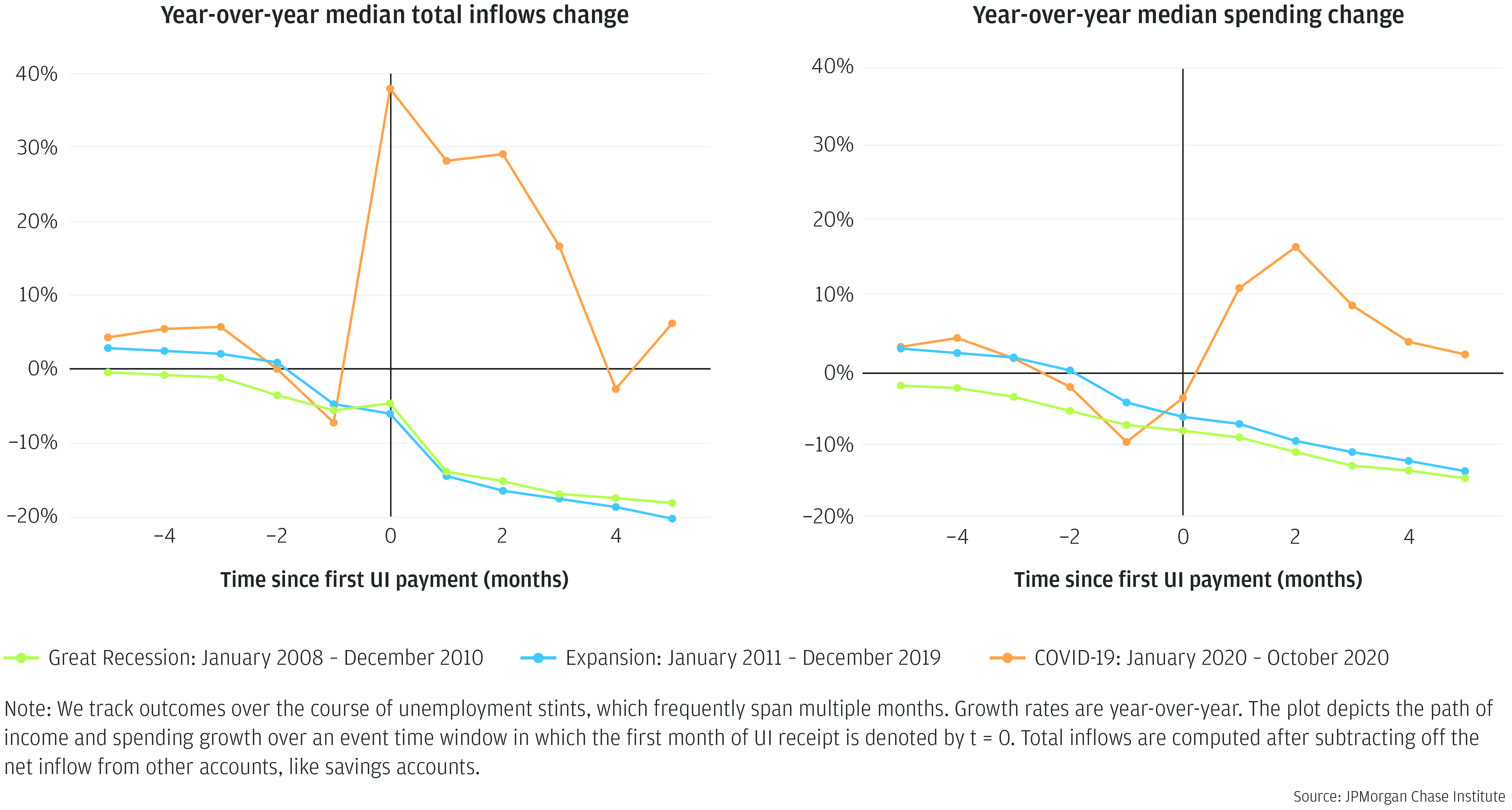

The financial consequences of a family experiencing job loss for can vary widely. This report examines factors that drive the spending response during unemployment across households of different characteristics and over time. We leverage an expanded dataset that dates back to 2007, covering over 2 million job loss events and allowing a perspective that spans the Great Recession, the expansion period, and the COVID-19 recession.

