Today, JPMorganChase announced new philanthropic commitments to address housing affordability, small business growth, and workforce development in Chicago. Twenty-seven nonprofit and community-based organizations will receive a combined $10.9 million in philanthropic capital to bolster long-term, inclusive economic growth in the city. These commitments are part of the firm's broader $200 million commitment to address decades of disinvestment in Chicago’s South and West sides.

“We’re helping build the infrastructure to create a stronger, more inclusive economy,” said Alicia Wilson, Managing Director and Global Head of Philanthropy for the North America Region at JPMorganChase. “Through targeted investments that support the local workforce, bolster small businesses, and advance affordable housing development, we’re championing opportunity and making a sustainable impact for Chicagoans.”

Strengthening Local Workforce

In less than a decade, one-third of the United States workforce will need to learn new skills and find work in new occupations. To prepare for this, JPMorganChase is helping equip Chicagoans for the workforce of the future through 16 separate grants totaling more than $6 million. This includes over $2.7 million to support Chicago Women in Trades, HIRE360, Chicago Jobs Council, Rebuilding Exchange, The Chicago Community Foundation and Elevate Energy (Elevate) to develop and strengthen diverse talent pipelines for skilled trade jobs, including in the clean energy economy.

Additional funding will support local organizations in removing employment barriers and transforming how individuals are prepared to compete for and access well-paying jobs. Commitments include:

- One Million Degrees: $500,000. The funding will help accelerate community college students’ progress on career pathways to economic mobility by helping scale a public-private partnership with City Colleges of Chicago to close the racial opportunity gap.

- Revolution Workshop: $500,000. The funding will support job training in the construction industry.

- LiftUp Communities: $500,000. The funding will help LiftUp drive improved growth and profitability of LiftUp’s social enterprises and disseminate findings to advance the field of mission-driven social enterprises and workforce collaboratives.

- Current: $363,000. The funding will support the creation of an inclusive Collaborative that will map and bridge workforce opportunity gaps in water-related industries.

- Cara Collective: $260,000. The funding will help the organization to reach more people with training and quality employment, deepen participant experience, and increase impact.

- North Lawndale Employment Network (NLEN): $250,000. The funding will help NLEN’s Sweet Beginnings LLC address unemployment among residents with arrest or conviction records by offering reentry services, job training, and three-month transitional jobs in the honey and skincare industries.

- Revolution Institute: $250,000. The funding will help Revolution Institute acquire existing businesses in high growth sectors such as manufacturing and convert them into worker-owned entities, preserving quality jobs, enhancing business stability, and empowering employees to build their wealth through ownership and governance.

- Metropolitan Planning Council (MPC): $230,000. The funding will support The Lead Service Line Replacement (LSLR) and City of Chicago Cut the Tape initiatives, helping low and moderate income populations secure quality employment.

- United Way of Metro Chicago: $200,000. The funding will help support the launch of the third cohort of the Corporate Coalition Fair Chance Hiring initiative, a 9-month program for 8-10 companies looking to more effectively hire, retain and advance second chance talent.

- Metropolitan Family Services: $200,000. The funding will help grow quality career pathways for individuals with a history of criminal justice involvement by supporting orientation, needs assessments, coaching, and connection to wrap-around resources for individuals at the highest risk of gun violence involvement in Chicago's West and South sides.

In addition to supporting programs that connect workers to well-paying jobs – JPMorganChase is also committed to ensuring those jobs are helping employees build a strong foundation of financial health. That’s why JPMorganChase is supporting Commonwealth to launch “Benefits for the Future,” an initiative that helps employers and benefits providers pilot and scale workplace benefits to improve the financial health of workers earning low-to-moderate incomes. With a $7 million philanthropic commitment from JPMorganChase – $1 million of which will touch down in Chicago – Commonwealth actively seeks partnerships with forward-thinking employers to design, test, and scale innovative debt reduction, workplace savings, and wealth-building strategies.

