Maintaining our #1 position across industry-leading businesses

We’re the clear market leader in Consumer and Business Banking, as well as Card, on the back of strong new account acquisition and primary bank relationships.

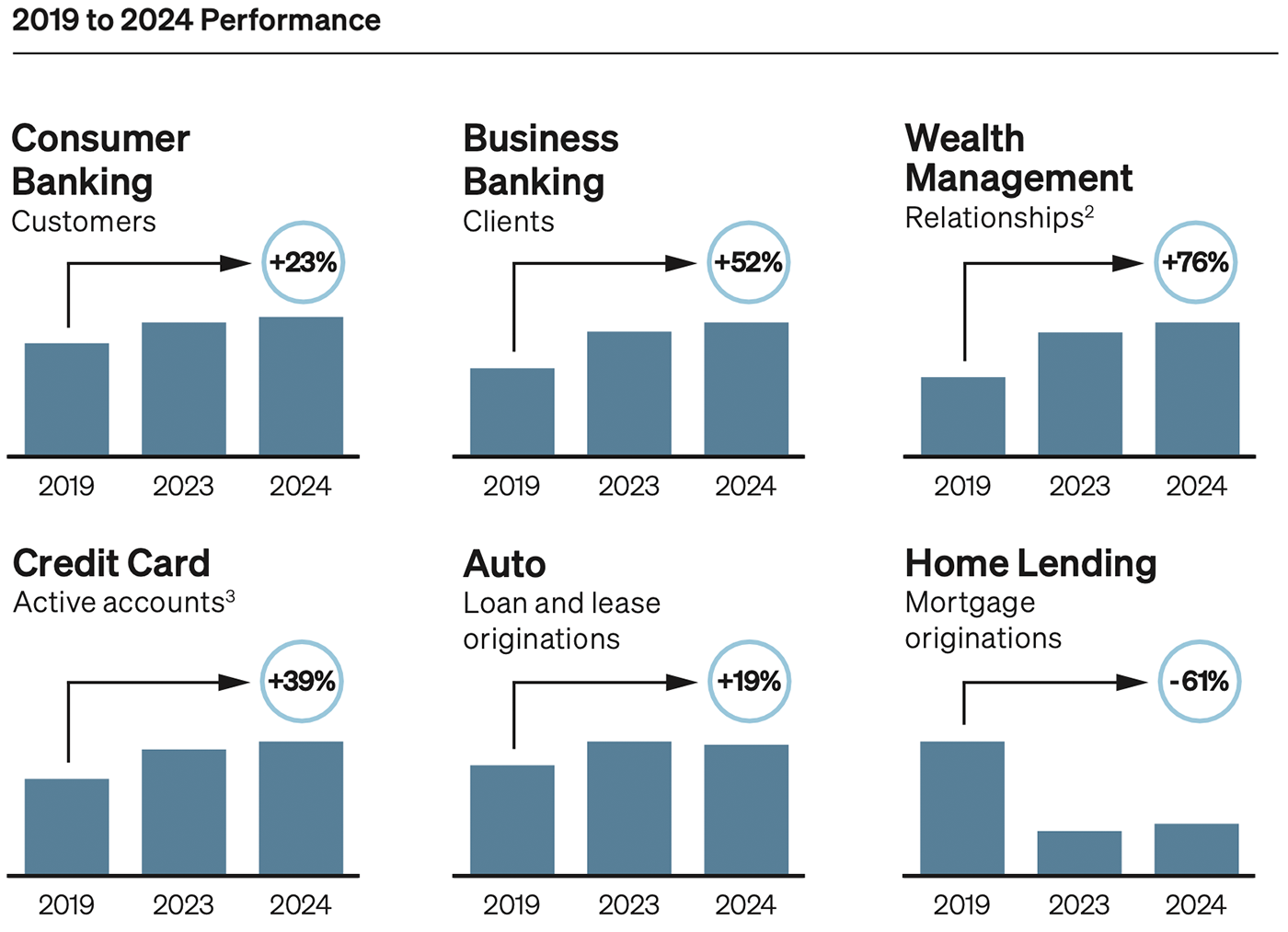

Consumer and Business Banking: We maintained the #1 position in 2024 and outperformed large bank peers with 11.3% national retail deposit share, up 220 basis points since 2019 (down 7 basis points year-over-year). We also remained #1 in small business with 9.7% primary bank share, up 28 basis points since 2019 (up 25 basis points year-over-year). We ended 2024 with 44 million Consumer Banking relationships (up 4% year-over-year) and 7 million small business clients1 (up 10% year-over-year). Approximately 80% of consumers and 65% of small business owners with whom we have banking relationships consider us their primary bank.

This position reflects strong new account acquisition, as well as over a decade of investment in our branch network. Historic investments continue to mature, and we invest for the future with plans to get to 15% national retail deposit share.

