Small businesses, defined as businesses with fewer than 500 employees, play a critical role in the US economy. They provide work for nearly half of all employees in the US and are credited with creating 52 percent of net job growth. Small businesses also account for a significant share of personal income, given their average annual payroll of $45,000 per employee. Despite its importance, relatively little is known about the underlying dynamics of employment growth and volatility at the individual small business level. In particular, publicly available aggregate data provide an incomplete view of the ways in which employment in the sector shapes the financial well-being of small business owners and their employees.

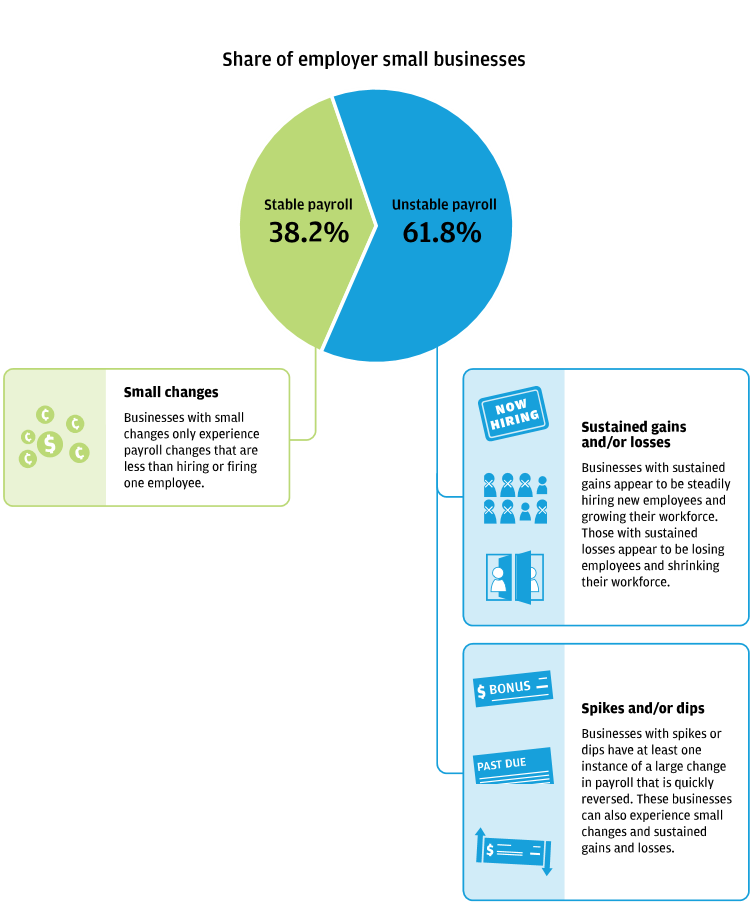

As part of its broader research agenda on the small business sector, the JPMorgan Chase Institute analyzed the size, growth, and volatility of payroll outflows for small businesses. Using a sample of over 45,000 small business customers, we found that payroll is a high expense for most employer small businesses. Furthermore, even though most small businesses experience low payroll growth each year, the month-to-month volatility of payroll expenses around that growth can be quite high, making it more difficult for small business owners to manage their cash flows.