Frequently Asked Questions

How can these data be used?

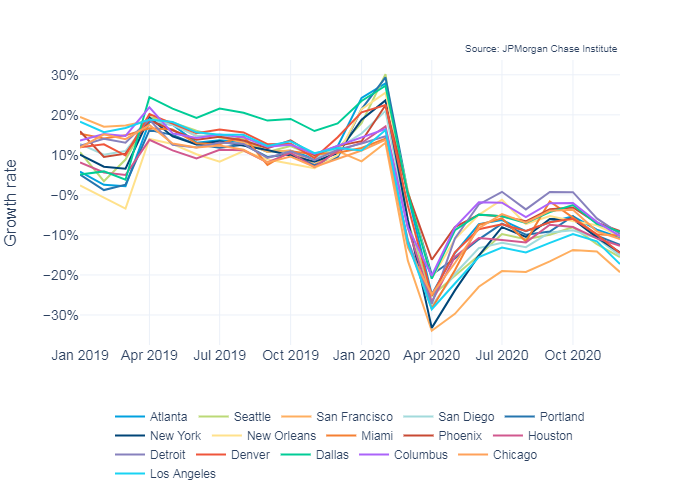

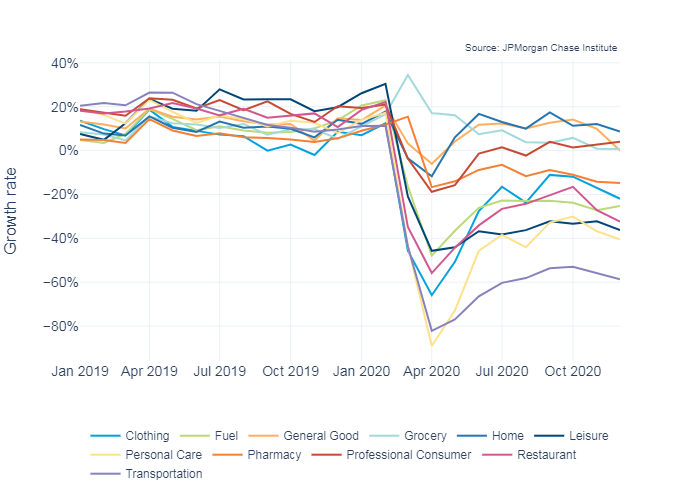

Local commerce data provide a lens into the evolution of retail spending in the metro areas we track. In the context of COVID-19, these data enable local stakeholders to better understand initial responses to the pandemic, the path of consumer spending as policy interventions change, and the extent to which spending is returning to pre-pandemic levels. In more general terms, local commerce patterns illuminate trends in a critical fiscal base for state and local governments.

The data are organized in a directory structure by geography. Data that span the 16 metro areas we track are in the National directory. The same views for each metro area sit in the sub-directories of the CBSA directory. Each data view is comprised of both a chart and the associated data file.

Users of local commerce data should also be aware that these series are versioned products. The goal is to provide the best view of local commerce spending we can provide at any given time. To the extent that updates are made to sampling, reported measures, or the set of attributes (e.g. channel), the older versions of the data series will be made available for comparison.

