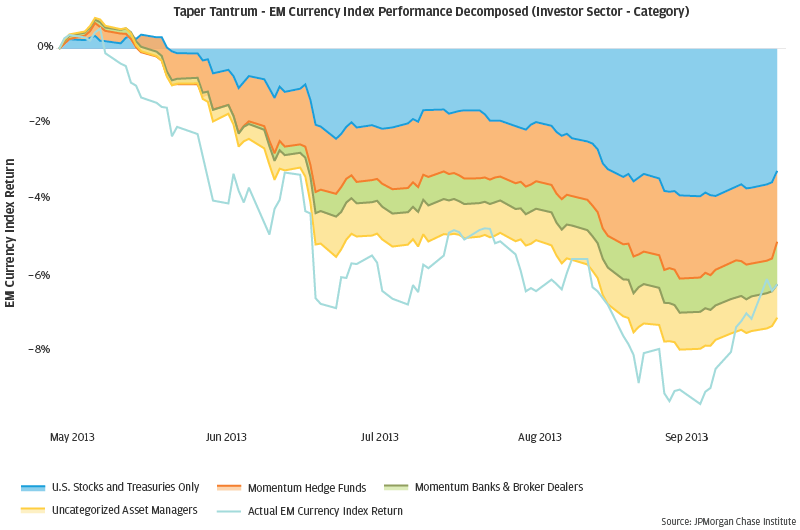

In this JPMorgan Chase Institute report on financial markets, we use the mid-2013 taper tantrum episode to elucidate interactions between market movements and institutional investor behavior around a major monetary policy shock, focusing on spillovers to emerging market (EM) currencies. We study the taper tantrum because it represents a key episode in the post-financial crisis use of large-scale asset purchases (LSAPs). Given the sustained low level of interest rates over the past decade, these measures have become an indispensable part of the modern central banking policy toolkit; however, policymakers’ imperfect knowledge of market participant expectations and potential responses to policy adjustment has meant that these programs have been challenging to unwind smoothly.

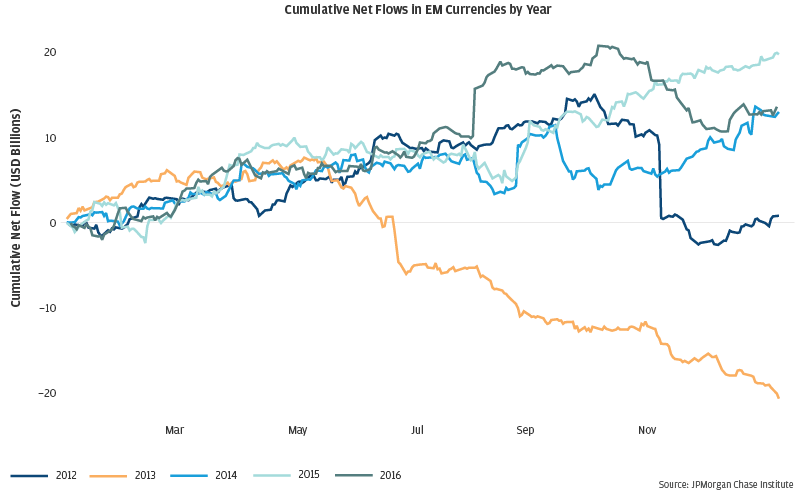

Using the unique data available to the Institute, we document how investor behavior changed starkly around the onset of the taper tantrum, as flows from market participants that on-net were buying EM currencies began to reverse. In addition, we leverage the granular nature of the data to help answer the following three questions in the taper tantrum context:

- Which market elements—news, liquidity, and net flows—best explain EM FX market performance?

- Do particular groups of market participants drive the overall link between flows and market changes? If so, which groups?

- Did herding activity play a role in price action and net flow changes?

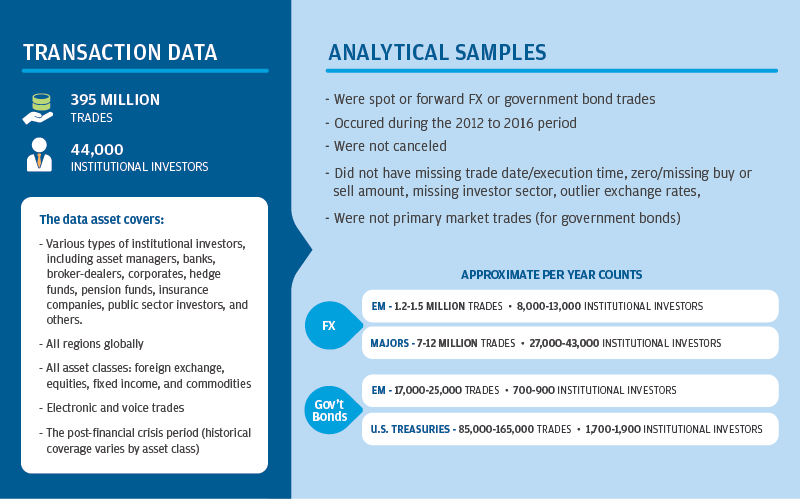

Answers to these questions, grounded in new data (summarized in the graphic below), provide insight into how the taper tantrum period unfolded in EM currency markets and offers more general lessons on the potential role of investor behavior in contributing to large market swings. Accordingly, we organize our research around three findings described in the following pages. The taper tantrum represents a key episode in the post-financial crisis use of large-scale asset purchases.