Conclusion

In this report, we examined the trading behavior of institutional investors in the hours and days leading up to, during, and after three events that had major impacts on foreign exchange markets. Our results are informative along two dimensions: financial market stability and central bank communications.

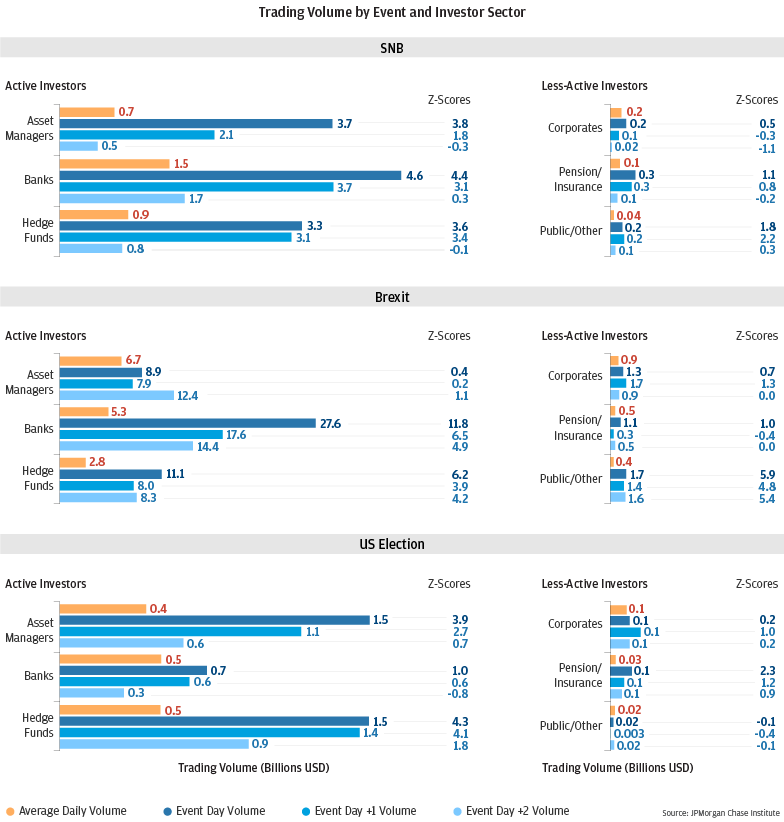

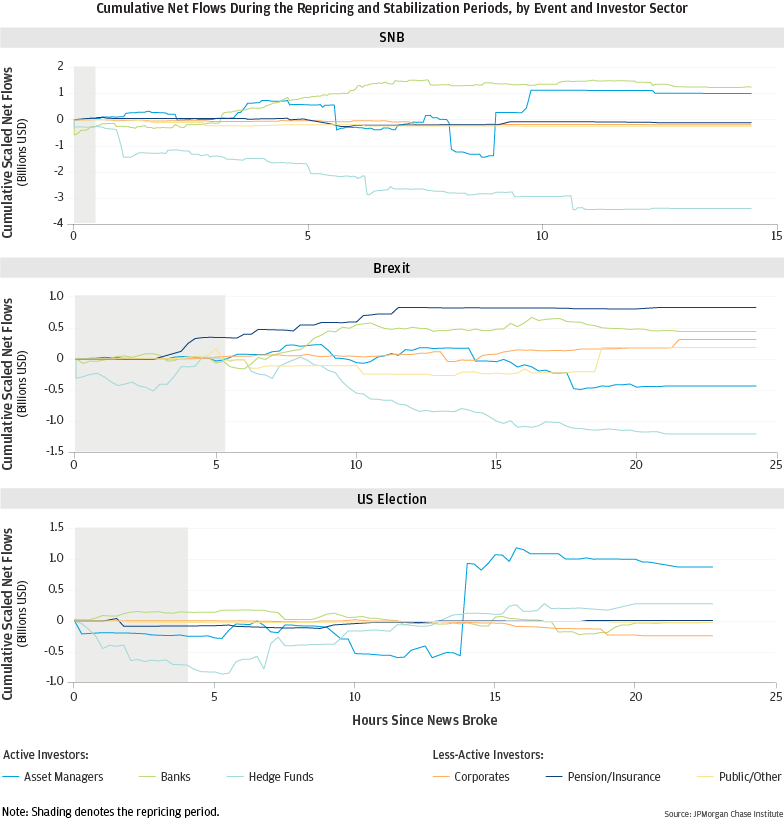

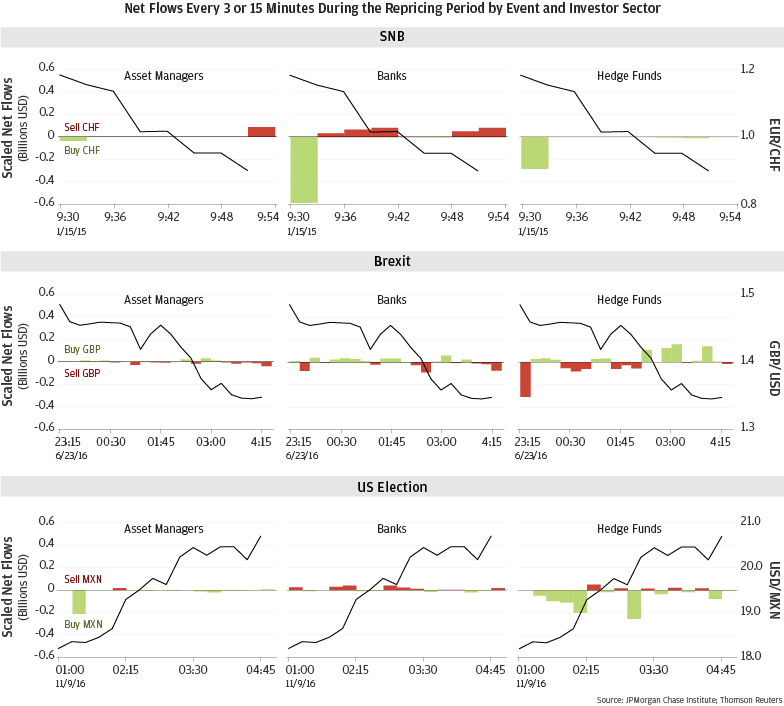