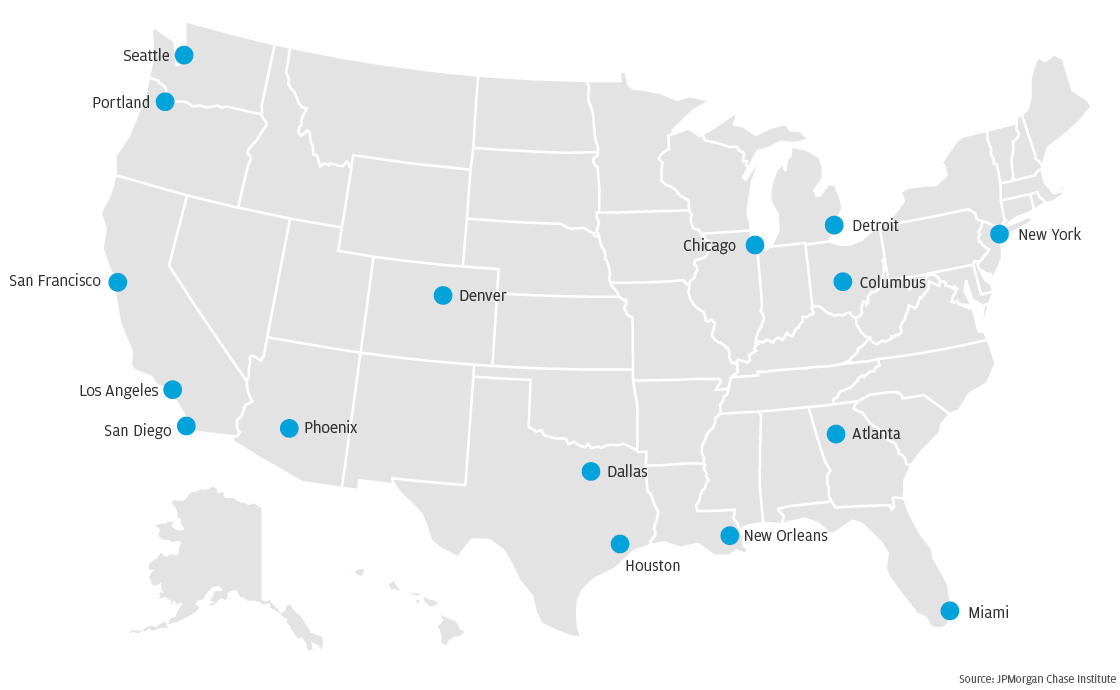

Which geographic areas are included in the data?

There are 16 metro areas in data:

- Atlanta

- Chicago

- Columbus

- Dallas-Ft. Worth

- Denver

- Detroit

- Houston

- Los Angeles

- Miami

- New Orleans

- New York

- Phoenix

- Portland (OR)

- San Diego

- San Francisco

- Seattle

Each metro area is represented by the collection of ZIP codes that intersects the relevant

Core-Based Statistical Area.

How is the Pandemic Spending (PS) series different than former Local Commerce Index (LCI)?

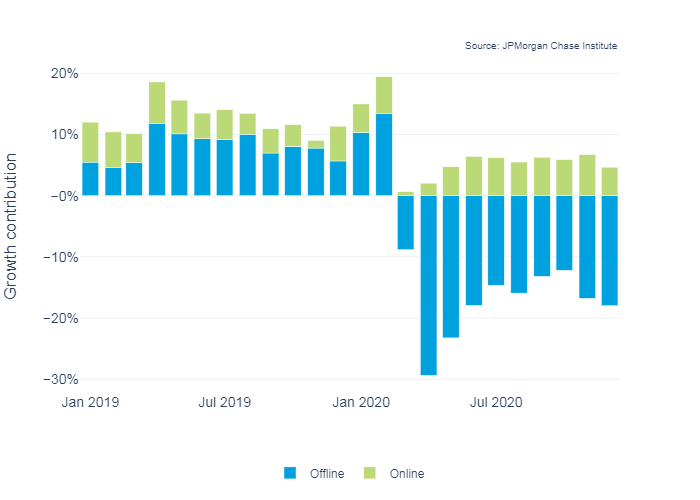

The Pandemic Spending (PS) series differs from the former Local Commerce Index (LCI) in two primary ways. First, the former LCI was based on transactions that occurred at establishments located inside of metro areas (i.e. the Sellers'/Merchant view). The PS series, by contrast, is based upon transactions that are executed by people that live inside certain metro areas (i.e. the Buyers'/Consumer view). These two views overlap, but are different in important ways. Among other things, the Buyers' view provides better coverage of online purchases.

The PS series also differs in the sampling approach. Both the former LCI and the PS series rely on a version of a "stable cohort". The former holds exactly the same population in the target (e.g. January 2020) and comparison (e.g. January 2019) months in the growth calculation, while the latter only prevents new customers from joining the sample over the course of the year. The PS series also differs by freezing the sample in the last month of the status quo, February 2020. See "How are people selected for inclusion into the sample?" for details.

How are people selected for inclusion into the Pandemic Spending series sample?

To the extent we are seeking to estimate growth in the broader economy, we leverage a stable cohort approach. For transactions to be included in our series, the person making the transaction must have cleared our transaction threshold in the target month (e.g. January 2020) and the comparison month in the growth calculation (e.g. January 2019). This approach precludes, for example, growth due to new people entering the sample over the course of the year. This sampling approach also means that the population used for the January 2020 calculation can differ from the population used for the December 2019 calculation.

To focus on effect of the pandemic, we stop updating our population in February 2020. Since we require people to clear a transaction threshold to be included in the sample, we would have lost people when everyone pulled back spending. To measure the impact of the pandemic-related reduction in spending, we freeze our sample to include those people that cleared the threshold in February and use the same population for all subsequent months.