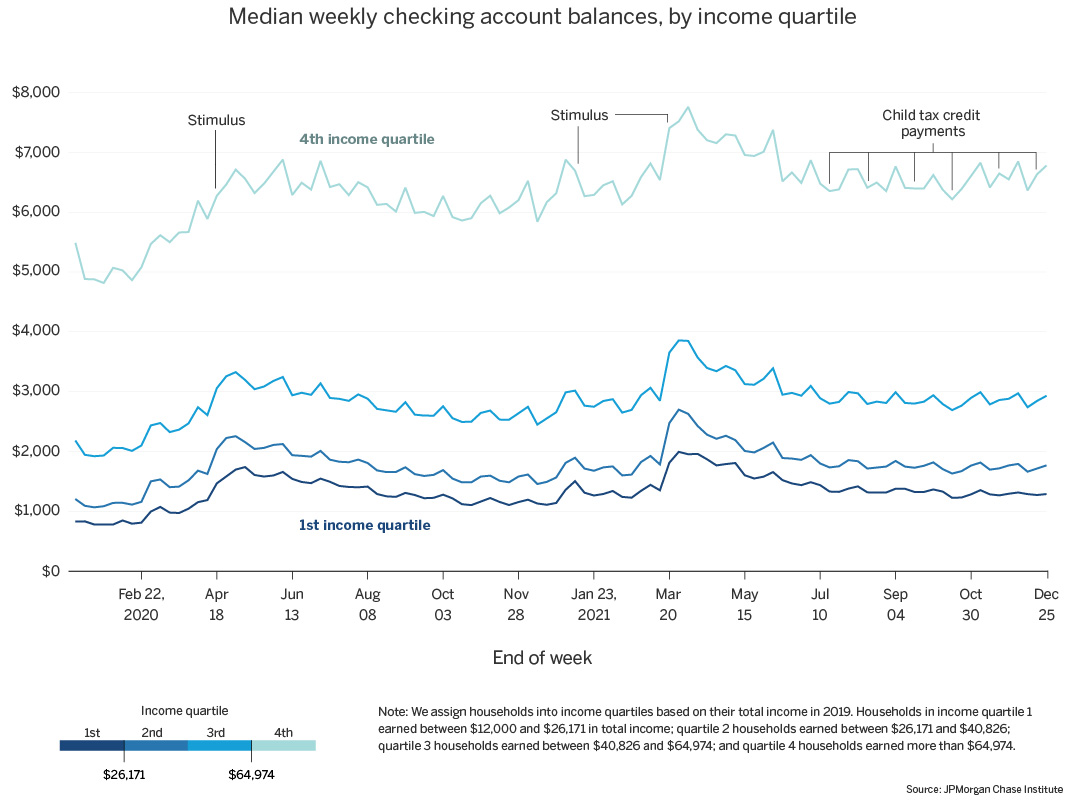

Figure 1: Median checking account balances remained boosted at the end of 2021, with lower-income families having a little under $1,300 in their checking accounts.

Findings

The COVID-19 pandemic resulted in an unprecedented recession that impacted families’ financial positions. Based on recent JPMorgan Chase Institute research, our Household Finances Pulse leverages de-identified administrative banking data to analyze changes in cash balances during the COVID-19 pandemic and ongoing recovery.

This release examines the path of household cash balances through the end of December 2021, giving us a look at liquid asset trends during the six months of advanced Child Tax Credit (CTC) payments. Relative to prior releases, we have significantly expanded our sample to roughly 7.5 million families across the US (see box). We compare cash balance trends across the income distribution and between families who did and did not receive advanced CTC payments.

During the pandemic, the federal government provided cash assistance and relief to families through a range of fiscal interventions, including three rounds of stimulus payments, expanded unemployment insurance, mortgage and student loan debt forbearance, and advanced CTC. The first round of stimulus, or economic impact payments (EIP), started April 15, 2020, and delivered up to $1,200 per adult and $500 per qualifying child under the age of 17. Stimulus payments provided progressively more per child in each round, reaching up to $600 per child with the second stimulus, and up to $1,400 per child with the third.

Throughout this time, expanded unemployment insurance delivered payments to jobless workers, including gig workers and self-employed workers, with a weekly supplement of $600 between March and July 2020 and $300 during October 2020 and between January and September 2021. Twenty-six states had ended expanded UI benefits by the end of July 2021, with the remaining states ending benefits on September 5, 2021.1 At this time, roughly two-thirds of benefit recipients lost benefits entirely, while one-third lost just the weekly $300 supplement.

