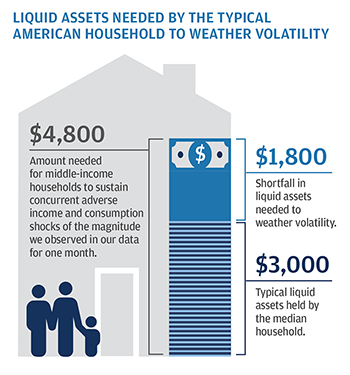

The typical household did not maintain enough liquid savings that could be accessed immediately in the event of a large, unexpected expense sustained at the same time as a loss in income. While many in the field of consumer finance have long advised that consumers maintain an emergency fund, our research into income and consumption volatility shows that a financial buffer is a more important consideration for individuals across the entire income spectrum than is generally understood. We find that not only was volatility high for income and consumption, but also changes in income and consumption did not move in tandem. This creates the risk that people might experience a negative swing in income at the same time that they incur a large, potentially unexpected, expense. Based on our findings, we estimate that a typical middle–income household needed approximately $4,800 in liquid assets—roughly 14% of annual income after taxes—to have sustained the observed monthly fluctuations in income and spending but they had only $3,000. Required levels of liquid assets, however, were largely unavailable to most individuals across quintiles, except top earners.