Figure 1: A segmentation of the small business sector

Source: JPMorgan Chase Institute

The small business sector is frequently lauded for its contributions to the U.S. economy. A thriving small business sector is an indicator of a strong economy, given the outsized contributions to job creation that certain innovative and entrepreneurial small businesses make, though in an economic downturn like the current COVID-19 pandemic, the sector may sustain the greatest job losses. In 2016, firms with fewer than 500 employees made up more than 99 percent of all businesses in the U.S., and these firms were responsible for nearly half of all net new jobs.1 In particular, a minority of very fast growing firms have drawn the attention of researchers by creating the majority of new jobs (Birch and Medoff, 1994; Audretsch, 2012). These high-growth firms are identifiable from their early behavior (Guzman and Stern, 2016) and continue to distinguish themselves from other small businesses over time (Pugsley, 2018).

While job creation is an important outcome, it is not the only way that small businesses contribute to the real economy. Other than the jobs created for their owners, job creation fails to capture the economic contributions of the 25 million small businesses with no employees at all. All small businesses sell goods and services and procure the inputs needed to produce those goods and services. The revenues, expenses, and other cash flows associated with this economic activity provide an alternative lens on the sector and its broader contribution to economic vitality and growth. In addition, a high-frequency lens on revenue, expenses, and financial flows provides a new opportunity to understand how small businesses manage cash-flow challenges while attempting to survive and grow.

Over the past five years the JPMorgan Chase Institute has explored the financial lives of U.S. small businesses through the lens of de-identified transaction and account summary data from over 1 million small businesses with a Chase business deposit account.2 These data correspond to the universe of both employer and nonemployer businesses, and provide unprecedented views of high-frequency cash flows in the small business sector. Through answering questions about how small businesses contribute both to aggregate and broad-based U.S. economic growth, these analyses have generated three consistent and cross-cutting insights:

A first insight from financial transactions data is that all small businesses, employer or not, have the ability to deliver economic gains to broad and diverse segments of the U.S. economy. Revenue generation is the foundation for this growth and dynamism, allowing small businesses to cover expenses and provide a livelihood for owners and their families. Revenue growth is often an indicator of small business financial health, and given the sheer number of small businesses, even modest increases in revenue generation and growth could have a large effect on the economy and improve the financial well-being of tens of millions of small business owners.

The breadth of these contributions can be obscured by a homogenous view of the sector as comprised principally by employer businesses, or technology-intensive firms that grow through external finance. In fact, the full small business sector contains substantial heterogeneity. Several observers have proposed segmentations of the sector that identify the distinctive contributions of different small business segments to the economy (Birch and Medoff, 1994; Mills, 2015; Farrell and Wheat, 2017a). While these segments differ in their contributions to the economy, liquidity and the management of cash flows are core issues to businesses seeking to grow as well as those simply seeking to survive.

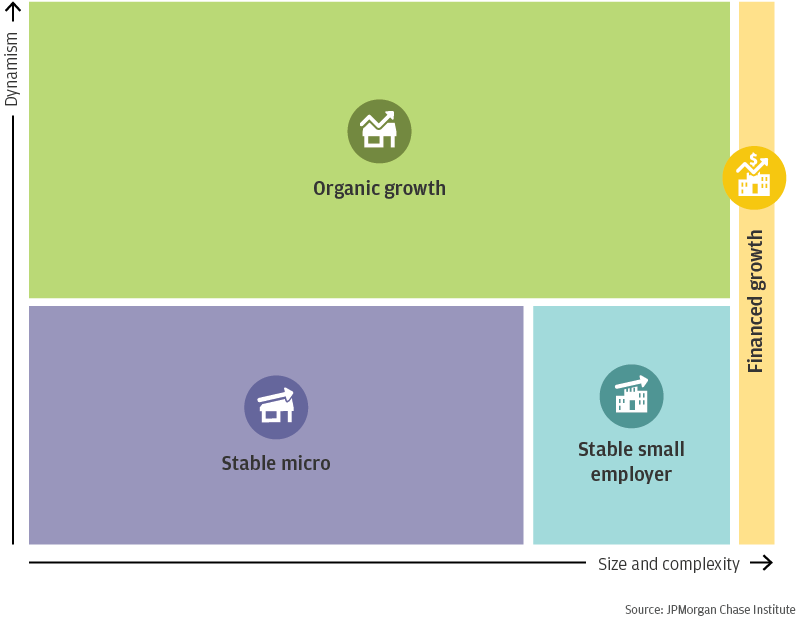

In order to place the revenue generation contributions of businesses in context, Figure 1 presents a segmentation of the small business sector framed in terms of the dimensions of growth, complexity, and dynamism (see Box 1 for details of segment definitions). Small stable employers and financing-intensive small businesses with the potential for dramatic growth make important contributions to the economy, but only comprise 4 and 3 percent of new firms in our data, respectively. The other 93 percent of new businesses in our sample do not fall in either of these categories, and are businesses less likely to be observed by using employment records and/or by seeking to identify high-growth businesses. Data on financial transactions show that, contrary to the often-held belief that firms that grow using external finance contribute the most to the economy, organic growth firms make substantial contributions in terms of their prevalence, revenue generation, and employment. The left panel of Figure 2 shows that over their first four years, organic growth firms were the most common type of firm with 54 percent of first-year firms falling within the segment. Organic growth firms also abound across industries and local economies. Even in San Francisco—a city well-known for financed high-tech firms—organic growth firms comprised 52 percent of new small firms (Farrell et al., 2018).

