Executive Summary

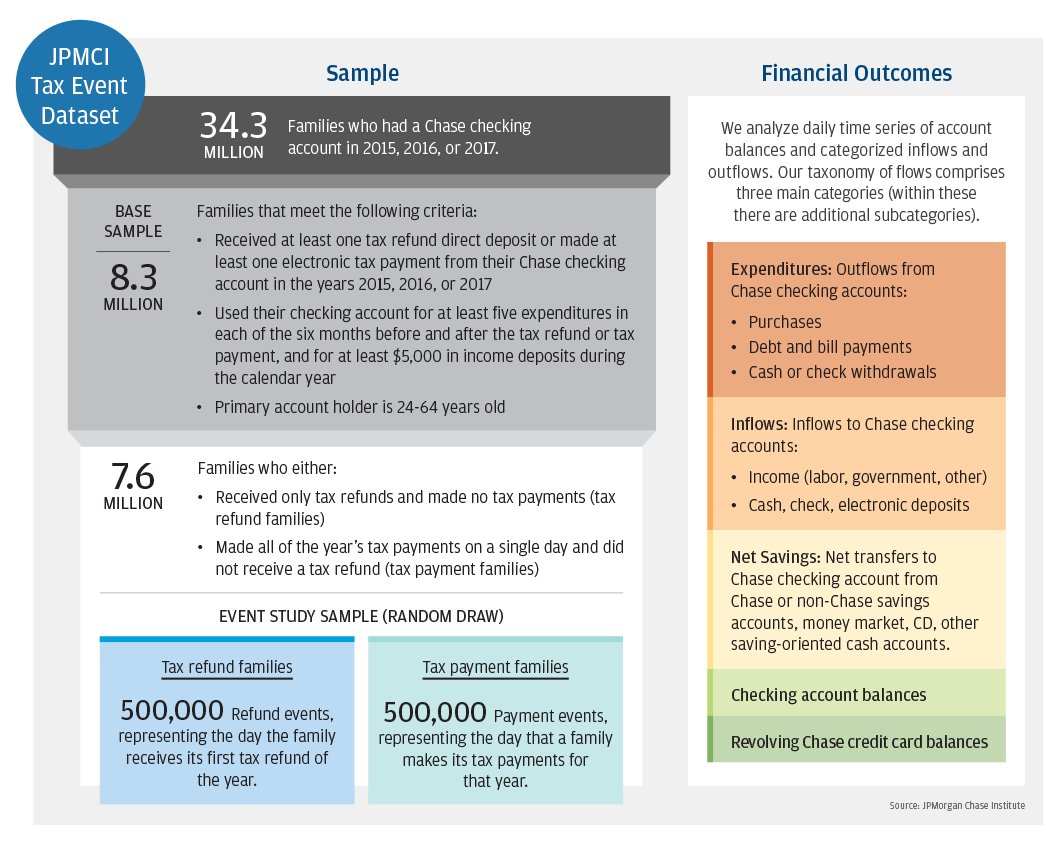

Every spring more than a half trillion dollars flow into and out of the financial accounts of American families as they reconcile taxes paid against taxes owed for the prior year. Most of these flows–representing 2.5 percent of the year’s total GDP–hit families’ financial accounts during the dozen weeks of the traditional tax season from mid-February to mid-May. In previous JPMorgan Chase Institute research, we reported that out-of-pocket spending on healthcare services jumps by 60 percent in the week a tax refund is received and remains elevated for 75 days. This report builds on that research, investigating more comprehensively how families manage the positive cash flow from tax refunds and negative cash flow from tax payments. We analyze daily financial flows and balances for one million families who receive tax refunds or make tax payments, and find that tax reconciliation has a significant and long-lasting impact on spending and saving patterns of some, but not all of them.

Our findings underscore that fact that, whether by design or not, the tax system is a primary tool by which many families generate lump sums of cash. They raise questions about roles that families, financial service providers, and policy makers might play in creating cheaper and more flexible tools for this purpose.