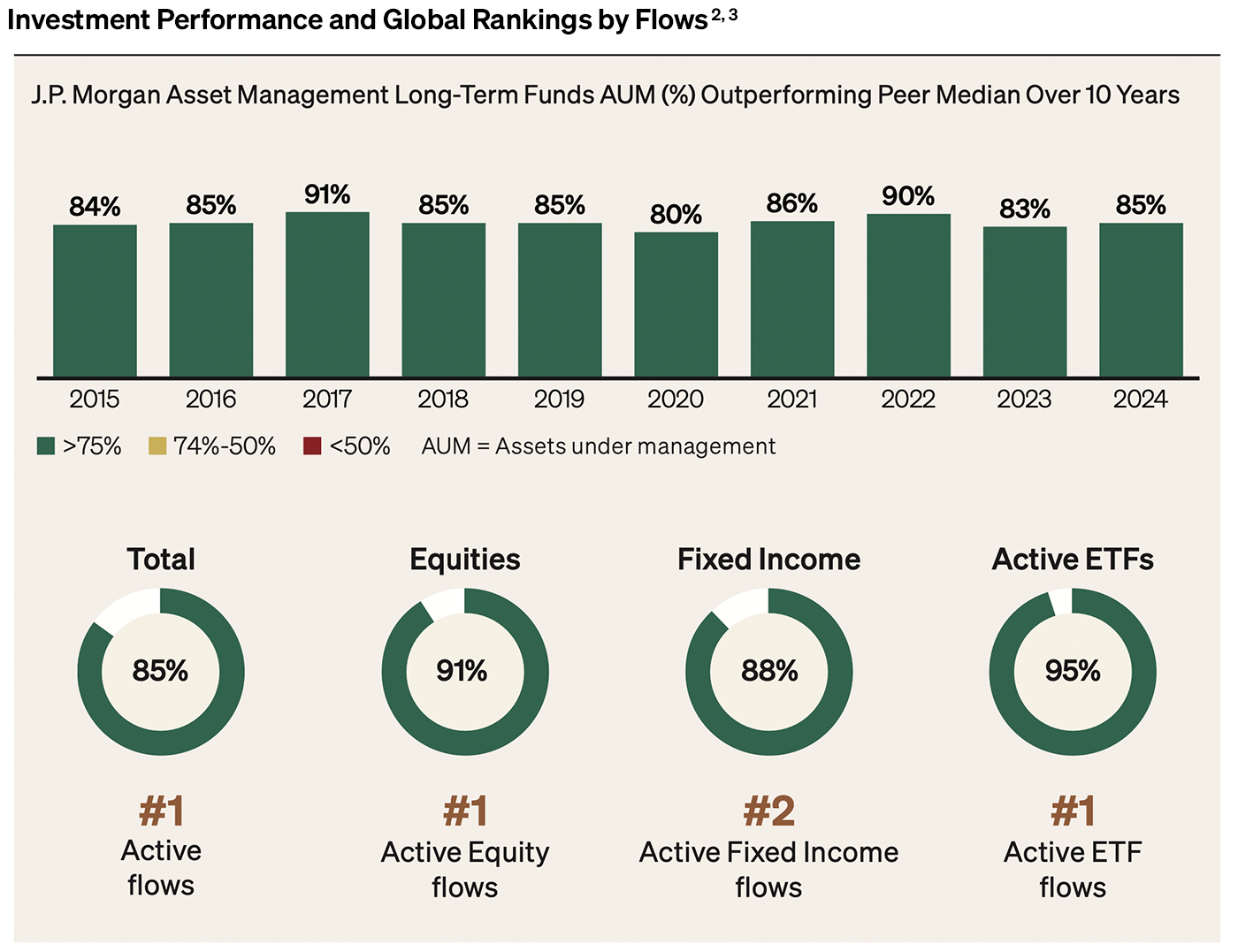

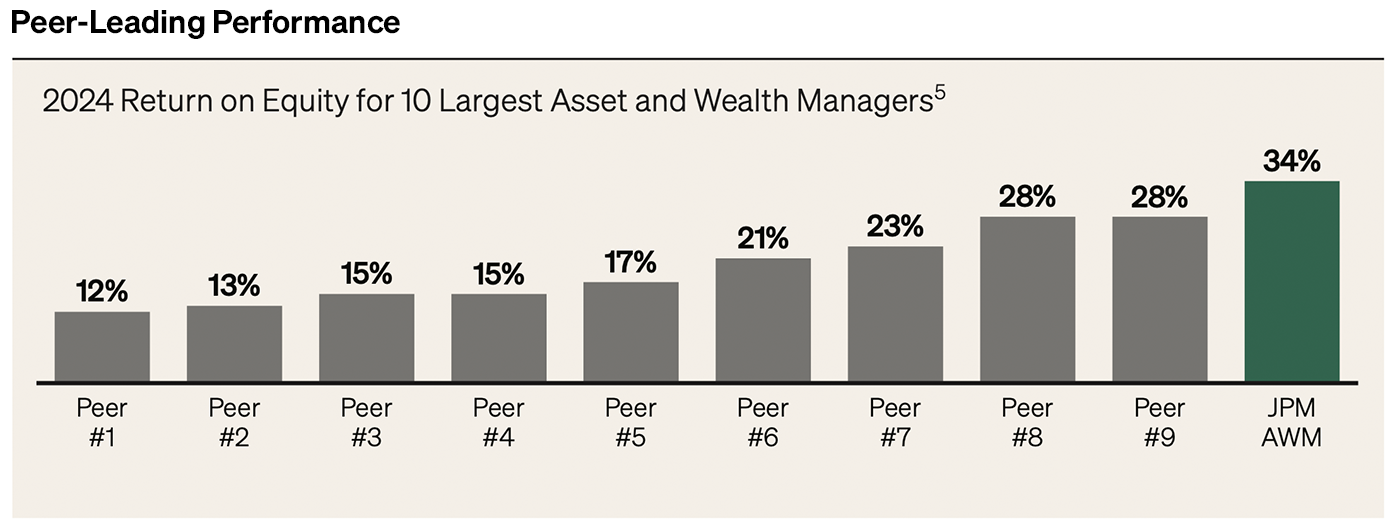

J.P. Morgan has a proud fiduciary history spanning nearly two centuries of managing client assets. Throughout each decade, we have consistently delivered valuable insights and strong performance to a distinguished clientele worldwide, including governments, major institutions, central banks, sovereign wealth funds, CEOs, founders and individuals. Our steadfast commitment to delivering strong and consistent results has solidified our position as a leader in industry growth. Whether supporting a first-time saver seeking cash management solutions or retirement options at a Chase branch or serving a major state pension plan in need of tactical asset allocation overlay strategies, our franchise continues to strengthen with each new relationship, earning the trust of our clients.

Having had the privilege of working for Jamie Dimon for over two decades, I am reminded every day that success is not accidental and should never be taken for granted. Sustainable growth requires constant innovation, extraordinary focus, intensity and drive, coupled with a fortress mindset – always preparing for the toughest challenges while remaining poised to seize new opportunities. We are in a fiercely competitive race to identify the best opportunities for our clients and for our future growth while simultaneously maintaining our unwavering focus on cutting waste and achieving operational excellence.