Banking is local, and nearly 1 million customers walk into a Chase branch each day. The bank’s team of approximately 50,000 experts helps customers transact, open accounts, and get information and advice. In 2024, 85% of business checking accounts and nearly 30% of Chase-branded cards were opened in branches.

Branch expansion remains core to long-term growth. Since 2019, we’ve added over 860 new branches, more than all large bank peers combined, and we are the only bank with a presence in all 48 contiguous states. As a result, Chase covers more Americans than any other bank, with 68% of the U.S. population within an accessible drive to one of our branches. We are on track to meet the goals we announced last year to build 500 new branches by 2027, contributing to our long-term plans of reaching 75% of the national population within an accessible drive and over 50% within each state. This goal demonstrates our commitment to providing local banking services in all communities, from urban centers to rural areas across America’s heartland.

In 2024, we entered 10 new markets, opened approximately 150 new branches – including the first two J.P. Morgan Financial Centers in Manhattan and San Francisco – and three Community Center branches in the Bronx and Brooklyn in New York City and Columbus, Ohio. We’re also investing in existing branches, refreshing nearly 450 in 2024.

We aim to be the bank for all and remain committed to evolving products, services and experiences to meet the unique needs of each customer segment. In 2024, we enhanced Secure BankingSM, a product geared toward emerging segments, and introduced J.P. Morgan Private Client as a new tier in our affluent product continuum. We also launched new tools to help small business owners run their businesses, including invoicing, payroll and customer insights.

The First Republic integration is complete, and we’re proud to have retained approximately 90% of banking clients and over 95% of deposit balances across the firm. In the Wealth Management businesses, we retained nearly 80% of advisors and assets.

Card: In 2024, we remained the #1 credit card issuer in the U.S. and continued to gain share. We increased total active accounts to nearly 60 million and outstandings to $214 billion (up 12% year-over-year). This fueled market share gains to 23.5% share of sales and 17.3% share of outstandings, up 110 basis points and 90 basis points, respectively, since 2019 (each up 60 basis points year-over-year).

Our ongoing investment in marketing distribution is driving strong new account production and engaging existing cardmembers. In 2019, we booked 7.8 million new card accounts, and since 2022, we’ve consistently booked approximately 10 million new accounts each year with strong return profiles. This step-change in growth will serve as a solid financial foundation for the Card franchise for years to come. Through industry-leading product benefits, we drove engagement with existing cardmembers, and in 2024, more than 60% of customers chose Chase as their top-of-wallet card, which is a record high.

We invest in benefits and capabilities to keep our cards fresh and relevant, and in 2024:

- Refreshed the Marriott Bonvoy Bold® card with an embedded lending benefit, inspiring cardmembers to “Travel Now, Pay Later” and to divide qualifying purchases into equal monthly payments with no interest or plan fees.

- Launched Chase Pay Over Time® at Amazon checkout so customers can break up large purchases into fixed monthly payments without requiring a credit check or forfeiting rewards.

- Extended our partnership with InterContinental Hotels Group and further deepened the relationship into Chase TravelSM and other businesses.

We continue to focus on adding value for key segments where we have outsized opportunity to grow, including:

- New-to-credit customers: Continued to scale the Freedom Rise® card while increasing the number of annual new accounts within this segment by 85% year-over-year.

- Small businesses: Refreshed the Ink Business Cash® card to better serve the needs of smaller businesses. Continued to deepen with Chase Business Banking clients, who contributed to over 50% of business card spend growth.

- Affluent clients: Expanded our award-winning lounge network, opening five new Sapphire airport lounges, including at LaGuardia Airport. The Points Guy named it the best new U.S. airport lounge and recognized the Sapphire Preferred® card as the best travel rewards card in 2024.

These strategies will fuel our plans to get to 20% share of outstandings.

Scaling growth businesses

In Connected Commerce and Wealth Management, we have the assets to win and outsized opportunity to grow to what we view is our fair share, given the breadth of CCB relationships. These businesses are natural adjacencies to credit card and banking, and both diversify and strengthen the CCB franchise.

Connected Commerce: We continue to build a powerful two-sided platform to connect customers with relevant merchant brands. In 2024, we reached over $23 billion in volume and are on track to reach $30 billion in volume in 2025. Since launching Connected Commerce in 2021, we’ve doubled volume on both Travel and Offers platforms.

Travel – We maintained our rank as a top five consumer leisure travel provider and secured the #3 spot in 2024. We launched Chase TravelSM as a standalone brand in 2024 to help customers discover, plan and experience travel and delivered $11 billion in booked volume, up 9% year-over-year. We also scaled The Edit by Chase TravelSM to more than 1,000 hotels, offering customers exclusive benefits and experiences at our curated list of premium hotels. The share of Chase proprietary card spend on our platform has increased by more than 200 basis points since 2021, and we expect ongoing growth.