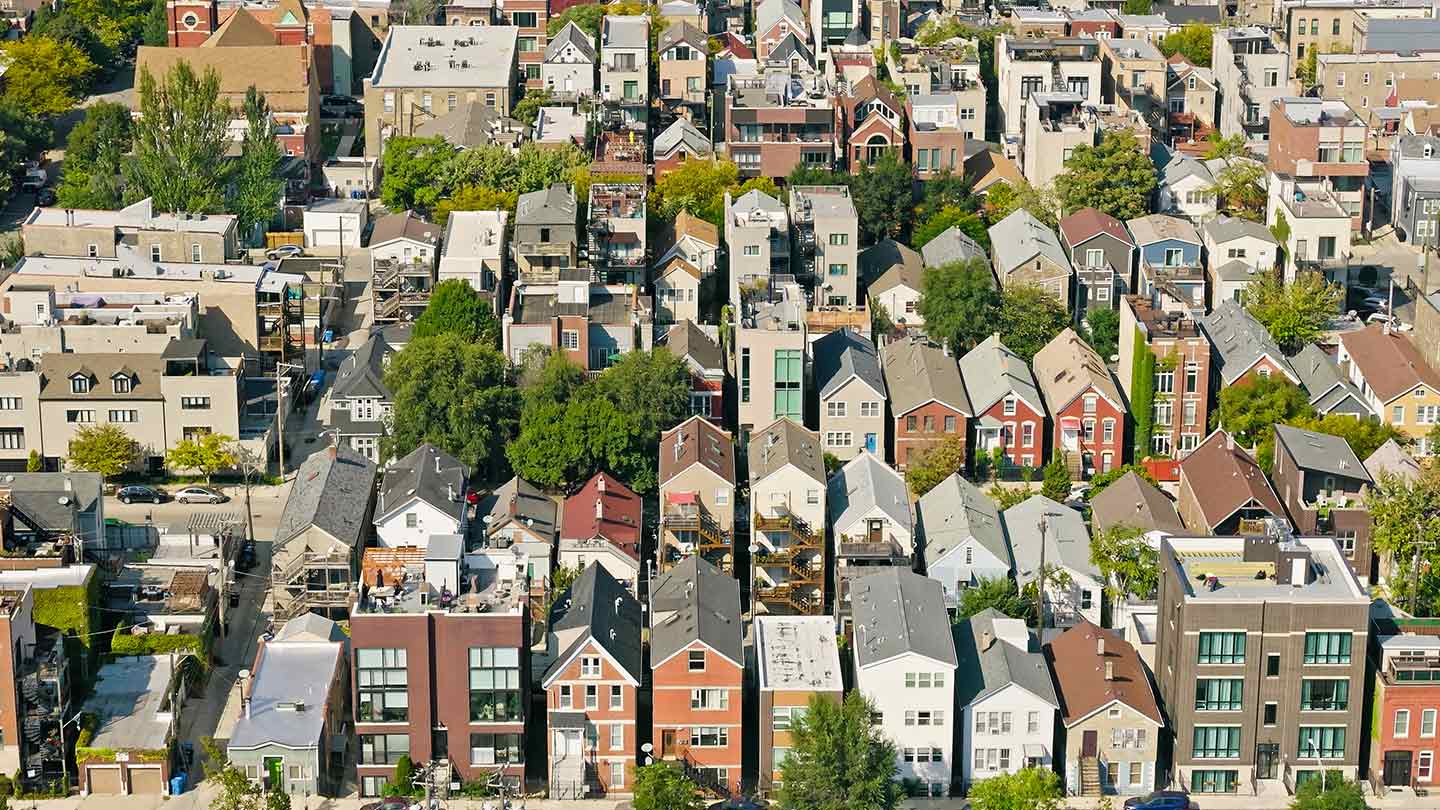

Expanding Access to Affordable Housing

In Chicago, nearly 40% of all households are cost-burdened, meaning they spend more than 30% of their income on mortgage, rent, or other housing needs. To help address this, JPMorganChase is committing more than $1.8 million in philanthropic capital to six organizations to ensure more residents have access to safe, stable, and affordable housing in Chicago.