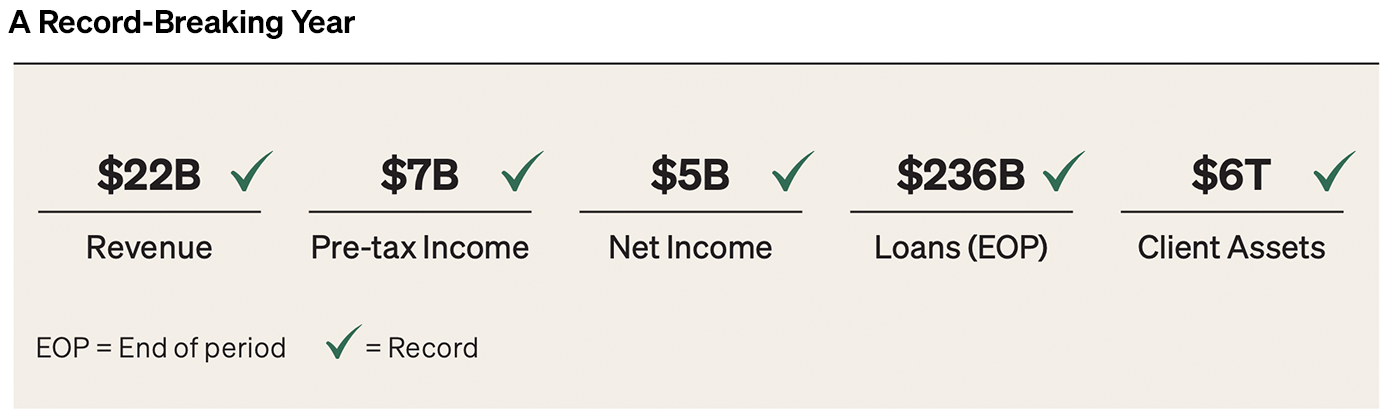

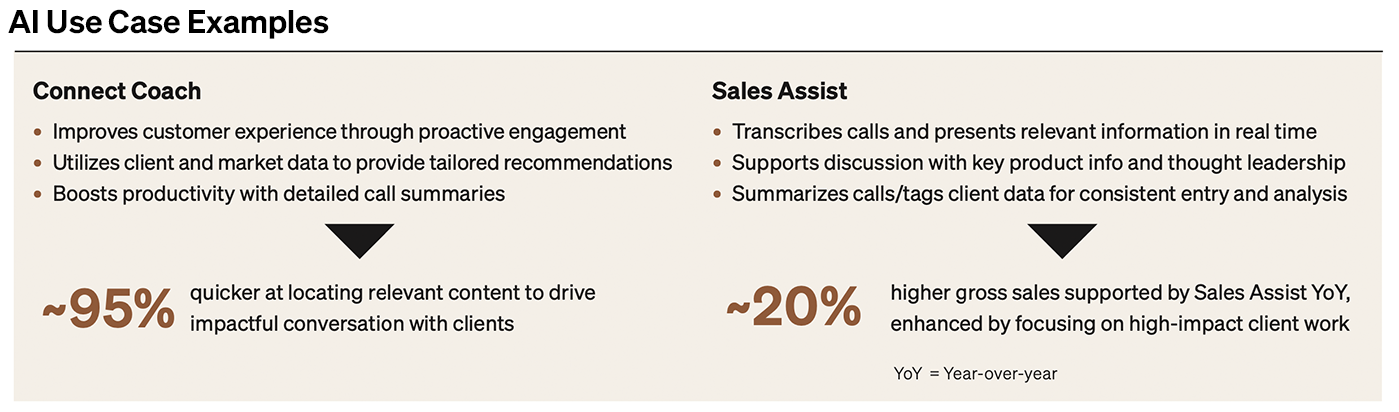

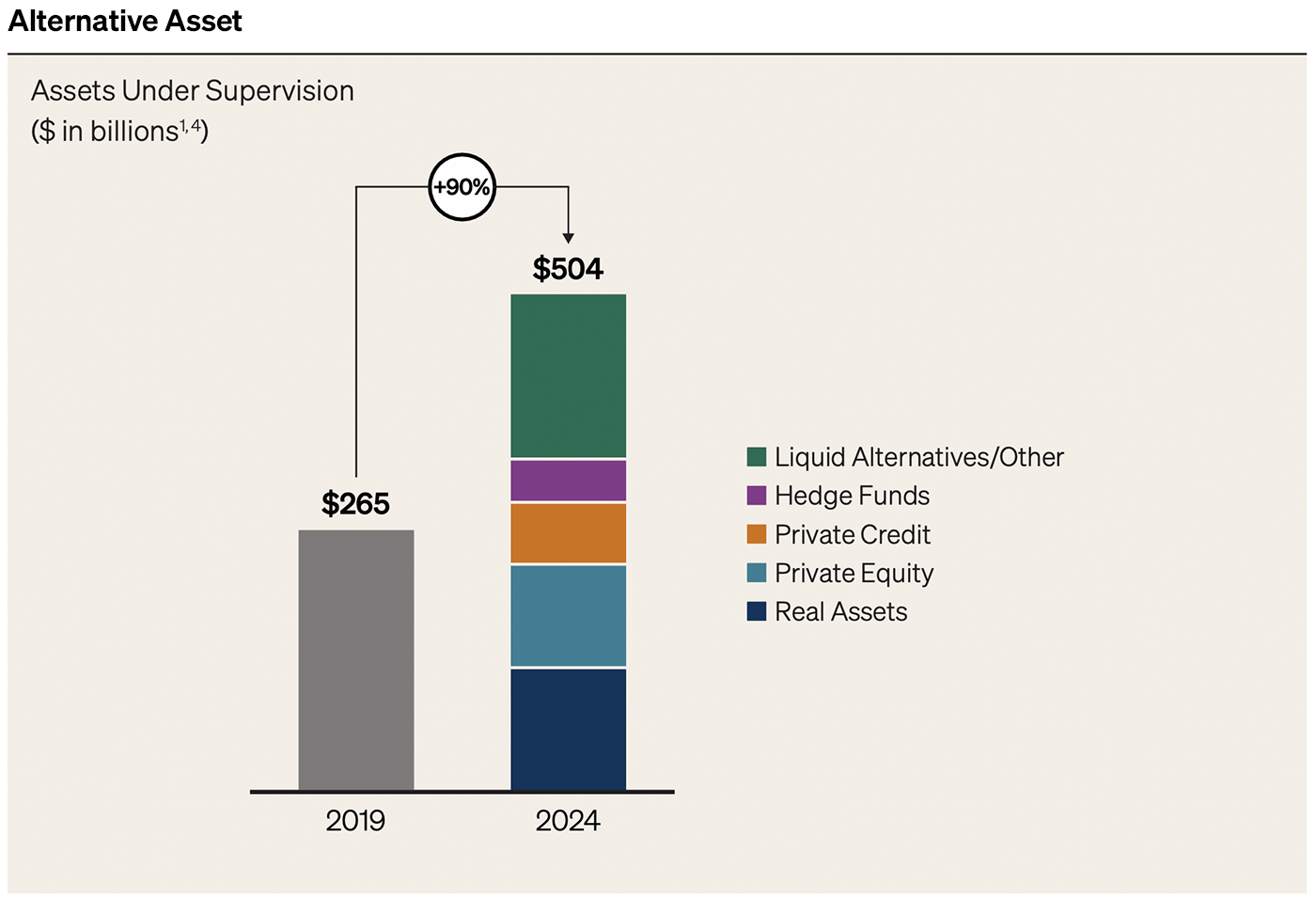

In Asset & Wealth Management (AWM), my partners and I work tirelessly to optimize client portfolios and future-proof them for what lies ahead. We achieve this by delivering leading investment performance, leveraging what I believe is the most exceptional talent in the industry and executing our most ambitious investment agenda to date. Our focus on investing in cutting-edge technology and our elite talent, while