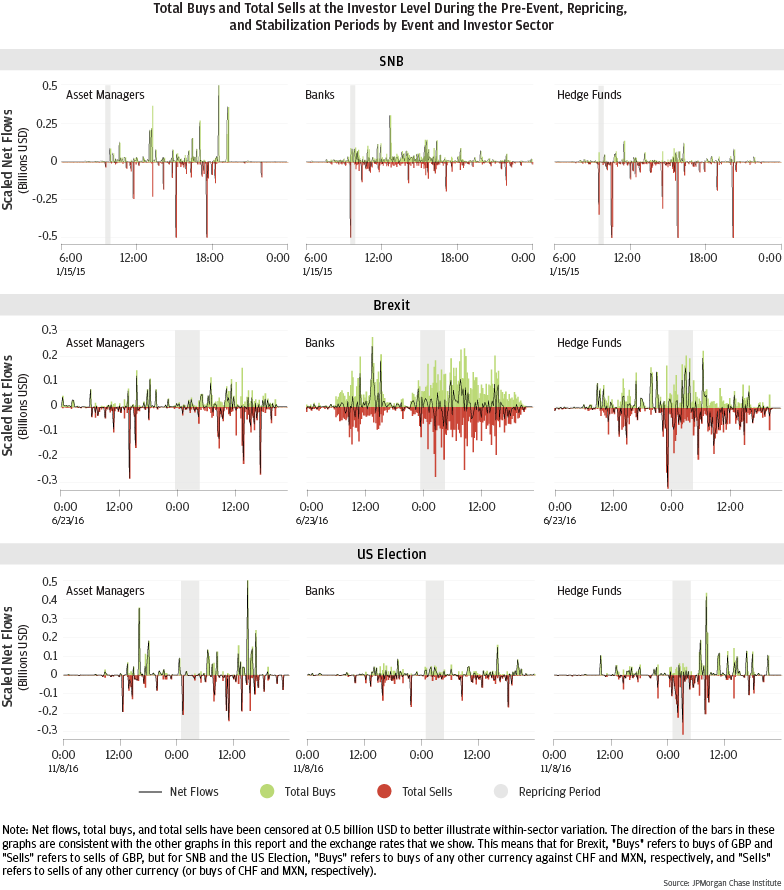

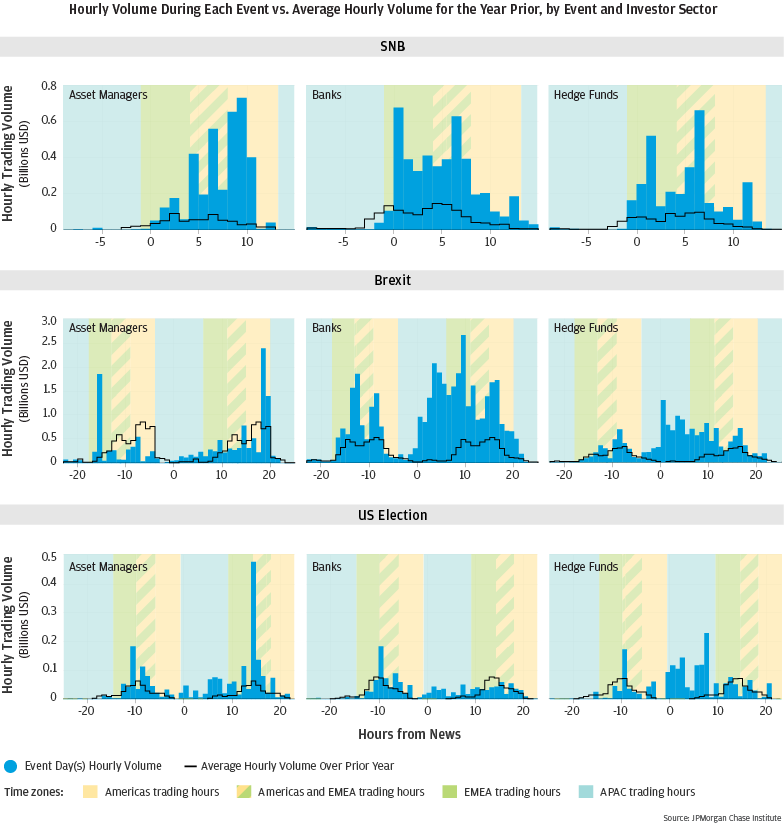

Our analysis shows that the institutional investor reactions to major market events, as reflected in trading volumes and risk transferred, varied in pace and size across sectors. The slower risk transfer response of asset managers, corporates, pension/insurance companies, and public sector investors to the three news events that changed perceptions of the fundamental value of each currency suggests these four investor sectors did not participate in the price discovery process. Furthermore, these same four investor sectors did not transact against the prevailing move in exchange rates during the volatile repricing periods of these three events, contradicting the popularly held narrative that long-only investors with long-term investment horizons act as a stabilizing force during market dislocations.