Figure 1: A segmentation of the small business sector

Source: JPMorgan Chase Institute

These firms engage in financial behaviors consistent with the intention to make early investments in assets that would serve as the basis for a scale-based competitive advantage (e.g., investments in technology, brand, learning curve, or customer networks). Specifically, we identify a firm as a member of the financed growth segment if it has at least $400,000 in financing cash inflows during its first year—a level consistent with financing amounts used by small businesses that take in investment capital.

Firms in this segment also have growth intentions, but they primarily attain that growth organically out of operating profits rather than through the use of external financing. In order to capture both firms that intend to grow and succeed and those that intend to grow but fail, we leverage post hoc observations of revenue growth and define this segment as those firms with less than $400,000 in financing cash inflows in their first year that either achieve average revenue growth of at least 20 percent per year from their first year to their fourth year, or those that see revenue declines of at least 20 percent per year. We also include firms that exit prior to four years that average above 20 percent revenue growth or 20 percent revenue declines per year prior to exit.

Firms in this segment are less dynamic: they are in neither the financed growth nor the organic growth segments and likely have a stable growth strategy and a business model premised on the employment of others. We define stable small employers as those firms that have electronic payroll outflows in six months or more of their first year. To capture larger small employers who do not use electronic payroll, we also include firms that have over $500,000 in expenses in their first year—approximately equivalent to payroll expenses for ten employees—in this segment.

Firms in this segment have either no or very few employees and do not exhibit behaviors consistent with growth intentions. We define the stable micro segment as containing those businesses that do not have electronic payroll outflows for six months of their first year and have less than $500,000 in expenses.

Figure 2: Organic growth firms contribute the majority of small business revenue four years after founding

Source: JPMorgan Chase Institute

Perhaps even more surprisingly, organic growth firms generate the majority of aggregate revenue, the overwhelming majority of aggregate revenue growth, and even the majority of payroll dollars over these first four years. The right panel of Figure 2 shows that organic growth firms generated 51 percent of aggregate revenue. They make even larger contributions to aggregate revenue growth. Organic growth firms were overwhelmingly the largest contributors to aggregate revenue growth in each of the twenty-five cities we analyzed (Farrell and Wheat, 2019). Moreover, while most organic growth firms were nonemployers, by their fourth year 55 percent of employer firms had grown organically, and these firms generated 52 percent of aggregate payroll dollars (Farrell et al., 2018).

The economic contributions of small businesses through revenue are especially important given the relative stability of employer status. The stability of employer status is important because, as other researchers have observed, the creation of a single job by a large fraction of microbusinesses could have a material impact on net job creation (e.g., JPMC and ICIC, 2016) and a number of recent policy proposals have drawn attention to the possibility of generating inclusive and broad-based economic growth through increased employment in the small business sector. Our data shows that it is decidedly more likely for nonemployer businesses to exit than to add employees to their payroll. In each of their first four years, only 2 percent of nonemployers added employees, while 33 percent exited by their fourth year. Additionally, for the first ten years, the exit rate for nonemployer businesses at each age was more than five times higher than the rate at which nonemployers become employer businesses (Farrell et al., 2018).3

After their first year of employment, small businesses actually lose more jobs than they create, principally through firm failure. For every 100 small business jobs, new small businesses created 5.6 new jobs, while existing small businesses lost 3.9 jobs—mostly due to losses from the exit of these small businesses. In many cases, employer small businesses also have to contend with volatile changes in payroll, which can have adverse effects. Most small employer businesses experience unstable payroll and employment volatility including job gains and losses and other spikes and dips in payroll (Farrell and Wheat, 2017b).

Our data uniquely documents the contributions of smaller small businesses for whom the cash-flow lens is more important than the employment lens, and highlights the importance of revenue generation and growth. Nonemployer small businesses make up the majority of the sector and while they are unlikely to transition to employer status, they are nevertheless important when viewed through other lenses of economic growth. Also, while high-growth success stories deserve to be celebrated, they are rare. Most small businesses do not achieve and may not even attempt to achieve this type of success, but they nevertheless produce large shares of small business revenue, especially in their first few years.

