The US government projects that American households will save on average $700 this year on gasoline, as the price of a gallon of gas has fallen by nearly $1.50 from its peak of $3.70 in April 2014 and is projected to remain low through 2015. But who feels the biggest increase in spending power? How much of that extra money do consumers spend, and what do they spend it on?

Until now, the answer to that question has come from surveys or estimates based on aggregate data and has indicated that less than half of the money saved at the pump was spent. However, this report by JPMorgan Chase Institute shows that individuals are spending roughly 80% of that extra money. With lower gas prices expected to last through the year, this extra disposable income is fueling consumer spending on categories other than gas.

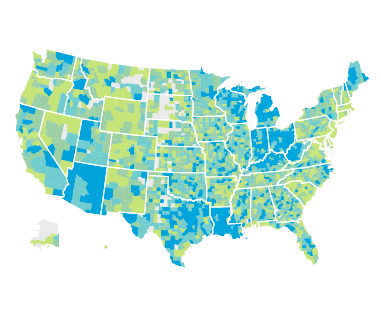

Our data, drawn from 57 million Chase regular debit and credit card customers illuminated the effects declining gas prices had across the US. These four findings cover gas spending and savings, geographic location, age and income level, and consumer spending.