driving out inefficiencies, has led us to highly profitable growth for our shareholders.

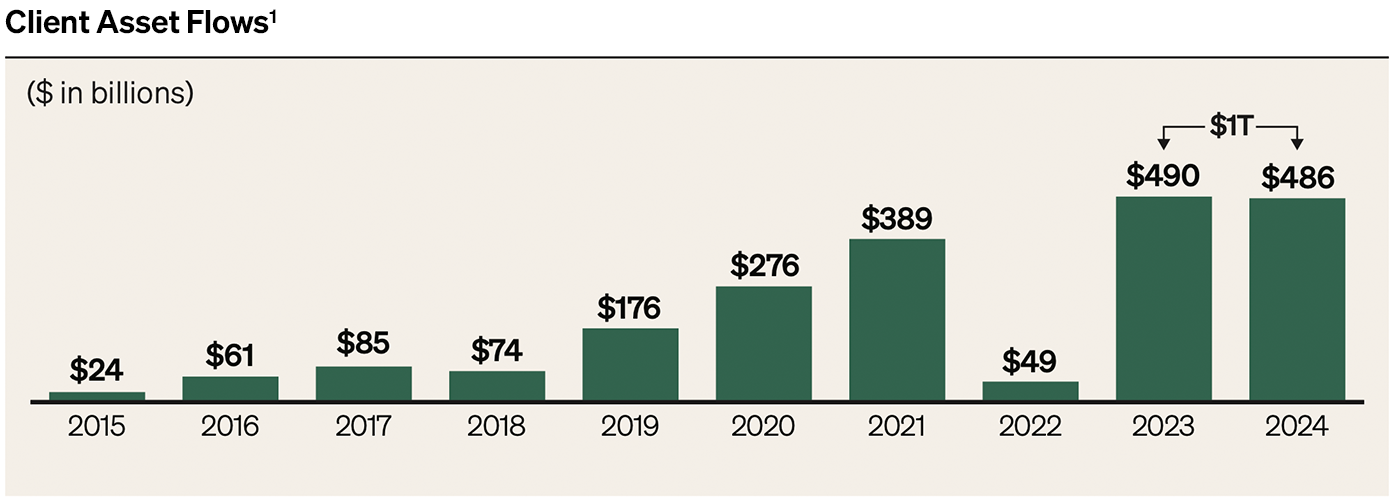

Our clients vote daily on our success with their consistent contribution of new assets. They have demonstrated their ongoing confidence in our strategy by entrusting us with an additional $486 billion in net new assets, bringing the total to nearly $1 trillion of inflows over the past two years. This remarkable achievement stands as the ultimate testament to the strength and effectiveness of our business.