All small businesses, regardless of industry or segment, must manage their cash flows in order to survive and grow. Unless revenues and expenses are perfectly coordinated, small businesses need access to sufficient funds in order to purchase the inputs required to deliver those goods and services. Maintaining cash balances is one approach to address challenges related to the irregularity of cash flows such as these. This potential for mismatched revenues and expenses leads to three key questions:

To answer the first question, we first turned to measuring the regularity of small business cash flows from deposit transaction data (See Farrell et al., 2018 for details). Revenues and expenses may be irregular in their dollar amounts and/or their timing. For example, a firm offering a single product might always receive a fixed dollar amount for each sale, but could generate these sales at varying and perhaps unpredictable intervals. Alternatively, a firm providing a weekly service could generate sales on a regular weekly cadence, but with wide variation in dollar amounts. Through this lens, few small businesses have very regular cash-flow patterns, and some have less regular patterns than others (Farrell et al., 2018).

Employer small businesses, while making material contributions to the economy through job creation, may be especially exposed to irregular cash flows. Among small businesses with electronic payroll outflows, 61.8 percent had unstable payroll outflows over a year, driven either by sustained gains or losses in employment, or perhaps less predictably, spikes or dips in employment levels (Farrell and Wheat, 2017).

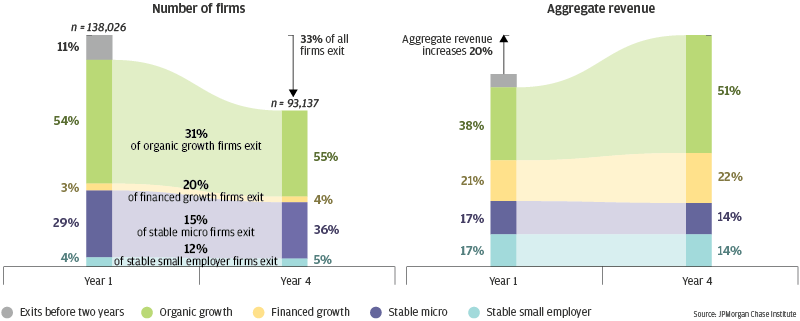

While many small businesses have irregular cash flows, even more have limited cash liquidity. In principle, a small business might be able to manage irregular cash flows by holding a “cash buffer” that allows it to operate without interruption in the event of a revenue disruption or major expense. We operationalize this idea by calculating the average number of cash buffer days held by small businesses by dividing the average daily cash balance by the average daily cash outflows (Farrell and Wheat, 2016). As shown in Figure 3, 50 percent of small businesses had fewer than fifteen cash buffer days (Farrell et al., 2019b), and only 40 percent had more than three weeks. Small business cash buffers vary substantially across local economies—the median small business in San Francisco, San Jose, and Seattle has eighteen cash buffer days, more than 60 percent higher than the eleven cash buffer days held in reserve by the median business in Atlanta and Orlando.

Figure 3: Many small businesses have limited cash liquidity

Source: JPMorgan Chase Institute

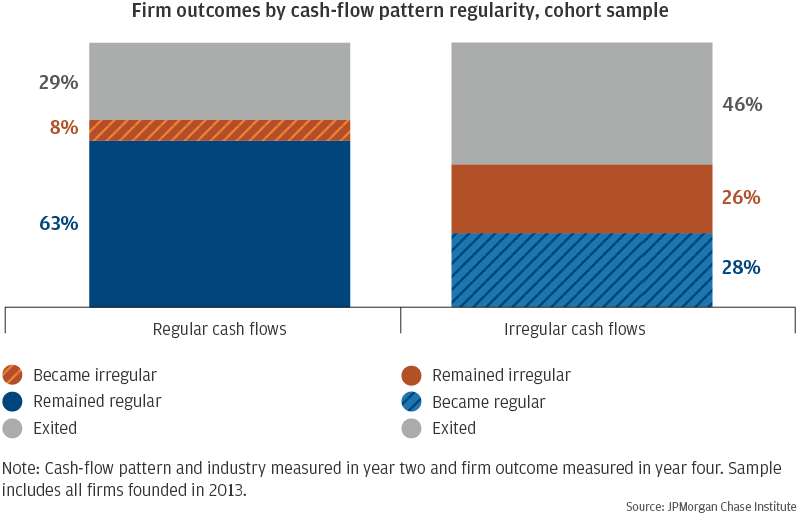

A combination of relatively thin cash buffers and irregular cash-flow patterns could pose a threat to the survival of small businesses. All else equal, small businesses with larger cash buffers are more likely to survive—in the first year, each additional cash buffer day reduces the likelihood of an exit in the next year (Farrell et al., 2019a). Moreover, over their first four years, small businesses either transition from less regular cash-flow patterns to more regular patterns, or exit the market. As depicted in Figure 4, firms with irregular cash flows were nearly twice as likely to exit as those with regular cash flows. Moreover, those that transitioned to more regular cash-flow patterns have faster revenue growth.