The American Rescue Plan increased the dollar amount of CTC payments and expanded eligibility for families in the 2021 fiscal year.2 On July 15, 2021, the first monthly advanced CTC payments were delivered, paying up to $300 per child under the age of 6 years of age and up to $250 per child aged 6 to 17 years. Monthly advanced CTC payments expired at the end of 2021. The remainder of the CTC will arrive when families file tax returns for the 2021 fiscal year.

Open questions remain as to the role of liquidity in explaining ongoing labor market and spending trends. For example, some have speculated whether liquid balance boosts could be a contributing factor to why people are not going back to work more quickly. In addition, the expiration of monthly advanced CTC payments as well as potential delays in tax refunds could influence cash balance trends in early 2022.

Our expanded sample

Our updated Household Finances Pulse data asset covers 7.5 million families who were active checking account users between January 2019 and December 2021 and had at least $12,000 in total income deposited to their Chase checking accounts every year in 2019, 2020 and 2021. This sample is more than four times larger than our most recent pulse sample of 1.6 million families, which used more restrictive measurements of family income and account activity for sample inclusion eligibility. Our expanded sample shows very similar trends to our prior sample but has slightly lower total incomes and slightly higher balance levels.

We categorize families into income quartiles based on their total income in 2019, which captures all non-transfer checking account inflows. We classify families as CTC-targeted or not, based on receiving three payments of advanced CTC during the first three months of CTC disbursement, July, August, and September 2021. Families that received CTC payments in only one or two of these months are excluded from our analysis. Families that opt out of advanced payments are in the non-targeted group, as are families with dependent children and income over the policy threshold of $440K for joint filers and $240K for individual filers. So families in the non-targeted group are not necessarily all child-free.

To put our measures of family checking account balances into perspective with other household finance metrics, there are three important considerations to keep in mind. First, our balance growth numbers are based on nominal dollars, not adjusted for inflation. This is especially noteworthy given the high rate of inflation in the economy – inflation rose by 6.8 percent in November, the fastest pace in three decades.3

Second, the charts below do not account for the secular upwards trend of liquid balances prior to the pandemic. JPMorgan Chase Institute research shows that during normal times, checking account balances grew by roughly 11 percent per year among balanced samples of households comparable to the one used here.4 In this sample, cash balances in the first two months of 2020 had grown by roughly 7 percent on a year-over-year basis. Thus, 2021 cash balances could have been up by 14-23 percent compared to 2019 levels due to these trends, independent of the pandemic and corresponding government interventions.

Finally, there is significant heterogeneity in asset allocations for different groups of households. For instance, the 2019 Survey of Consumer Finances shows that lower-income families hold a larger share of their financial wealth in checking accounts. Accordingly, they may have maintained a larger proportion of their balance increases from government intervention in their checking accounts, compared to higher-income families. Thus, other cash balance metrics may differ from ours in amount or trend, based on these or other differences in measurement.

