The COVID-19 pandemic resulted in an unprecedented recession that impacted families’ financial positions. Based on recent JPMorgan Chase Institute research, our Household Finances Pulse leverages de-identified administrative banking data to analyze changes in cash balances during the COVID-19 pandemic and ongoing recovery.

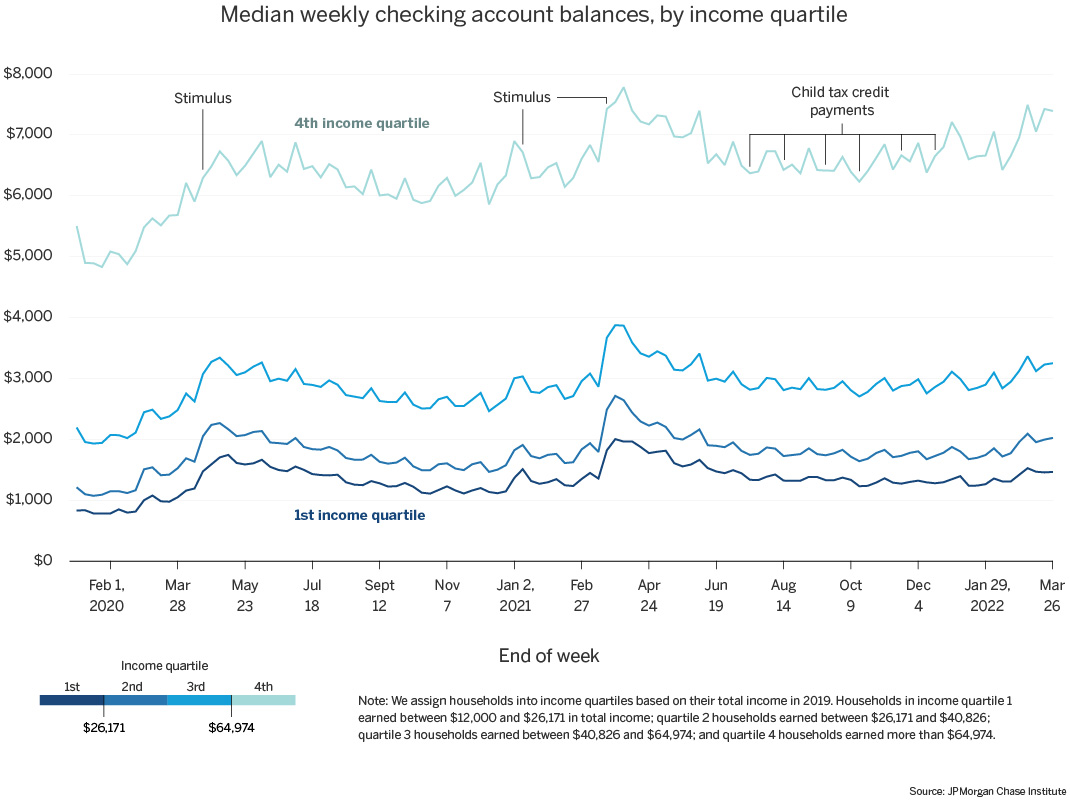

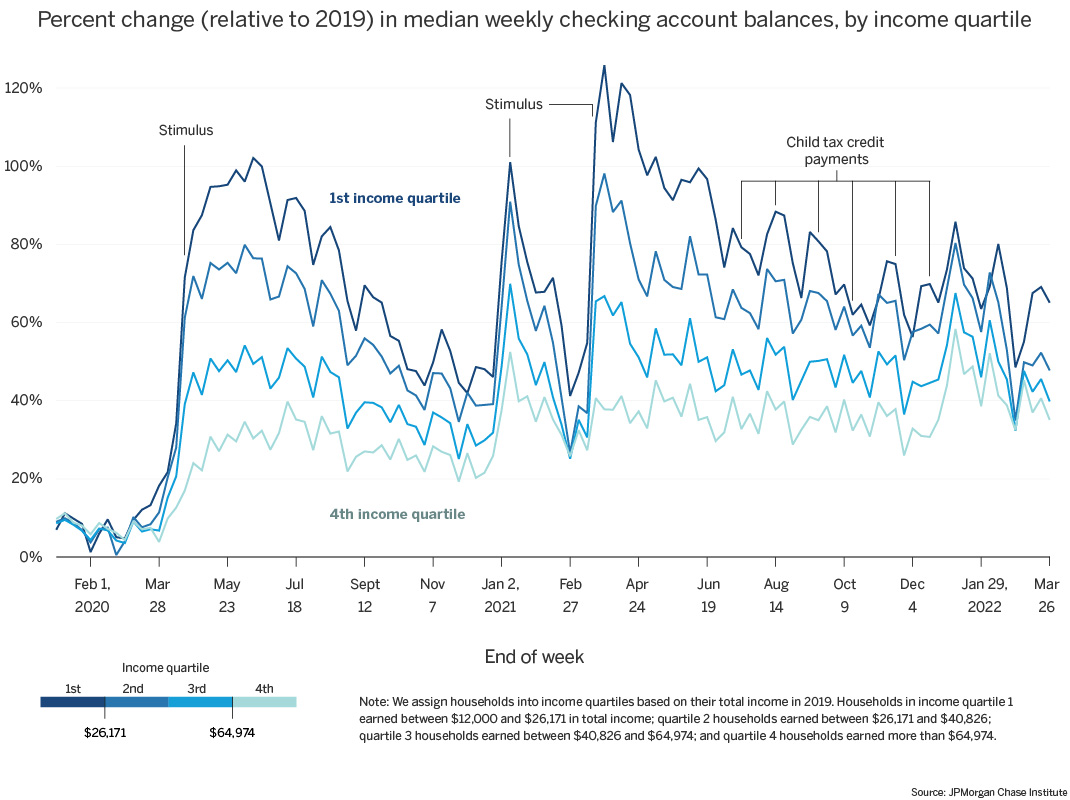

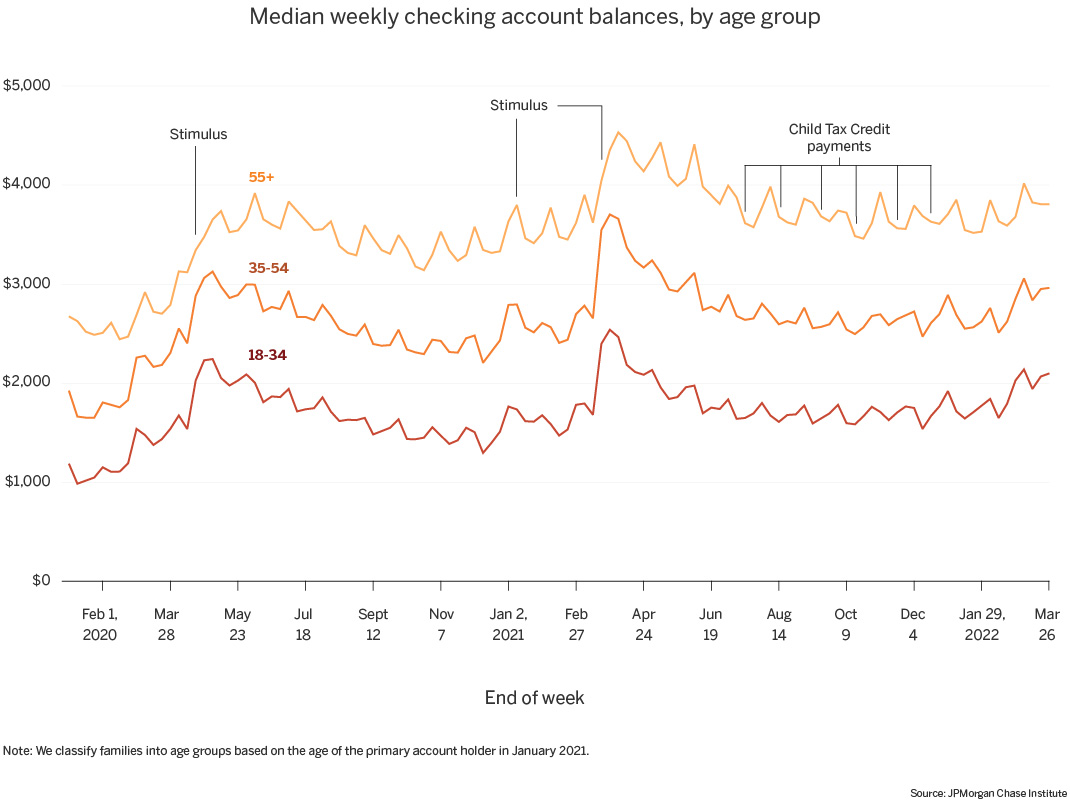

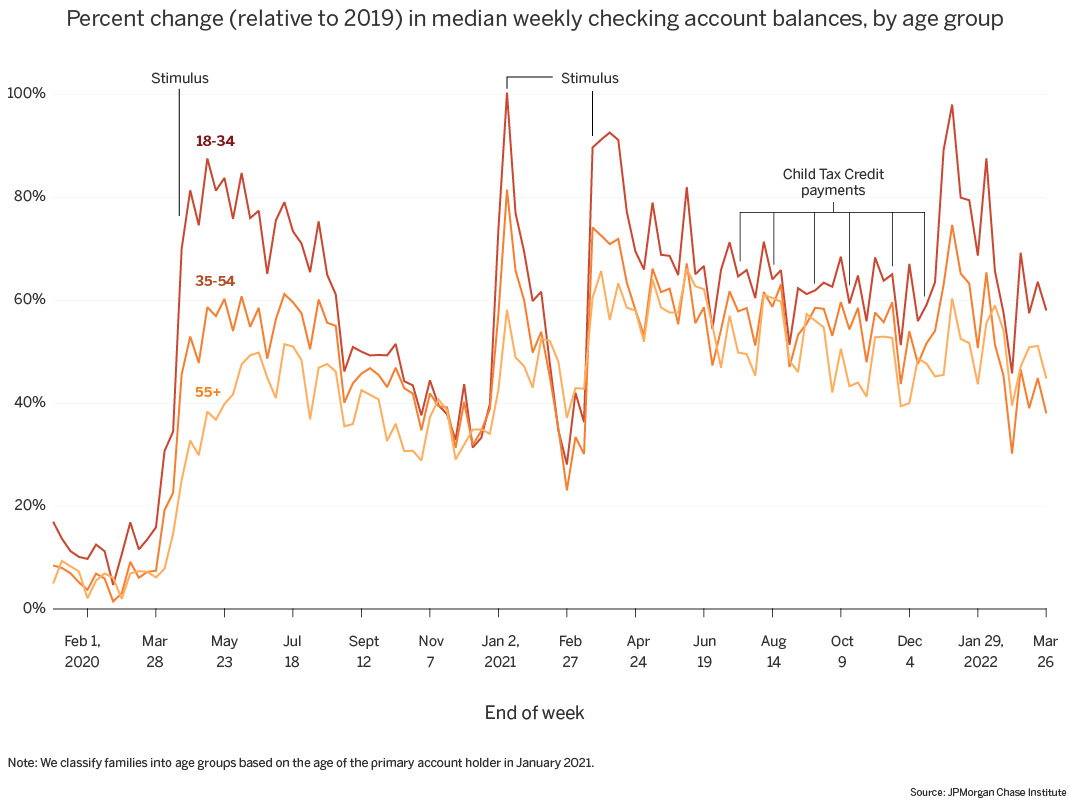

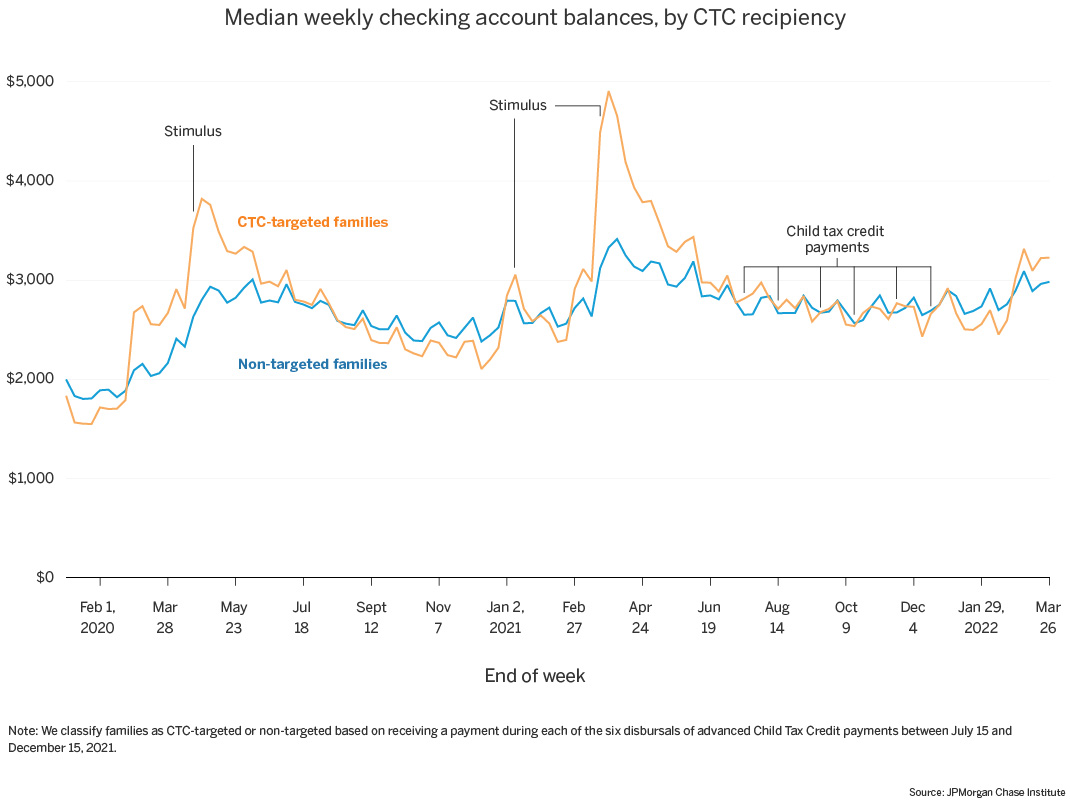

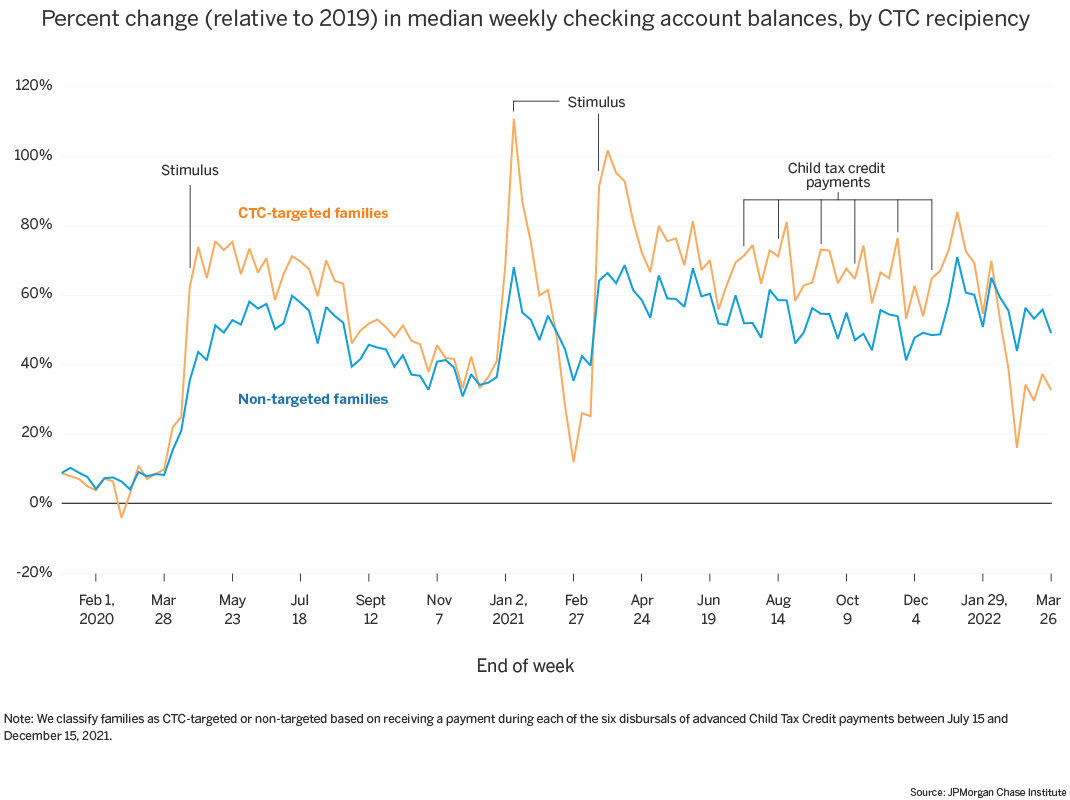