Figure 4: Firms with irregular cash flows are nearly twice as likely to exit as those with regular cash flows

Source: JPMorgan Chase Institute

While these observations suggest that small businesses would find it difficult to manage consistently irregular revenues and expenses, real-world evidence shows that they may be surprisingly resilient when faced with short-term disruptions. For instance, after Hurricane Harvey hit Houston, Texas on August 25, 2017, and Hurricane Irma hit Miami, Florida on September 10, 2017, the cash balances of typical small businesses declined by just under 8 percent. These declines were the combined result of drops in revenue by 63 percent and 82 percent in Houston and Miami, respectively, partially offset by corresponding drops of 54 percent and 62 percent in expenses. These disruptions were short-lived: twelve days after they reached their lowest point, cash inflows again showed increases compared to the previous year in that same period. By four weeks after landfall, few businesses appeared to suffer continued cash-flow impacts directly related to the storms (Farrell and Wheat, 2018).

While our data do not directly speak to whether expenses decreased due to overt actions on the part of business owners or due to circumstance (e.g., hourly workers not being paid while the business could not open), the reduced expenses protected the business until revenues returned to their prior levels. Further research is needed to better understand whether small businesses are equally resilient in the face of longer-term irregularities in cash flows.

In recent years, there has been increasing evidence about the wide and growing variation of economic performance across communities in the United States, as well as differences in small business financial outcomes by owner gender, race, age, and other demographic characteristics. This variation is reflected in the resilience and consistent economic contributions of some cities, communities, and businesses, and the vulnerability and more modest economic contributions of others. These differences can limit the otherwise strong potential of the sector to contribute to broad-based growth in a strong economy, and disproportionally impact some businesses, owners, and communities in an economic downturn.

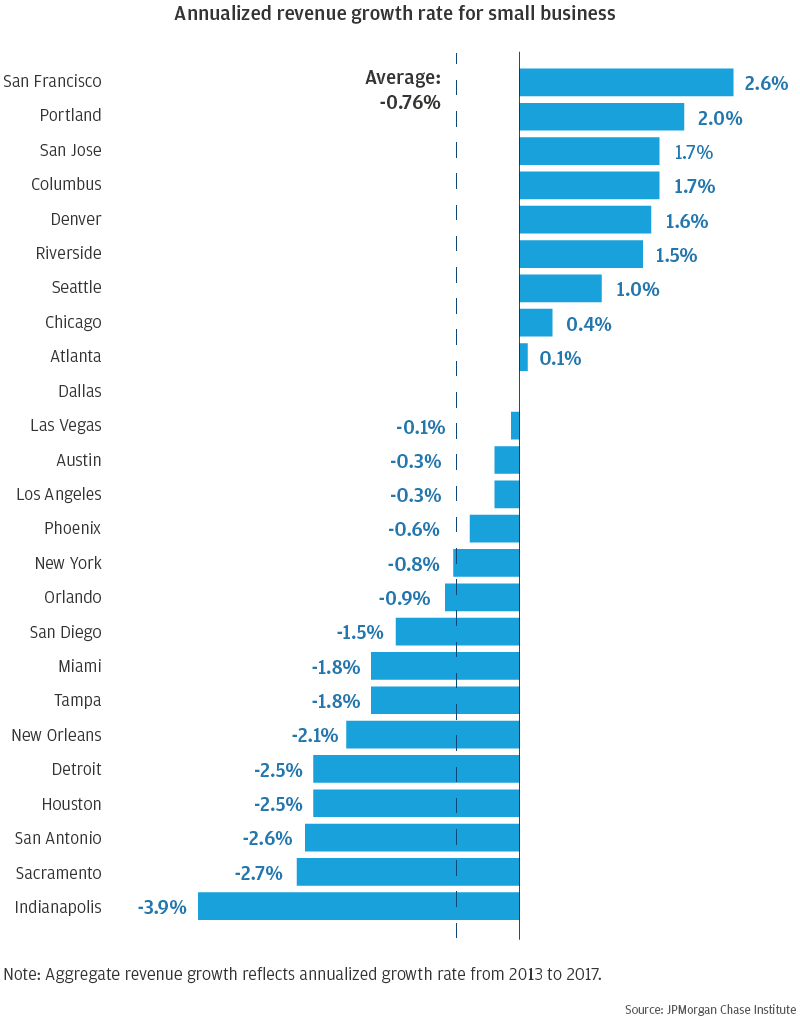

First, the economic contributions of the small business sector vary widely by city and region. Figure 5 shows that aggregate revenue growth varies especially sharply across cities. The aggregate revenue of small businesses operating in cities like San Francisco and Portland grew 2 percent or more annually over a period of four years, while the small business sector in places like Houston and Sacramento experienced aggregate revenue declines of 2.5 percent or more per year over this same period (Farrell and Wheat, 2019). There are also differences across cities in which industries contribute the most to growth. The construction industry is the largest overall contributor to aggregate revenue growth, and is the largest contributor in eleven of the twenty-five cities we analyzed. Also, contrary to a common belief that technology-intensive firms are the primary drivers of growth, among small businesses, high-tech services firms were the largest contributors to growth in only San Antonio, Seattle, and Tampa.