A substantial amount, $775,000, will support IFF and The Resurrection Project (TRP). As part of the Reclaiming Chicago campaign, IFF, working with the Foundation for Homan Square, and TRP will focus on building affordable homes in several neighborhoods across Chicago. Additional commitments include:

- The Chicago Community Foundation (The Chicago Community Trust): $400,000. The funding will help increase access to capital and accelerate and scale housing construction, and expand investments in community development infrastructure to build the capacity of local developers on Chicago’s South and West sides.

- Chicago Community Loan Fund: $275,000. The funding will increase access to equity, venture, and patient capital, and to create and preserve rental and for-sale homes that are affordable for LMI households.

- Civic Consulting Alliance (CCA): $225,000. The funding will support CCA providing consultative support to develop and implement the City of Chicago’s Cut the Tape recommendations, improving the City’s complex property development processes and aid in supporting the implementation of the City of Chicago and Cook County’s workforce agenda.

- Chicago Area Fair Housing Alliance (CAFHA): $200,000. The funding will support CAFHA’s efforts to expand home ownership for Housing Choice Voucher holders and advance fair housing.

Driving Small Business Growth

Small businesses rarely scale to $1 million in annual revenues, especially those with Black, Hispanic, and/or female owners, according to data from the JPMorganChase Institute. Through a combined $2 million in new philanthropic capital, JPMorganChase is helping to empower local business owners to overcome barriers and achieve sustainable success. Commitments include:

- Allies for Community Business: $500,000. The funding supports providing flexible capital to underserved entrepreneurs on the South and West Sides of Chicago.

- Local Initiatives Support Corp (LISC): $500,000. The funding will enable LISC to increase access to capital and technical assistance for emerging real estate developers and small business owners.

- Enterprise Community Partners: $400,000. The funding provides flexible capital and technical assistance to underrepresented developers, including developers of color, thus broadening the scope of real estate development in Chicago.

- NYBDC Local Development Corporation (dba Pursuit Lending): $250,000. The funding will support Pursuit’s entry into the Chicago market and address market gaps in coverage for technical assistance and lending for underserved businesses.

- YWCA Metropolitan Chicago: $200,000. The funding will support the YWCA Metropolitan Chicago’s Breedlove Entrepreneurship Center which supports the growth and development of small businesses at all levels of operations from ideation up to revenues of $1,000,000.

- HIRE360: $150,000. The funding will help to increase opportunities for women and diverse-owned enterprises to participate in Illinois’s transition to a clean energy economy.

“We’re here to support the individuals, families, and businesses that make Chicago vibrant because our business is only as strong as the communities we serve,” said Curtis Reed, Chicago Region Manager for Middle Market Banking and Specialized Industries at JPMorganChase. “Through our investments in their strength and well-being, we’re building a stronger Chicago for generations to come.”

JPMorganChase in Chicago

For more than 160 years, JPMorganChase has brought the best of our business to help power Chicago’s economy and serve its communities. Across Greater Chicago, the firm currently serves more than 4.2 million consumers and 380,000 small businesses through more than 275 local Chase branches—including our Stony Island Community Center branch that is working to expand access to banking and boosting financial health among underserved communities.

Since 2017, the firm has committed to providing $200 million in philanthropic capital and low-cost loans to address decades of disinvestment in Chicago’s South and West sides. The firm has also provided more than $17 billion over the last five years to help finance Chicago’s essential institutions, including hospitals, schools, colleges, universities and other large corporations and employers.

About JPMorganChase

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorganChase had $4.2 trillion in assets and $346 billion in stockholders’ equity as of September 30, 2024. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.