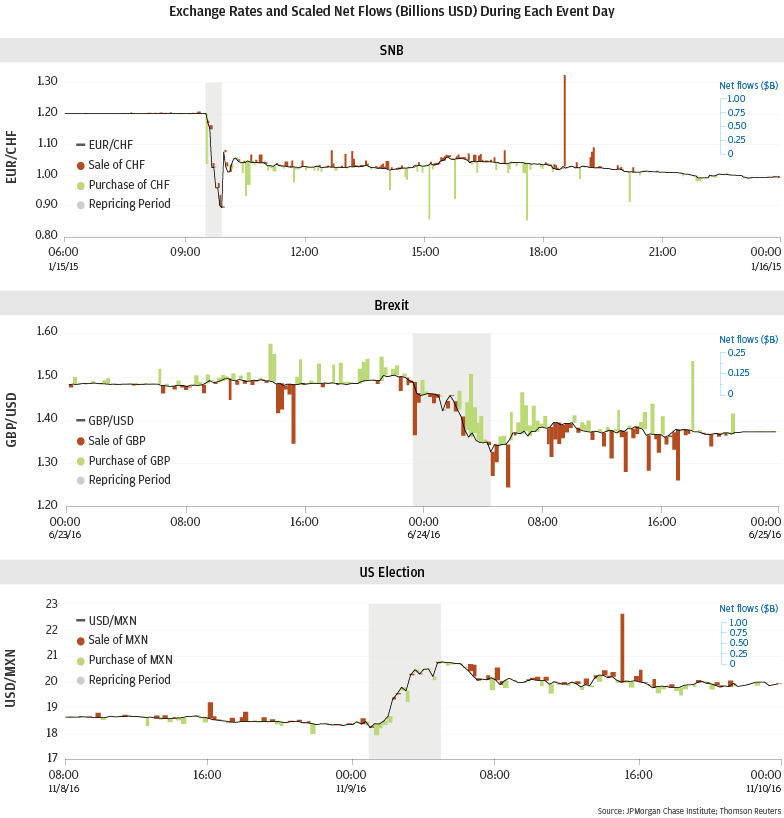

Hedge funds and market makers played an especially significant role in the market ecosystem during these three events. Hedge funds transacted actively in FX markets just after each news event broke and during volatile conditions, participating in the establishment of a post-event market equilibrium. For all three events, market makers reconciled news about the fundamental value of the relevant currency with net flows, adjusted market liquidity, and established a post-event equilibrium exchange rate. When deliberating policies that limit the trading activity of market makers or hedge funds, policymakers can use our results regarding the differential roles institutional investors played in establishing a post-event market equilibrium exchange rate to weigh this factor against any other relevant considerations.

Company policies or regulations that limit the trading activity of institutional investors to their normal business hours or the local market of a currency may prevent these investors from accessing liquidity and mitigating their risk during market-moving events. Limitations to after-hours trading may also reduce market efficiency as markets might take longer to reach a new equilibrium price. With the appropriate safeguards, controls, and security in place, after-hours trading capabilities could be a useful addition for some institutional investors.

While a role for capital controls as a tool for enhancing financial stability in certain instances has gained popularity over the last 10 years, our results imply that strict controls on FX flows may act as a hindrance to market efficiency during times of instability and prevent domestic investors from accessing liquidity abroad.

Our results could be helpful to central banks as they pursue the appropriate balance between their increasing tendency toward transparency in communicating policy actions and other critical factors, such as maintaining their credibility. Enacting unexpected policy changes via a surprise announcement (like the SNB event) may not allow investors to adjust their risk in advance which in turn leads to directional net flows that could amplify price movements. When choosing the most appropriate method to communicate policy changes, policymakers can use these results to help weigh market expectations with respect to both the timing of announcements and the outcome in the context of other pertinent factors and their desired market impacts.

When deliberating unconventional policy measures that directly change the price of financial instruments, policymakers should carefully consider how they will unwind the policy. For example, policies such as the SNB’s minimum exchange rate take pricing power away from the market and therefore can distort the incentives and, in turn, the behavior of market participants. To the extent that policymakers want to unwind such a policy and return pricing power to the market with minimal unintended market impacts, the behavior induced by the distorted incentives can become a complicating factor.