Chase Media SolutionsSM – Our new digital media business connects customers’ personal passions and interests with brands they love. Customers benefit from the ability to earn extra cash back at places where they already shop or just discovered. Since launching last year, we’ve experienced strong growth with 18 billion offers and $12 billion of customer spend on the platform in 2024, up 31% year-over-year.

Payments and Lending Innovation – In payments, trust and security are top priorities. We continue to invest and use assets that we believe will help protect customers from fraud and scams. This includes adding steps in the ZelleSM user flow to warn customers about scams. As a result, we had a 26% reduction in fraud and scam claim rates in 2024. We are making enhancements to new capabilities, including preventing higher-risk transactions that originate from social media. To introduce new, secure payments solutions, we’ve rolled out PazeSM, a digital wallet created in partnership with Early Warning Services. We’ve onboarded 40 merchants and expect it will continue to scale.

In lending, we now offer a range of Pay Over Time® solutions across credit and debit cards, both in our own and partner digital channels, and we’ve had strong customer adoption. In 2024, over 6 million customers used our flexible payments and lending solutions (compared with over 5 million in 2023), totaling $10.7 billion in originations, up from $8.5 billion in 2023.

Wealth Management: We reached a milestone of $1 trillion in client investment assets ahead of schedule, doubling assets since 2019 (up 34% year-over-year). While the First Republic acquisition and strong market performance in 2024 provided tailwinds, nearly half of this growth was driven by a record 150,000 first-time investors (up 27% year-over-year), product enhancements (such as launching fractional shares in Self-Directed Investing), and investments in advisor hiring (adding approximately 300 net advisors in 2024 alone). In fact, we had a record year for advisors, doubling net flows per advisor relative to 2019. These factors should continue to spur growth. Our branch referral program was particularly impactful with more than 90% of first-time investors being introduced to J.P. Morgan Wealth Management by their banker.

We have tremendous opportunity to further advance growth by leveraging existing assets and continuing to invest in products and distribution.

Customers increasingly want to manage their banking and investments together, and we are uniquely positioned to fill that need and capitalize on the opportunity. More than 5 million affluent households have banking relationships with us, but the majority still have their investment relationships elsewhere.

We continue to invest to meet customers’ evolving wealth management needs. As a result, 2024 was a breakthrough year in which we made significant progress in our digital customer experience. In 2024, J.D. Power ranked us #1 in Wealth Management Digital Experience Satisfaction among full-service and self-directed investors.

Secured Lending

In both Home Lending and Auto, we’ve faced a few years of challenging market conditions, but we continue to focus on what we can control while managing returns on a through-the-cycle basis. We make ongoing investments in products, experiences and technology platforms that position us for growth as conditions become more favorable. These two businesses remain strategically important, as they provide diversification and help us serve customers’ needs in life’s key moments.

Home Lending: We continue to face some of the strongest market headwinds we’ve seen in generations, as high rates are coupled with limited housing supply and elevated prices. Since 2019, home prices are up more than 50% (roughly flat year-over-year), inventory is down approximately 15% (albeit recovering strongly and up over 20% year-over-year) and mortgage rates have increased to nearly 7% (roughly flat from 2023).

Despite these challenges, in 2024 we scaled originations to $41 billion in volume, up from $35 billion in 2023, while maintaining our position as the #1 owned servicer. We scaled Chase MyHomeSM, a digital home shopping platform, to promote deeper engagement and generate leads. In 2024, over 9 million unique users visited Chase MyHomeSM (up 46% year-over-year). We experienced an increase of approximately 20% in customers who engage with high-value features, including searching for homes, viewing insights on their current property and mortgage, and understanding how much they can afford.

Our investments in technology, data and AI enhance our sales and underwriting capabilities, improve productivity, and facilitate efficiencies and speed to market. Our newly modernized loan origination system enabled us to roll out a home equity product in 2024 to provide additional lending options for customers.

Auto: The industry showed signs of improvement, with COVID-era, secular headwinds abating. In 2024, new vehicle sales recovered from pandemic lows to about 90% of 2019 levels (up 2% year-over-year).

While the industry outlook remains uncertain, Chase Auto has been on a strong growth trajectory. Up 19% from 2019, the business originated $40 billion in 2024 compared with $41 billion the year prior. Notably, lease originations have rebounded from recent lows, though they remain below pre-pandemic levels. We continue to enhance digital capabilities and drive engagement with customers. In 2024, over 13 million unique users visited our digital car shopping and financing platform, Finance & DriveSM, down 12% year-over-year. Importantly, the number of customers engaging with high-value features (including shopping for a car and pre-qualifying for a loan) was up 16% year-over-year, which reflects our focus to deepen engagement with our digital tools.

J.D. Power scores indicate our products and services resonate with customers, as we ranked #1 in Digital Experience for Customer Satisfaction among Non-Captive Automotive Finance Lenders.

Finally, we’ve increased operational efficiency across the business. About 80% of all applications are automatically decisioned, and we continue to streamline and automate more back-end processes.