Figure 5: Aggregate small business revenue growth varies widely across cities

Source: JPMorgan Chase Institute

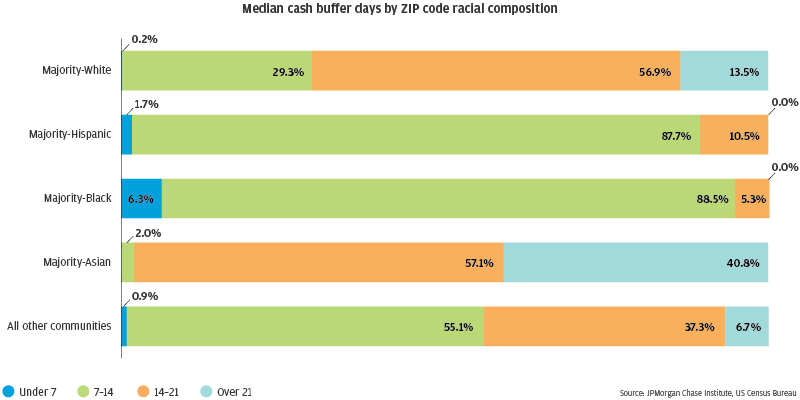

While differences in the ability of small businesses to thrive and contribute varies across cities and regions, small business financial outcomes vary even more between neighborhoods within a city. An important factor that enables the resilience of small businesses in the face of uncertainty is cash liquidity. Accordingly, the wide variation we observe in small business cash liquidity across communities is especially concerning (Farrell et al., 2019b). Small businesses in majority-Black or majority-Hispanic communities have significantly lower cash liquidity than businesses in majority-White communities. As shown in Figure 6, in 89 percent of majority-Hispanic communities and 95 percent of majority-Black communities, most small businesses operated with a cash buffer of two weeks or less, as compared to about 30 percent of majority-White communities and only 2.3 percent of majority-Asian communities. Small businesses in communities with low home values or few college graduates also have less cash liquidity.

Figure 6: Small businesses with large cash buffers are rare in majority-Black and majority-Hispanic communities

Source: JPMorgan Chase Institute

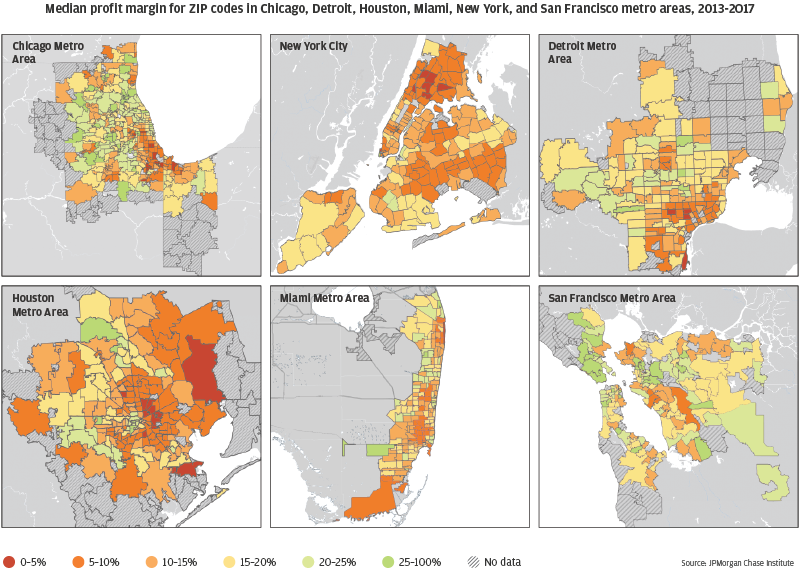

Moreover, small businesses in majority-Black and majority-Hispanic communities and communities with lower home values and few college graduates also generate lower profits. Figure 7 presents the median profit margin for communities in the Chicago, Detroit, Houston, Miami, New York, and San Francisco metro areas (Farrell et al., 2019b). In each metro area, there are large contiguous areas in which most small businesses had low profit margins. In contrast, there are large areas where most small businesses were quite profitable.

