossain, Sankar Mukhopadhyay, and Peter Toth. 2024. “The Cost of Health Insurance and Entry into Entrepreneurship.” Small Business Economics. https://link.springer.com/article/10.1007/s11187-024-00927-x.

Keehan, Sean P., Jacqueline A. Fiore, John A. Poisal, Gigi A. Cuckler, Andrea M. Sisko, Sheila D. Smith, Andrew J. Madison, and Kathryn E. Rennie. 2023. “National Health Expenditure Projections, 2022-31: Growth To Stabilize Once the COVID-19 Public Health Emergency Ends.” Health Affairs, Vol. 42 No. 7. https://doi.org/10.1377/hlthaff.2023.00403.

Keisler-Starkey, Katherine, Lisa N. Bunch, and Rachel A. Lindstrom. 2022. “Health insurance coverage in the United States: 2022”. Census. gov. 2023. https://www.census.gov/library/publications/2023/demo/p60-281.html.

Krizan, C. J., Adela Luque, and Alice M. Zawacki. 2014. “The effect of employer health insurance offering on the growth and survival of small business prior to the Affordable Care Act.” US Census Bureau Center for Economic Studies Paper No. CES-WP-14-22. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2448207#.

McKinsey & Company. “Employers Look to Expand Health Benefits While Managing Medical Costs.” May 25, 2022. https://www.mckinsey.com/industries/healthcare/our-insights/employers-look-to-expand-health-benefits-while-managing-medical-costs.#/.

Mendoza, Roger L. 2022 “Why Do Small Firms Offer Health Insurance in Spite of the Employer Mandate Exemption.” Journal of Insurance Regulation, Vol. 41, no. 6: 133-152. https://content.naic.org/sites/default/files/why-do-small-firms-offer-health-insurance-in-spite-of-the-employer-mandate-exemption-jir-2022-06.pdf.

Miller, Stephen. 2018. “Employees Are More Likely To Stay If They Like Their Health Plan.” SHRM. https://www.shrm.org/topics-tools/news/benefits-compensation/employees-likely-to-stay-like-health-plan.

“New Research Finds Percentage of Small Employers Offering Health Benefits in Decline but Employment-based Health Coverage Still Most Common Source of Health Coverage for Nonelderly Population.” EBRI. 2024. https://www.ebri.org/content/new-research-finds-percentage-of-small-employers-offering-health-benefits-in-decline-but-employment-based-health-coverage-still-most-common-source-of-health-coverage-for-nonelderly-population?.

“Opinion Poll: Small Businesses Struggling with Rising Healthcare Costs, Support Bipartisan Policy Solutions.” Small Business Majority. February 21, 2024. https://smallbusinessmajority.org/sites/default/files/research-reports/poll-small-businesses-struggling-with-healthcare-costs.pdf.

Porter, Michael E. 1979. “How Competitive Forces Shape Strategy.” Harvard Business Review, Vol. 57, No. 2 (March–April): 137–145. https://hbr.org/1979/03/how-competitive-forces-shape-strategy.

City and County of San Francisco. “Health Care Security Ordinance.” 2024. https://www.sf.gov/information/health-care-security-ordinance.

Squeezed from All Sides: Restaurants Pressured by Labor, Food, Insurance Costs.” My New Markets. April 9, 2024. https://www.mynewmarkets.com/articles/184315/squeezed-from-all-sidesrestaurants-pressured-by-labor-food-insurance-costs.

Wheat, Christopher, and Chi Mac. 2024. “The Burden of Health Insurance Premiums on Small Business.” JPMorganChase Institute. https://www.jpmorganchase.com/institute/all-topics/business-growth-and-entrepreneurship/small-business-health-insurance-burdens.

Whittaker, Julie M. 2016. “The Affordable Care Act’s (ACA) Employer Shared Responsibility Determination and the Potential Employer Penalty.” Congressional Research Service report R43981. https://crsreports.congress.gov/product/pdf/R/R43981.

Morgan Health published research exploring how small and mid-size businesses make tradeoffs to keep healthcare coverage in place and areas where they need additional support. Among other findings, Morgan Health found that offering benefits is crucial for small businesses and their ability to grow and that information gaps and rising costs place a significant burden on these businesses. You can read the full report from Morgan Health here.

Footnotes

Bureau of Labor Statistics (https://www.bls.gov/web/cewbd/table_f.txt).

However, it's important to consider that mandating health insurance for small businesses could have unintended consequences. Some argue that such requirements might strain small businesses financially, potentially leading to job losses or hindering their ability to hire new employees. Advocates for regulatory relief suggest that flexibility in health insurance offerings allows small businesses to allocate resources in ways that sustain their operations and workforce. Balancing these perspectives is crucial in understanding the complex dynamics of health insurance policy and its impact on small businesses and their employees.

Specifically, they may enroll in a plan through one of the Affordable Care Act (ACA) marketplaces or buy it directly from an insurer. This requirement adds to the financial burdens they already encounter, including operational costs and other business-related expenses.