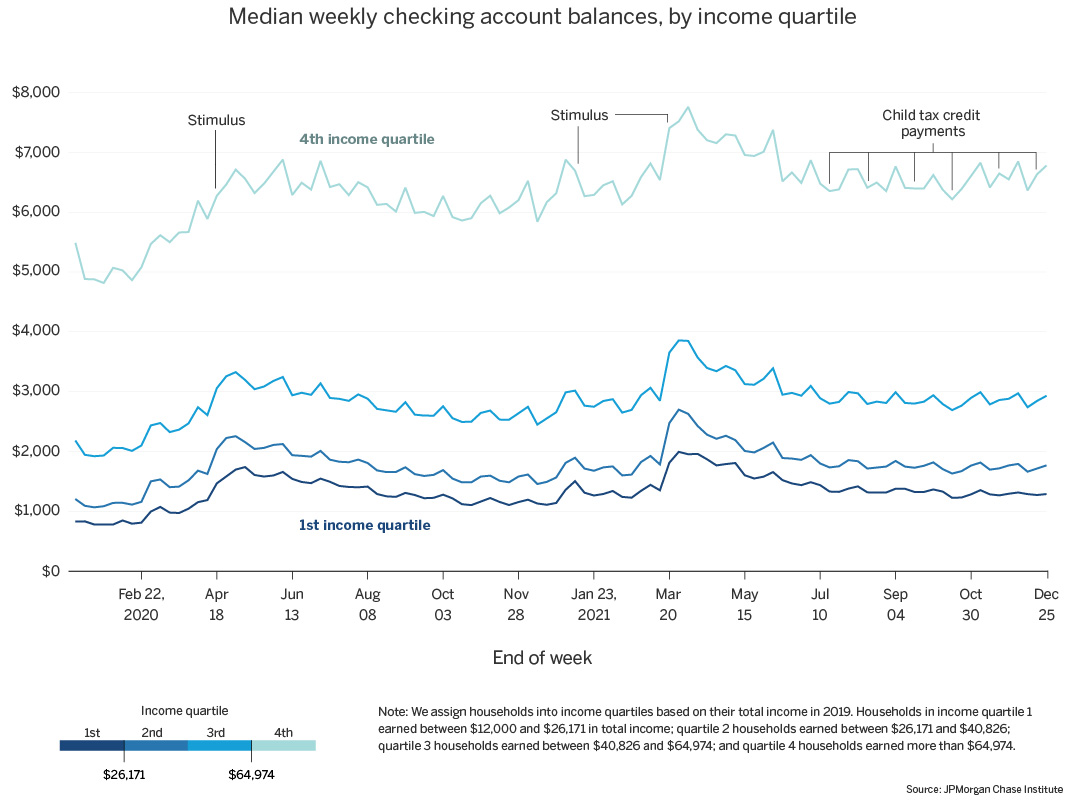

Low-income families saw rapidly depleting balance gains following the last round of stimulus. While balances in March 2021 were roughly 120 percent higher than two years before, balances at the end of 2021 were about 65 percent higher than 2019 levels, or just under $1,300. Although higher-income families also saw depletions in checking account balances since the last stimulus, trends relative to 2019 stayed stable, remaining roughly 30-35 percent elevated through the end of 2021. Thus, even among higher income families, cash balances remain elevated over and above secular pre-pandemic trends of roughly 7-11 percent per year.

Figure 1: Median checking account balances remained boosted at the end of 2021, with lower-income families having a little under $1,300 in their checking accounts.

Figure 2: At the end of 2021, median cash balances among low-income families were still 65 percent higher than 2019 levels.