Figure 7: Profitability varies substantially within metropolitan areas

Source: JPMorgan Chase Institute

In addition to the place in which a small business is located, the age and gender of the business owner can have an important impact on its financial well-being, its ability to contribute to broad-based growth, and its exposure to economic downturns. The demographic characteristics of owners of the smallest businesses are generally more similar to the overall demographics of the U.S. than those of larger businesses. Accordingly, the smallest small businesses—particularly nonemployer and very small employer businesses—may be best positioned to deliver broad-based economic growth, or most vulnerable to negative economic shocks. Moreover, the financial lives of these small businesses are deeply intertwined with the financial lives of their owners. As a result, understanding variation in financial outcomes by owner demographics can inform the extent to which the sector as a whole is delivering broad-based economic growth to the substantial share of U.S. families that own small businesses, or how impacts to the small business sector distribute across the economy.

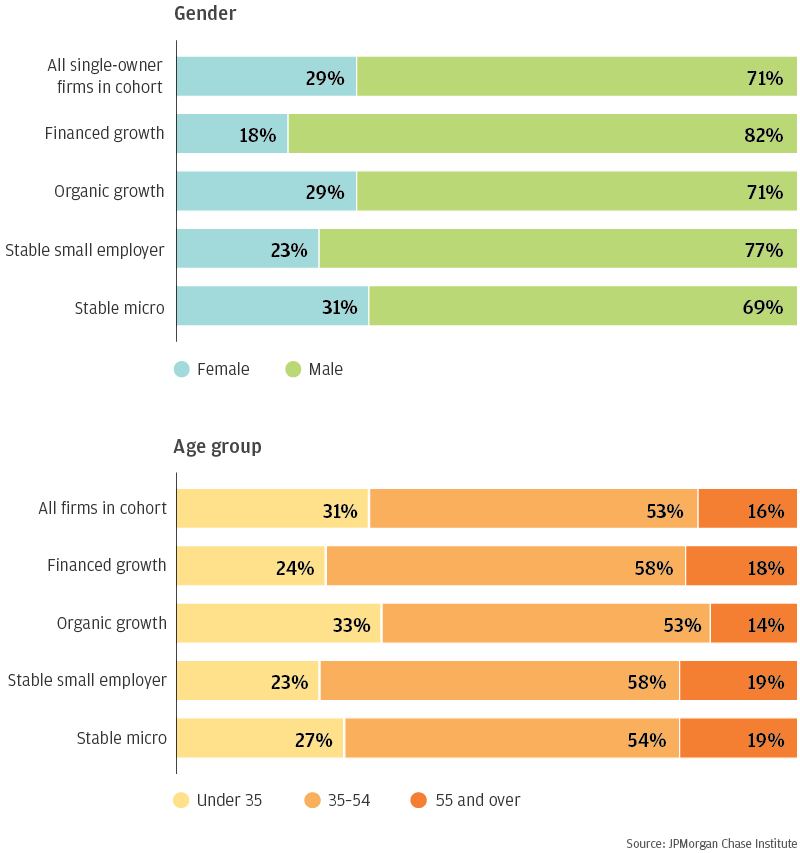

A first observation concerns the distribution of small business segments by gender and age. In general, financed growth firms are concentrated in a relatively small number of industries and geographic locations, while organic growth firms are much more evenly distributed (Farrell et al., 2018). We find a similar pattern in the distribution of these segments by gender and age, as shown in Figure 8. Women-owned small businesses and small businesses with younger owners are underrepresented among financed growth firms, but have shares of organic growth businesses that are quite close to their overall share of business ownership in our data.

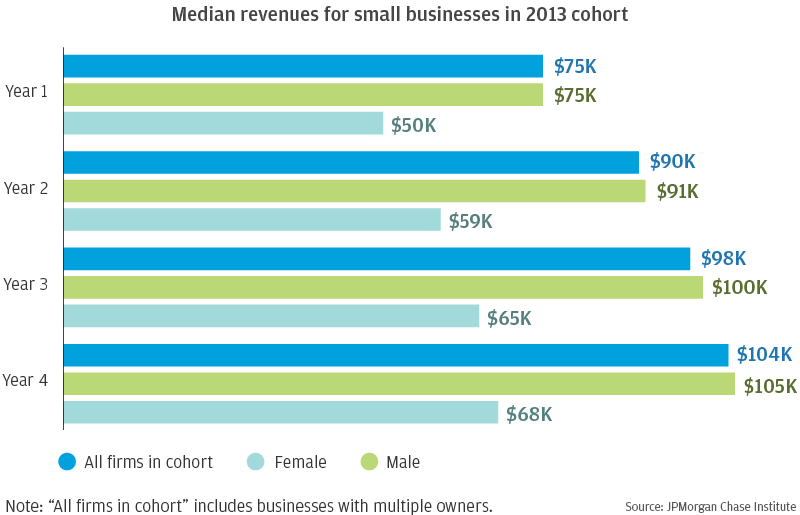

However, despite their representative presence among organic growth firms, a business founded by a woman starts smaller than a corresponding business founded by a man, and grows more slowly. Figure 9 shows that median first-year revenues among firms owned by women are $50,000, compared to $75,000 for ones owned by men, a 34 percent difference. Among new and young businesses, revenue growth is slightly but significantly lower for firms founded by women, compared to those founded by men (Farrell et al., 2019a). Starting with lower revenues and growing more slowly results in smaller businesses—by year four, the typical business owned by a woman has revenues of $68,000 compared to $104,000 for one owned by a man.