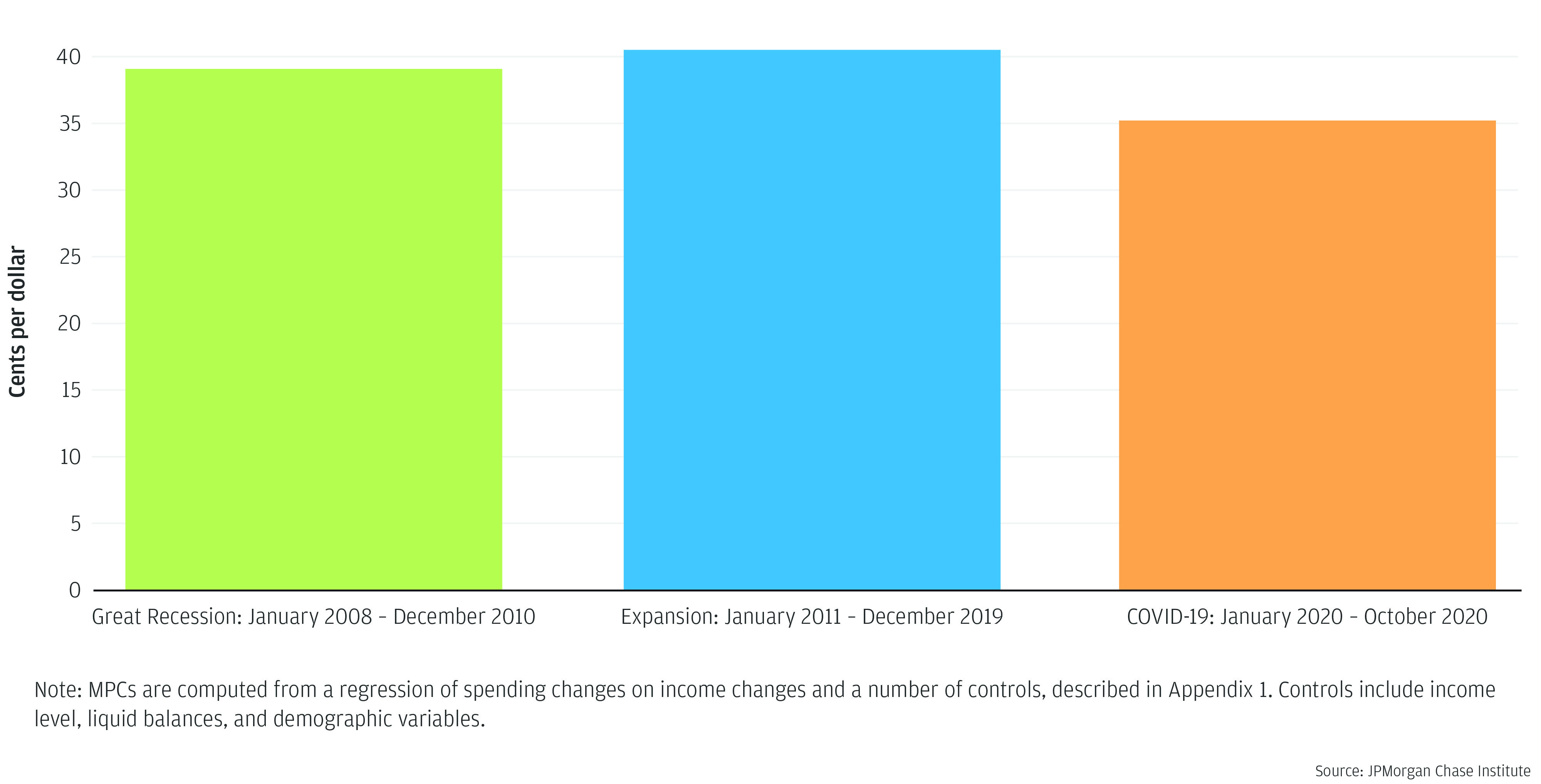

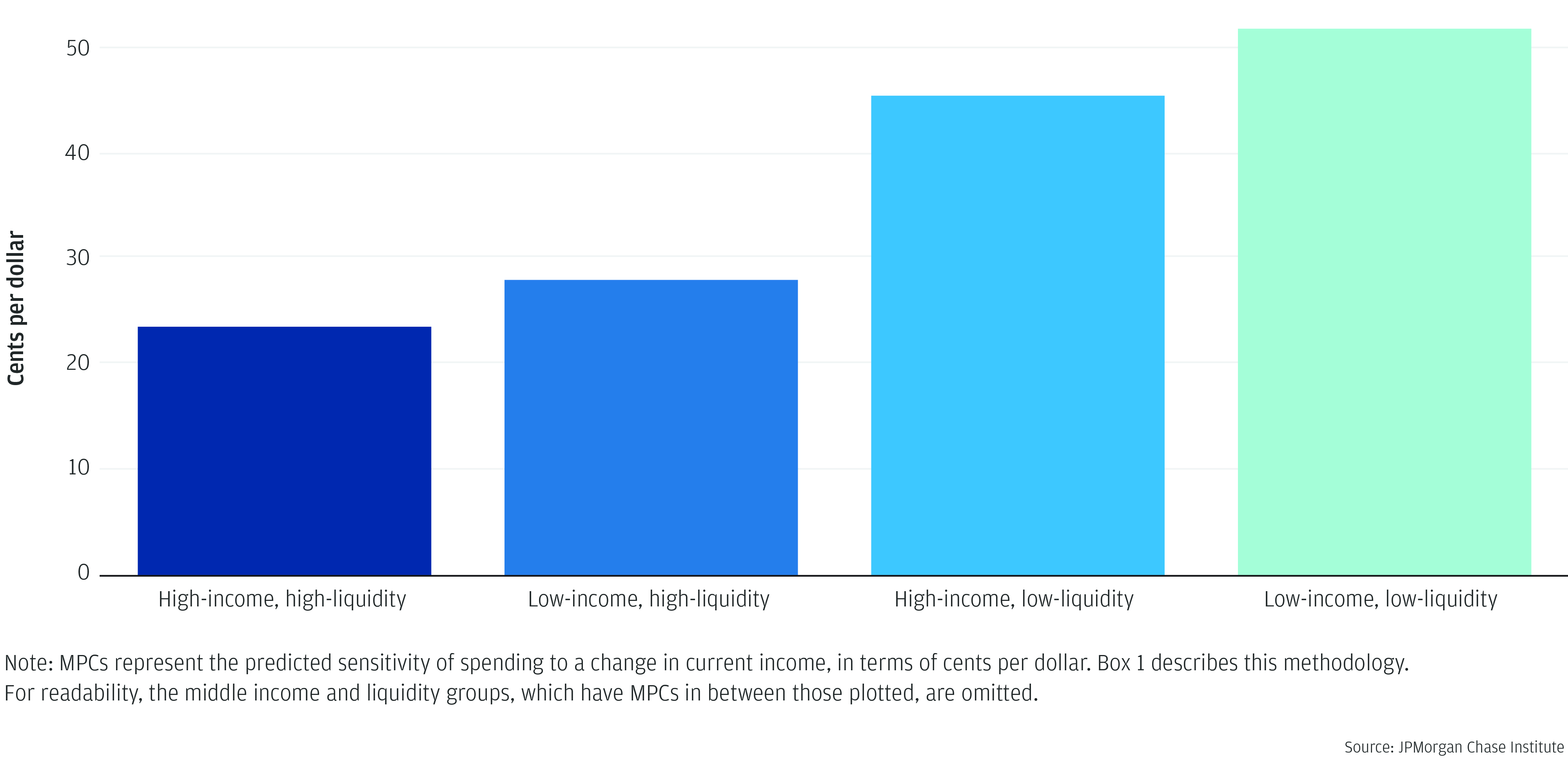

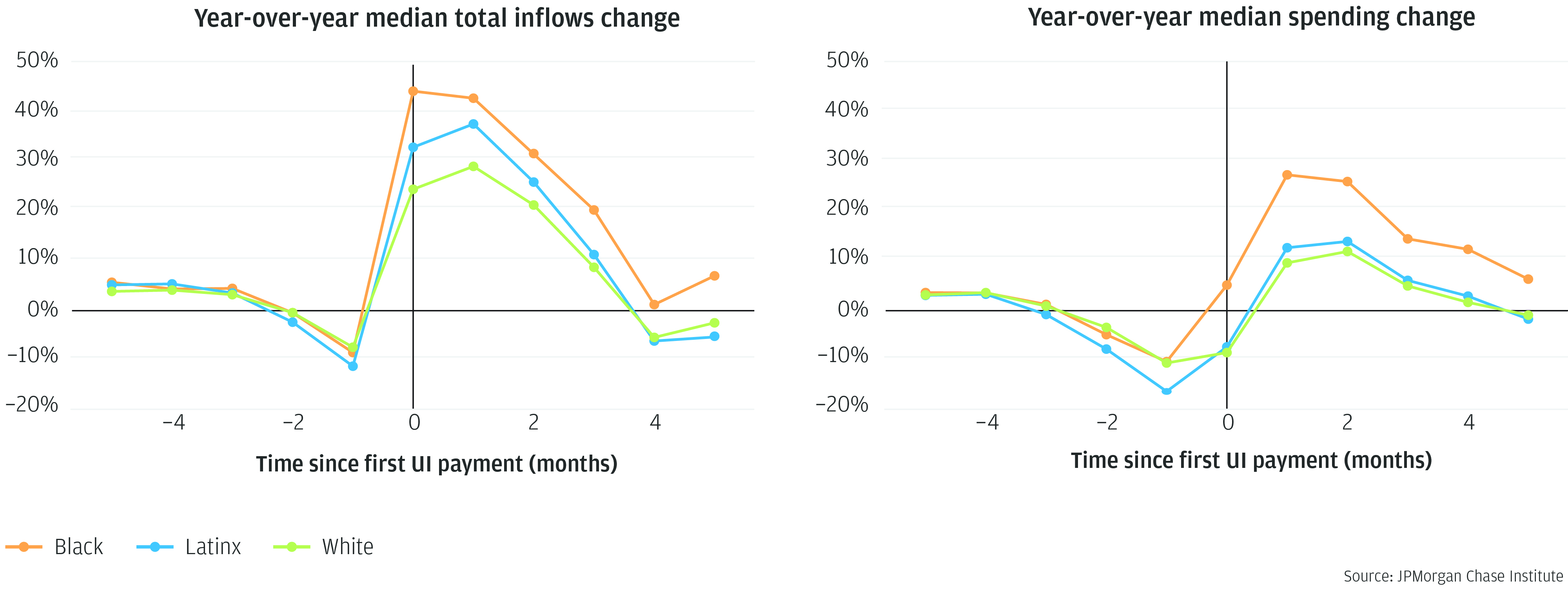

Our data show that household characteristics, such as liquidity and race, play a much larger role in explaining the consumption response to job loss than business cycle or local labor market conditions. Low-liquidity households are most prone to sharp spending declines after income drops, suggesting that targeting can be a useful way to support current consumption levels for financially vulnerable households. We also find that the tendency to spend out of unemployment insurance (UI) payments is fairly stable over disparate economic conditions. This implies that countercyclical payment levels could enhance the role of UI in supporting aggregate demand during recessions, because it channels government stimulus to the people most likely to spend.

The report is organized around four Findings, which are summarized below.