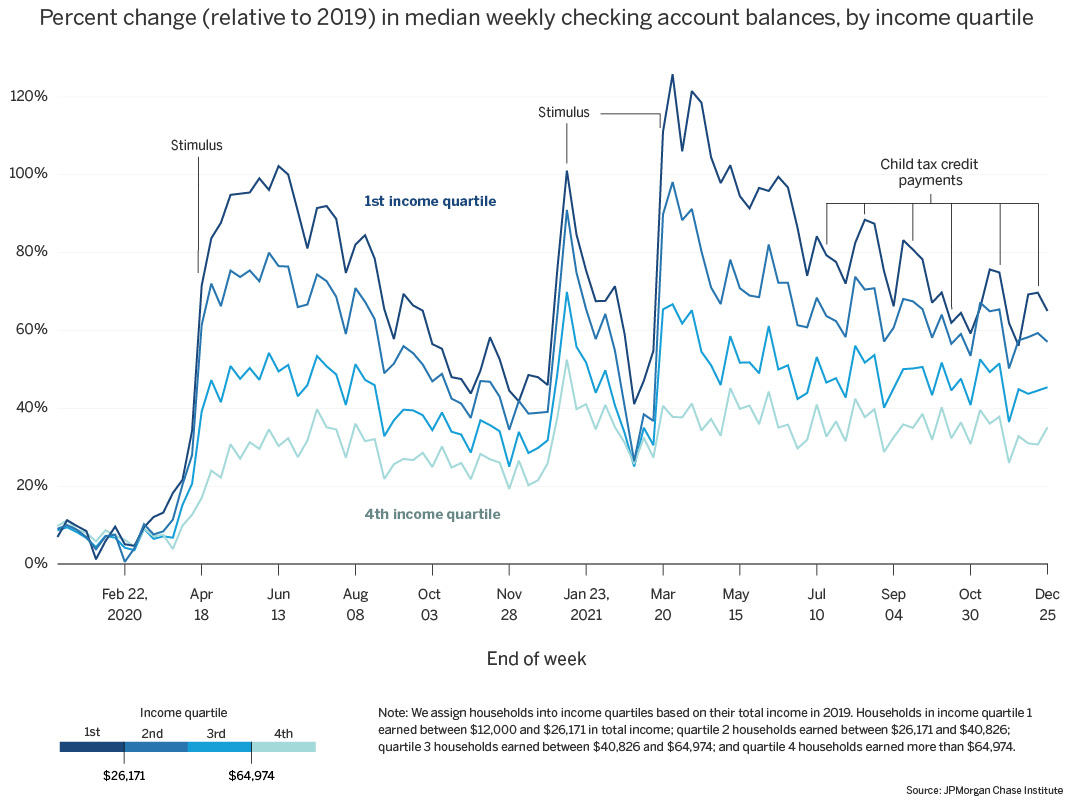

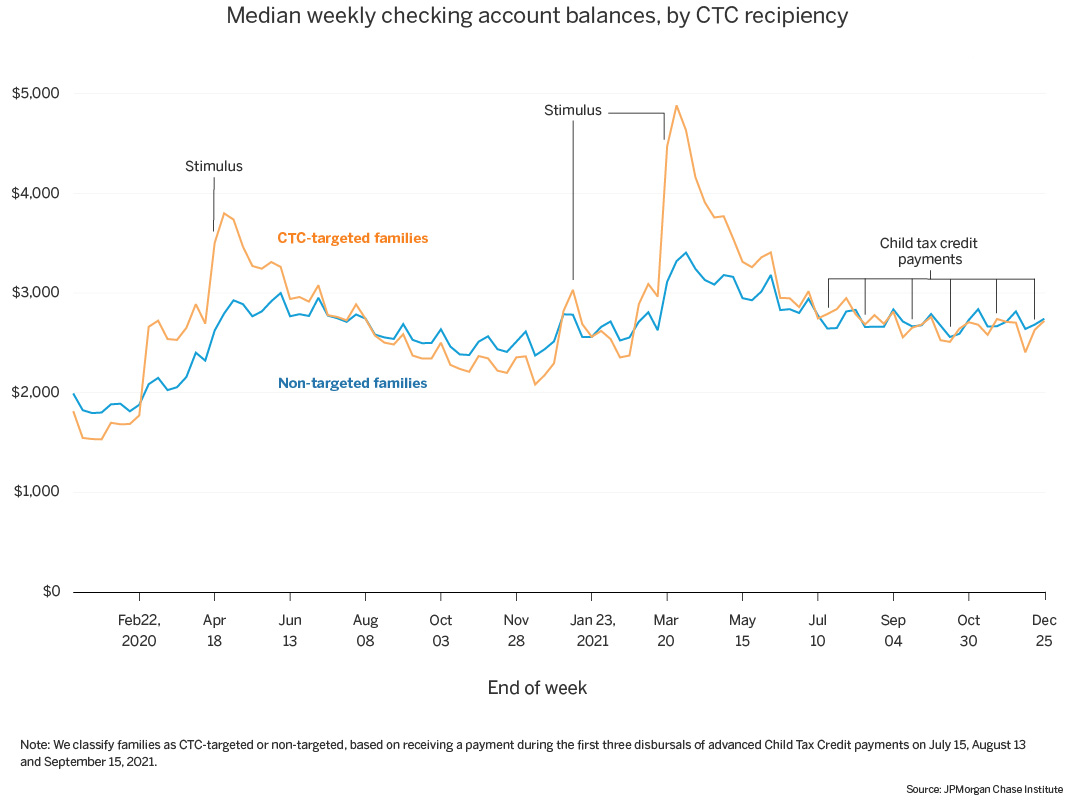

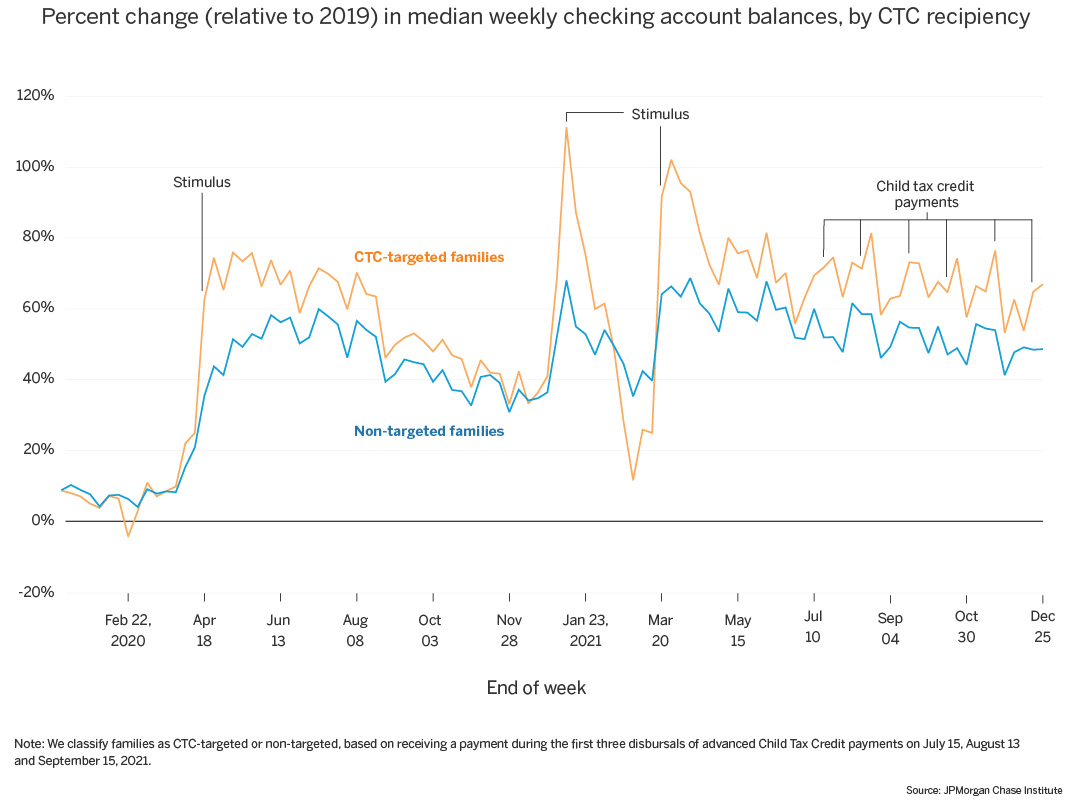

Relative to other families, those that received CTC experienced larger increases in checking account balances during each round of stimulus (consistent with larger stimulus checks), and also spent down their increased balances faster. Figure 3 shows that CTC-targeted families saw their balances decrease about 44 percent from March 2021 to December 2021, compared to 17 percent among families who did not receive advanced CTC.

CTC payments are smaller in dollar amount and reach compared to stimulus payments, therefore they do not result in large cash boosts in aggregate plots. However, starting in July when advanced CTC payments commenced, the rate of depletion of balance gains slowed down among CTC-targeted families (Figure 4). Non-recipient families, on the other hand, saw a steady decline in balance gains during this period. At the end of 2021, cash balances among advanced CTC recipients were roughly 60 percent elevated compared to 50 percent among families who did not receive advanced CTC.

Figure 3: CTC-targeted families saw larger increases in cash balances with each round of stimulus, compared to non-targeted families.

Figure 4: At the end of 2021, cash balances among advanced CTC recipients were roughly 60 percent elevated compared to 50 percent among families who did not receive advanced CTC.

Federal Reserve Board. 2019. “Survey of Consumer Finances.” https://www.federalreserve.gov/econres/scfindex.htm

We thank our research team, specifically Edward Biggs and Carolyn Gorman, for their hard work and contribution to this research. Additionally, we thank Stephen Harrington, Annabel Jouard, and Robert Caldwell for their support. We are indebted to our internal partners and colleagues, who support delivery of our agenda in a myriad of ways, and acknowledge their contributions to each and all releases.