While the small business sector has the potential to drive both aggregate and broad-based economic growth, its heterogeneity can present challenges. Differences in owner age and gender, employer status, and other factors could all affect firm growth trajectories and influence which policy levers to pull for maximum impact. Additionally, city- and community-level differences in the financial health of the small business sector have implications for the national economy as well.

Figure 8: Women and younger small business owners are well-represented among organic growth firms, but underrepresented among financed growth firms

Source: JPMorgan Chase Institute

Figure 9: Businesses founded by women have lower revenues in each of their first four years

Source: JPMorgan Chase Institute

A lens on small business cash flows provides a new perspective on the small business sector that more broadly captures its impact on both aggregate and broad-based growth in the U.S. economy. By capturing a wide range of small businesses, our data show the economic contributions of both employer and nonemployer businesses, and shed light on new segments and financial phenomena that might otherwise be difficult to observe. These data paint a picture of a sector that contains an impactful segment of businesses that grow organically, in which businesses manage irregular cash flows with limited cash liquidity, and show promising outcomes in terms of broad-based growth while persistent challenges remain.

Accordingly, policymakers seeking to drive overall economic growth in the sector should consider this level of heterogeneity. Specifically, programs and policies might target the specific financing needs of firms that grow organically in addition to those that grow with external finance. Firms that grow organically generate the majority of revenue, payroll dollars, and an overwhelming majority of aggregate revenue growth during their first few years. These small businesses may have different financing needs as compared to those who leverage substantial amounts of external finance in their first year, including, but not limited to, short-term working capital. These financial solutions may be especially relevant given the prevalence of irregular cash-flow patterns across the sector. Policymakers might use these irregular cash-flow patterns to structure policies and programs that might assist small businesses with cash-flow management, and tailor these policies and programs to the specific challenges faced by different kinds of small businesses.

Policies that boost cash liquidity and support small businesses in developing and maintaining a cash buffer may allow firms to better weather financial shocks. In the face of COVID-19, for example, revenue losses could cause more small businesses to shut down, particularly those with more limited cash liquidity. Policymakers can consider increasing liquidity for small business owners through grants and loans during economic downturns and periods of uncertain demand. Additional targeting of these programs to majority-Black and majority-Hispanic communities, communities with lower amounts of human and financial capital, and businesses with irregular cash flows could help to bolster the most affected.

Policymakers seeking to drive broad-based growth might also attend to important differences in small business outcomes by business owner gender and age. In many cases, the financial fates of small businesses and their owners are tightly coupled. In this sense, differences in small business outcomes that track owner demographic characteristics can generate differences in household financial well-being along similar lines. While growth opportunities afforded by organic growth businesses may be evenly distributed by age and gender, businesses founded by women start with lower revenues and experience slower revenue growth. Moreover, most revenue gains are concentrated in a small minority of firms. These differences in outcomes suggest that policies that target small businesses on the basis of the age and gender of their owners may help ensure that growth in the sector impacts the widest range of businesses, owners, and households.

The wide variation in profitability and liquidity of small businesses across cities and communities also highlights the potential for place-based policies that recognize the characteristics of communities and the relationship between a community and the city in which it is located. Broad-based economic growth may benefit from place-based small business economic development programs, since the ability of the sector to deliver a potential pathway to economic growth for entrepreneurs from all walks of life in a broad-based way appears inconsistent with the substantial differences we find between communities in small business financial health.

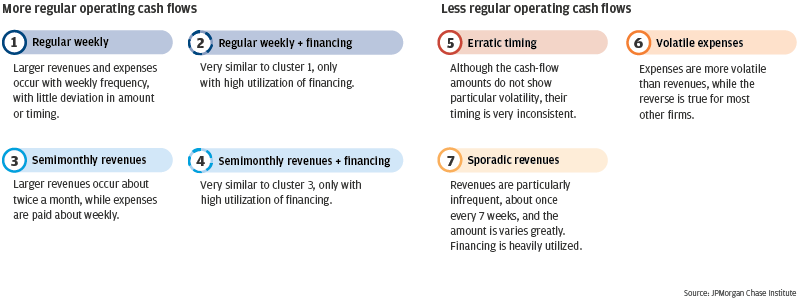

A key advantage of high-frequency cash flow transactional data is that it provides a granular view of the specific patterning of small business cash flows. We use these data to empirically characterize the kinds of cash-flow management challenges small businesses face by developing four quantitative measures: three that measure the irregularity of cash flows with respect to amounts and timing—volatility, frequency, and consistency—and one that measures the extent of financing use. Volatility describes the extent to which cash flows vary significantly in their daily total dollar amounts, frequency describes the typical schedule of sizeable cash flows, and consistency describes how often the timing of large cash flows varies from its central tendency. Financial utilization measures the extent to which cash inflows are mostly financial inflows rather than revenues.