In particular, Bailey (2017) examines whether the difficulty of obtaining health insurance independently deters entrepreneurship in the U.S. Leveraging the ACA’s dependent coverage mandate as a natural experiment, the author finds that while the mandate did not significantly increase self-employment among young adults overall, it did lead to a 19-23% increase in self-employment among disabled young adults. Fossen et al. (2024) study how health insurance costs impact individuals’ decision to transition from paid employment to self-employment. They find that higher premiums in local health insurance exchanges are associated with lower rates of entry into self-employment, suggesting that health insurance costs can act as a barrier to entrepreneurship.

However, it is important to note that the ACA has significantly improved access to health insurance for entrepreneurs by, for instance, allowing them to obtain coverage regardless of pre-existing conditions.

https://www.healthcare.gov/coverage/pre-existing-conditions/#:~:text=substance%20abuse%20coverage-,Coverage%20for%20pre%2Dexisting%20conditions,had%20before%20your%20coverage%20started

The importance of health insurance offering for small businesses performance has been long studied even before the introduction of ACA. For instance, Krizan et al. (2014) studied the impact of employer health insurance offering on the growth and survival of small businesses prior to the ACA highlights the challenges small businesses face in offering health insurance due to rising healthcare costs, premium variability, and administrative expenses.

Note that this tax credit is limited to only two years. Additionally, to qualify for the Small Business Health Care Tax Credit, a business must meet additional criteria beyond the number of employees. These include paying average annual wages below a specified amount that varies each year (e.g., for tax year 2023, the inflation-adjusted amount is $62,000) and contributing a uniform percentage (at least 50%) toward employees' health insurance premiums. Additionally, the insurance must be purchased through the Small Business Health Options Program (SHOP) Marketplace. https://www.irs.gov/affordable-care-act/employers/small-business-health-care-tax-credit-and-the-shop-marketplace?.

For instance, our nonemployer panel included 1,655 firms, and our employer panel included 1,863 firms (Wheat and Mac 2024).

Specifically, firms that no longer matched our definition of nonemployer or employer firms.

Note that, for each industry, the excluded category represents firms that remained in the sample. For example, across all industries, 49 percent of nonemployer firms continued to be active and pay health insurance premiums from 2018 to 2019. Including this category ensures that the percentages for each industry add up to 100 percent.

A recent survey among small business owners revealed that among those that have health insurance coverage for themselves, 20 percent obtained it through their spouse or partner’s health insurance (Small Business Majority 2024).

A recent article highlighted an example of a small business, upon decreasing its workforce to less than 50 employees, decided to help its employees purchase health insurance on the individual market instead of continuing to offer its employer-sponsored plan. This alternative was cost effective for the firm as well as its employees (Lydia DePillis, “A Capitalist for the Little Guy? How Harris Is Pitching Small Business.” The New York Times, October 29, 2024. https://www.nytimes.com/2024/10/28/business/economy/harris-economic-plans-small-business.html).

The health insurance burden was computed differently according to the type of firm. For nonemployer firms, this was the ratio between their health insurance premiums and their operating expenses, which includes health insurance premiums. For employer firms, we computed it to roughly account for the number of employees, calling it health insurance payroll burden to make the distinction. Specifically, the health insurance payroll burden was computed as the ratio between health insurance premiums and compensation costs, measured by the sum of health insurance premiums and payroll expenses.

Details on the regression analysis can be found in the appendix.

For example, a firm seeking to wind down may discontinue benefits such as health insurance prior to the final months of operations.

Statistical significance indicates that the observed effect of a 10 percent increase in the health insurance burden on the probability of discontinuing health insurance premiums is unlikely to be due to random variation in the data.

For instance, San Francisco local authority issued the San Francisco Health Care Security Ordinance (HCSO), a local law requiring that businesses with 20 or more employees make health care expenditures on behalf of their eligible employees. This ordinance mandates that employes provide health coverage or pay into the city’s health care fund for employees working more than 8 hours per week (City and County of San Francisco 2024). (https://www.sf.gov/information/health-care-security-ordinance)

It's possible that some of these firms initially had more than 49 employees, which required them to offer health insurance coverage to avoid penalties. However, if their employee count later fell below 50, they would no longer be legally obligated to provide such coverage. Since from our data we are not able to determine the exact number of employees in each firm, we cannot rule out this scenario as a contributing factor.

This is especially difficult given the limitation in the data. We can only observe evidence of total payroll expenses, not the number of employees at a given firm.

For nonemployer firms, we considered both the levels of health insurance premium payments and those payments relative to operating expenses, as those business owners were purchasing insurance for themselves and their families. For employer firms, we calculated a health insurance payroll burden in order to normalize the size of the premium payments relative to payroll. This measure is the monthly health insurance payment divided by the sum of monthly payroll and the health insurance payment. The denominator is a proxy for the monthly cost of payroll and benefits, and the ratio can be interpreted as the health insurance share of total compensation.

See https://www.irs.gov/affordable-care-act/employers/employer-shared-responsibility-provisions for details on the ACA’s employer shared responsibility provisions.

Authors

Chris Wheat

President, JPMorganChase Institute

Chi Mac

Business Research Director

Andrea Passalacqua

Small Business and LED Research Lead