We are also grateful for the invaluable constructive feedback we received from external experts and partners. We are deeply grateful for their generosity of time, insight, and support.

We would like to acknowledge Jamie Dimon, CEO of JPMorgan Chase & Co., for his vision and leadership in establishing the Institute and enabling the ongoing research agenda. We remain deeply grateful to Peter Scher, Vice Chairman, Demetrios Marantis, Head of Corporate Responsibility, Heather Higginbottom, Head of Research & Policy, and others across the firm for the resources and support to pioneer a new approach to contribute to global economic analysis and insight.

This material is a product of JPMorgan Chase Institute and is provided to you solely for general information purposes. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the authors listed and may differ from the views and opinions expressed by J.P. Morgan Securities LLC (JPMS) Research Department or other departments or divisions of JPMorgan Chase & Co. or its affiliates. This material is not a product of the Research Department of JPMS. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which is provided for illustration/reference purposes only. The data relied on for this report are based on past transactions and may not be indicative of future results. J.P. Morgan assumes no duty to update any information in this material in the event that such information changes. The opinion herein should not be construed as an individual recommendation for any particular client and is not intended as advice or recommendations of particular securities, financial instruments, or strategies for a particular client. This material does not constitute a solicitation or offer in any jurisdiction where such a solicitation is unlawful.

Greig, Fiona, Erica Deadman, and Tanya Sonthalia. 2022. “Household Pulse: The State of Cash Balances at Year End.” JPMorgan Chase Institute.

Authors

Fiona Greig

Former Co-President

Erica Deadman

Consumer Research Lead

Tanya Sonthalia

Research Associate