For each firm in our sample, we determined the volatility, frequency, and consistency of both revenues and expenses, and also the extent of external finance usage. Based on these measurements, we identified seven distinct clusters that captured the typical patterns of cash-flow irregularities we observed in our data. Figure 10 provides a textual description of each of these clusters—four of which reflect relatively greater regularity, and three of which are much less regular. Farrell et al. (2018) covers the specifics of our irregularity measures and clusters in more detail.

Figure 10: Firm cash-flow patterns can be classified into seven clusters, representing different cash-flow management problems firms face

Source: JPMorgan Chase Institute

Audretsch, David B. 2012. “Determinants of High-growth Entrepreneurship.” OECD/DBA report. https://www.oecd.org/cfe/leed/Audretsch_determinants%20of%20high-growth%20firms.pdf

Birch, David L. and James Medoff. 1994. “Gazelles.” In Labor Markets, Employment Policy and Job Creation, edited by Lewis C. Solomon and Alec R. Levenson, 159-168. Boulder: Westview Press.

Farrell, Diana and Christopher Wheat. 2016. “Cash is King: Flows, Balances, and Buffer Days.” JPMorgan Chase Institute. https://www.jpmorganchase.com/corporate/institute/report-cash-flows-balances-and-buffer-days.htm

Farrell, Diana and Christopher Wheat. 2017a. “Mapping Segments in the Small Business Sector.” JPMorgan Chase Institute. https://institute.jpmorganchase.com/institute/research/small-business/insight-mapping-smb-segments

Farrell, Diana and Christopher Wheat. 2017b. “The Ups and Downs of Small Business Employment: Big Data on Payroll Growth and Volatility.” JPMorgan Chase Institute. https://www.jpmorganchase.com/corporate/institute/report-small-business-payroll.htm

Farrell, Diana and Christopher Wheat. 2018. “Bend, Don’t Break: Small Business Financial Resilience After Hurricanes Harvey and Irma.” JPMorgan Chase Institute. https://www.jpmorganchase.com/corporate/institute/report-bend-dont-break.htm

Farrell, Diana and Christopher Wheat. 2019. “The Small Business Sector in Urban America: Growth and Vitality in 25 Cities.” JPMorgan Chase Institute. https://institute.jpmorganchase.com/institute/research/small-business/report-small-business-outcomes-cities

Farrell, Diana, Christopher Wheat, and Chi Mac. 2017. “Paying a Premium: Dynamics of the Small Business Owner Health Insurance Market.” JPMorgan Chase Institute. https://institute.jpmorganchase.com/institute/research/small-business/report-small-business-health-insurance

Farrell, Diana, Christopher Wheat, and Chi Mac. 2018. “Growth, Vitality, and Cash Flows: High-Frequency Evidence from 1 Million Small Businesses.” JPMorgan Chase Institute. https://www.jpmorganchase.com/corporate/institute/report-growth-vitality-cash-flows.htm

Farrell, Diana, Christopher Wheat, and Chi Mac. 2019a. “Gender, Age, and Small Business Financial Outcomes.” JPMorgan Chase Institute. https://www.jpmorganchase.com/corporate/institute/report-small-business-financial-outcomes.htm

Farrell, Diana, Christopher Wheat, and Carlos Grandet. 2019b. “Place Matters: Small Business Financial Health in Urban Communities” JPMorgan Chase Institute.

Guzman, Jorge and Scott Stern. 2016. “The State of American Entrepreneurship: New Estimates of the Quantity and Quality of Entrepreneurship for 15 US States, 1988-2014.” NBER Working Paper No. 22095. https://doi.org/10.3386/w22095

JPMorgan Chase and Initiative for a Competitive Inner City. 2016. “The Big Impact of Small Businesses on Urban Job Creation: Evidence from Five Cities”. http://icic.org/wp-content/uploads/2016/10/JPMC_R1_BigImpact_FINAL_forpost.pdf

Pugsley, Bejamin W., Petr Sedlacek, and Vincent Sterk. 2018. “The Nature of Firm Growth.” CEPR Discussion Paper No. DP12670. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3118318

Rossiter, Louis. 2009. “Rising Costs for Healthcare: Implications for Public Policy”.

According to the Census Bureau Business Dynamics Statistics data, firms with fewer than 500 employees created 1.4 million net jobs in 2016, out of a total of 2.9 million net jobs created that year.

The research findings shared in this synthesis were previously published by JPMorgan Chase Institute.

In our sample, a firm exits the market when it closes its small business bank account.

Authors

Diana Farrell

Founding and Former President & CEO

Chris Wheat

President, JPMorganChase Institute

Chi Mac

Business Research Director