This release examines the path of household cash balances through the end of March 2022, giving us a look at liquid asset trends during the months following the expiration of advanced Child Tax Credit (CTC) payments. We compare cash balance trends across income and age distributions, and between families who did and did not receive advanced CTC payments.

During the pandemic, the federal government provided cash assistance and relief to families through a range of fiscal interventions. Three rounds of stimulus, or Economic Impact Payments (EIP) provided cash benefits to families earning below specified income thresholds, with the dollar amount of the benefit determined by the size of the family, and progressively more paid per child in each round. Stimulus payments landed in April 2020, January 2021, and March 2021. Throughout this time, expanded unemployment insurance delivered payments to jobless workers, including gig workers and self-employed workers, with weekly supplements to typical benefits which were phased out in 2021. Finally, the American Rescue Plan increased the dollar amount of CTC payments and expanded eligibility for families in the 2021 fiscal year. Monthly advanced CTC payments were disbursed from July through December 2021, covering half of the total tax credit; the remainder will arrive when families file tax returns for the 2021 fiscal year.

To put our measures of family checking account balances into perspective with other household finance metrics, there are three important considerations to keep in mind. First, our balance growth numbers are based on nominal dollars, not adjusted for inflation. This is especially noteworthy given the high rate of inflation in the economy: inflation rose by 8.5 percent in for the year ending March 2022, the fastest pace in four decades. Second, the charts below do not account for the secular upwards trend of liquid balances prior to the pandemic. For our sample, cash balances in the first two months of 2020 had grown by roughly 7 percent on a year-over-year basis, implying that early 2022 cash balances could have been up by 23 percent compared to 2019 levels, independent of the pandemic and corresponding government interventions. Finally, there is significant heterogeneity in asset allocations for different groups of households. Families that hold a larger share of their financial wealth in checking accounts may have maintained a larger proportion of their balance increases from government intervention in their checking accounts. Thus, other cash balance metrics may differ from ours in amount or trend, based on these or other differences in measurement.